UAE Dental Service Organization Market Overview

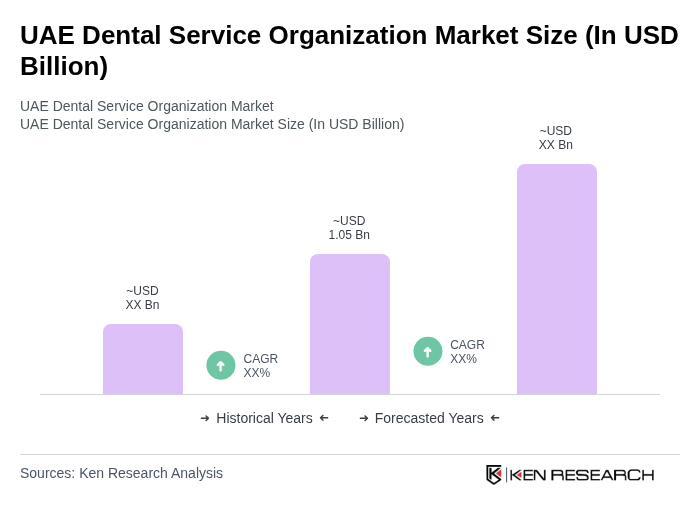

- The UAE Dental Service Organization market is valued at USD 1.05 billion, based on a five-year historical analysis. This growth is primarily driven by increasing awareness of oral health, rising disposable incomes, and a growing population seeking dental care services. The demand for advanced dental treatments, including digital dentistry, implants, and cosmetic procedures, as well as growing medical tourism for high-quality dental care, has also contributed significantly to the market's expansion.

- Key cities dominating the UAE Dental Service Organization market include Dubai and Abu Dhabi. Dubai's status as a global tourism and medical tourism hub attracts a diverse population seeking high-quality and aesthetic dental services, while Abu Dhabi benefits from significant government investment in healthcare infrastructure and organized dental clinics, enhancing access to both general and specialized dental care.

- In 2023, the UAE government reinforced regulations mandating that all dental clinics must adhere to strict infection control and quality standards under licencing and facility rules issued by health authorities such as the Dubai Health Authority (DHA) and the Ministry of Health and Prevention (MOHAP). One key binding instrument is the Dubai Health Authority’s “Regulation of Dental Services Provision in the Emirate of Dubai, 2021”, which sets detailed requirements on infection prevention, sterilization, facility design, staff qualifications, and ongoing compliance audits for dental clinics. This regulatory framework aims to ensure patient safety and improve the overall quality of dental services across the country, reflecting the government's commitment to enhancing healthcare standards.

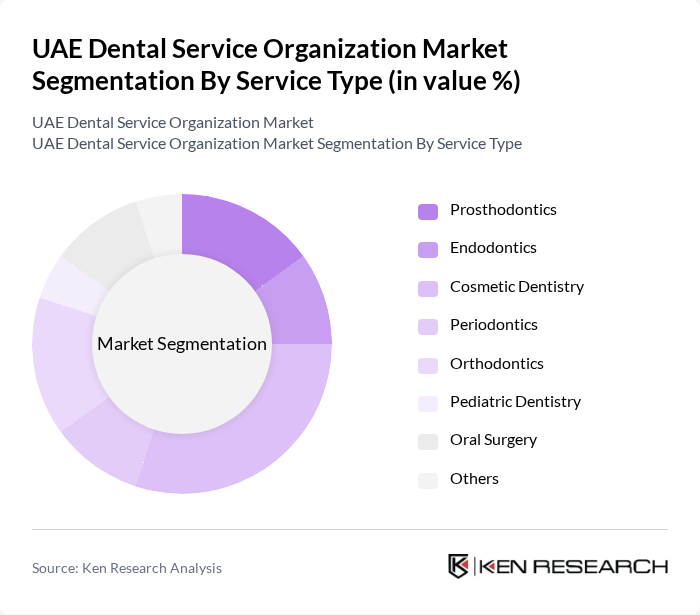

UAE Dental Service Organization Market Segmentation

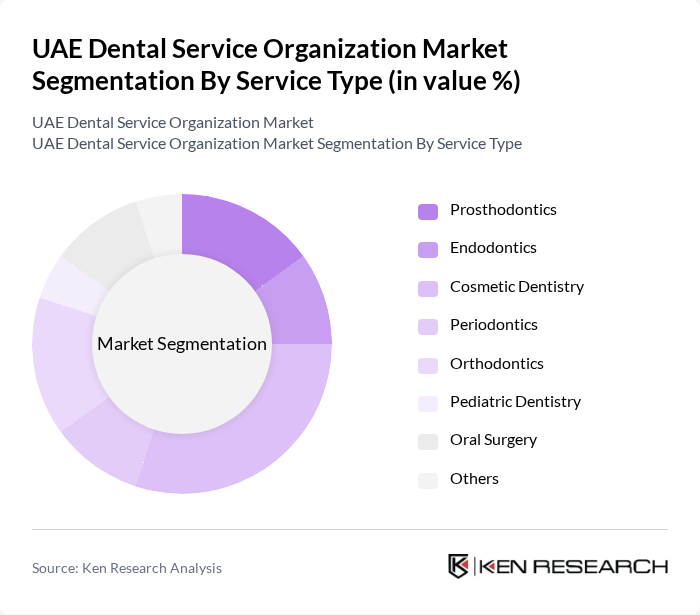

By Service Type:The service type segmentation includes various dental services such as Prosthodontics, Endodontics, Cosmetic Dentistry, Periodontics, Orthodontics, Pediatric Dentistry, Oral Surgery, and Others. Among these, Cosmetic Dentistry is currently one of the leading growth sub-segments, driven by increasing consumer interest in aesthetic enhancements, social media influence, and the growing trend of smile makeovers and dental tourism. The demand for teeth whitening, veneers, aligners, and other cosmetic procedures has surged, reflecting a shift in consumer behavior towards prioritizing dental aesthetics, while Periodontics also holds a significant share due to the high prevalence of gum-related conditions in the UAE population.

