Region:Middle East

Author(s):Rebecca

Product Code:KRAC8595

Pages:96

Published On:November 2025

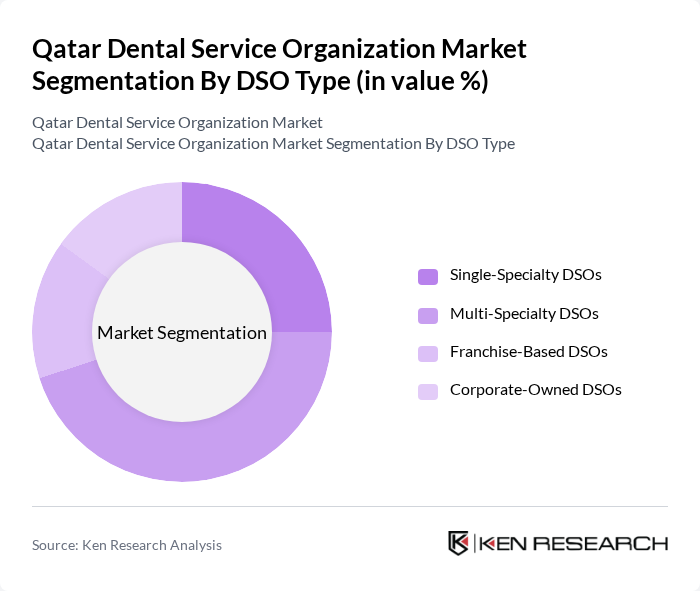

By DSO Type:

The DSO Type segmentation includes Single-Specialty DSOs, Multi-Specialty DSOs, Franchise-Based DSOs, and Corporate-Owned DSOs. Among these, Multi-Specialty DSOs are currently dominating the market due to their ability to offer a wide range of services under one roof, catering to diverse patient needs. This model attracts a larger patient base, as it provides convenience and comprehensive care, which is increasingly preferred by consumers. The trend towards integrated healthcare services and the adoption of digital dental technologies is driving the growth of Multi-Specialty DSOs, making them a preferred choice for patients seeking holistic dental care .

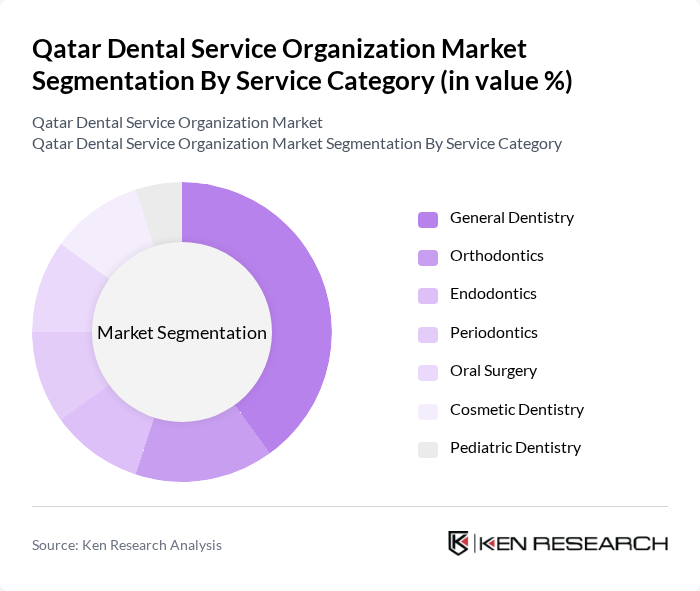

By Service Category:

The Service Category segmentation encompasses General Dentistry, Orthodontics, Endodontics, Periodontics, Oral Surgery, Cosmetic Dentistry, and Pediatric Dentistry. General Dentistry is the leading sub-segment, as it covers a broad range of essential dental services that cater to the majority of the population. The increasing emphasis on preventive care, regular check-ups, and the adoption of digital diagnostic tools has led to a higher demand for general dental services. Additionally, the rise in awareness regarding oral health and the growing trend of dental aesthetics have encouraged more individuals to seek routine and cosmetic dental care, further solidifying General Dentistry's position as the dominant service category .

The Qatar Dental Service Organization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hamad Medical Corporation, Sidra Medicine, Al Jameela Dental Center, Dr. Sarah's Specialist Dental Centre, Future Dental Center, Qatar Dental Center, The Dental Studio, Al-Sadd Dental Clinic, Smile Dental Clinic, Al-Mana Group Dental Services, Qatar Medical Center, Doha Dental Clinic, Al-Ahli Hospital Dental Center, Qatar University Dental Clinic, Qatar Specialized Dental Center contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar dental service market appears promising, driven by increasing public awareness and government support for oral health initiatives. As technological advancements continue to reshape the industry, dental practices are likely to adopt innovative solutions that enhance patient care. Additionally, the growing trend of dental tourism is expected to attract international patients, further expanding the market. Overall, these factors will contribute to a robust and evolving dental service landscape in Qatar.

| Segment | Sub-Segments |

|---|---|

| By DSO Type | Single-Specialty DSOs Multi-Specialty DSOs Franchise-Based DSOs Corporate-Owned DSOs |

| By Service Category | General Dentistry Orthodontics Endodontics Periodontics Oral Surgery Cosmetic Dentistry Pediatric Dentistry |

| By End-User | Hospitals Independent Dental Practices Group Dental Clinics Academic Institutions |

| By Service Delivery Model | In-House Dental Clinics Mobile Dental Services Tele-dentistry Hybrid Models |

| By Geographic Distribution | Doha Metropolitan Area Al Rayyan Al Wakrah Other Municipalities |

| By Patient Demographics | Children (0-12 years) Adolescents (13-19 years) Adults (20-60 years) Seniors (60+ years) |

| By Treatment Type | Preventive Care Restorative Care Cosmetic Care Emergency Care |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Dental Services | 120 | Dentists, Clinic Managers |

| Cosmetic Dentistry | 60 | Cosmetic Dentists, Marketing Managers |

| Pediatric Dentistry | 40 | Pediatric Dentists, Family Health Practitioners |

| Orthodontic Services | 50 | Orthodontists, Practice Administrators |

| Dental Hygiene Services | 40 | Dental Hygienists, Public Health Officials |

The Qatar Dental Service Organization market is valued at approximately USD 180 million, reflecting significant growth driven by increased awareness of oral health, rising disposable incomes, and the expansion of dental services across the country.