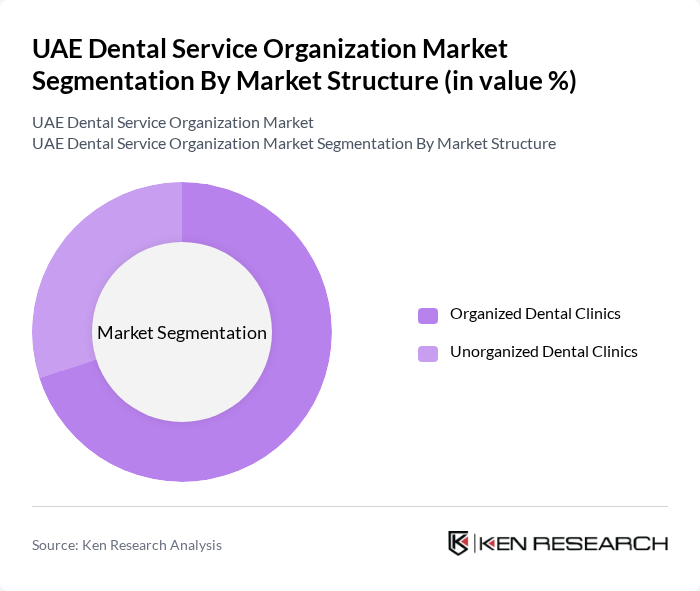

By Market Structure:The market structure segmentation includes Organized Dental Clinics and Unorganized Dental Clinics. Organized Dental Clinics dominate the market due to their ability to provide standardized services, comprehensive treatment portfolios, better patient management, and enhanced marketing strategies. These clinics often have more resources to invest in advanced technologies such as digital imaging, CAD/CAM, and practice management systems, as well as skilled multidisciplinary personnel, which attracts a larger patient base and strengthens brand trust.

UAE Dental Service Organization Market Competitive Landscape

The UAE Dental Service Organization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Dental Clinic, American Dental Clinic, Al Zahra Dental Clinic, Dr. Michael's Dental Clinic, The Dental Studio, Bright Smile Dental & Orthodontic Center, HealthPlus Dental Care Center, GSD Dental Clinics, Dentelia, Colosseum Dental Group, Dr. Sulaiman Al Habib Medical Group, Mediclinic Middle East, Dubai Autism Center Dental Clinic, Dental Care Alliance, MB2 Dental Solutions contribute to innovation, geographic expansion, and service delivery in this space.

UAE Dental Service Organization Market Industry Analysis

Growth Drivers

- Increasing Demand for Cosmetic Dentistry:The UAE's cosmetic dentistry sector is experiencing significant growth, with the market valued at approximately AED 1.8 billion in future. This surge is driven by a rising affluent population, with over 70% of residents expressing interest in cosmetic dental procedures. The demand for aesthetic enhancements, such as teeth whitening and veneers, is projected to continue increasing, supported by a cultural emphasis on appearance and social status, particularly in urban areas.

- Rising Awareness of Oral Health:The UAE government has launched various public health campaigns, resulting in a 35% increase in dental check-ups over the past two years. With a population exceeding 10 million, the focus on preventive care is evident, as more individuals recognize the importance of oral health in overall well-being. This awareness is further bolstered by educational initiatives in schools, leading to a growing demand for regular dental services and treatments.

- Technological Advancements in Dental Treatments:The integration of advanced technologies, such as 3D printing and digital imaging, has revolutionized dental practices in the UAE. In future, over 50% of dental clinics adopted digital solutions, enhancing treatment precision and patient experience. These innovations not only improve operational efficiency but also attract tech-savvy patients seeking modern dental solutions, thereby driving market growth and expanding service offerings across the region.

Market Challenges

- High Competition Among Service Providers:The UAE dental market is characterized by intense competition, with over 1,800 dental clinics operating in the region. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Established players are compelled to innovate continuously and enhance service quality to maintain market share, which can strain resources and impact overall profitability.

- Regulatory Compliance Costs:Dental practices in the UAE face stringent regulatory requirements, including licensing and health standards. Compliance costs can reach up to AED 250,000 annually for a single clinic, encompassing fees for inspections, certifications, and equipment standards. These financial burdens can deter small practices from entering the market and may limit the growth potential of existing providers, impacting service availability and quality.

UAE Dental Service Organization Market Future Outlook

The UAE dental service market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As digital dentistry becomes more prevalent, clinics will increasingly adopt AI-driven diagnostics and telehealth solutions, enhancing patient engagement and accessibility. Additionally, the focus on preventive care will likely lead to a rise in routine dental visits, fostering a healthier population. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the coming years.

Market Opportunities

- Expansion of Dental Tourism:The UAE is emerging as a dental tourism hub, attracting over 400,000 international patients annually seeking high-quality dental care at competitive prices. This trend presents significant opportunities for local clinics to expand their services and cater to a global clientele, enhancing revenue streams and promoting the UAE as a premier destination for dental treatments.

- Growth in Pediatric Dental Services:With a population of over 3 million children under the age of 14, there is a growing demand for specialized pediatric dental services. Clinics that focus on child-friendly environments and preventive care can tap into this market, addressing the unique dental needs of younger patients and fostering long-term relationships with families, ultimately driving sustained growth.