Region:Middle East

Author(s):Dev

Product Code:KRAC1237

Pages:90

Published On:October 2025

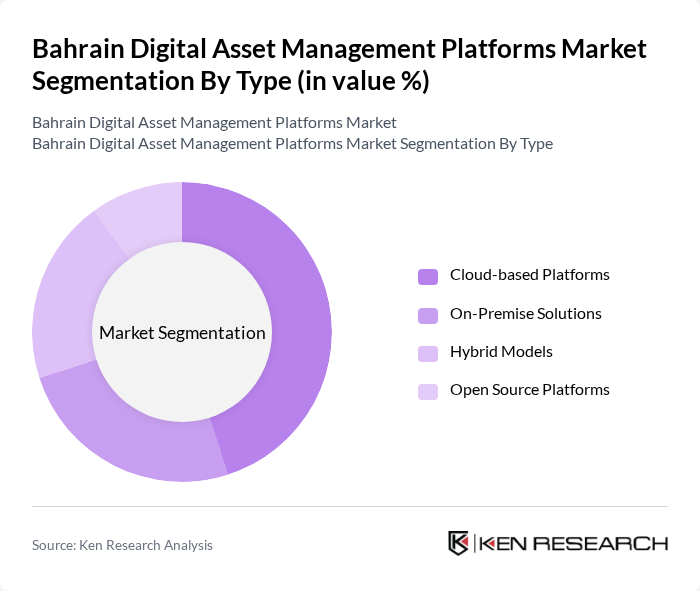

By Type:The market can be segmented into various types, including Cloud-based Platforms, On-Premise Solutions, Hybrid Models, and Open Source Platforms. Each of these types caters to different organizational needs and preferences, influencing their adoption rates. Cloud-based platforms are experiencing accelerated growth as organizations increasingly prioritize scalability, accessibility, and reduced infrastructure costs, with the global shift from on-premises to Software-as-a-Service (SaaS) models driving significant adoption.

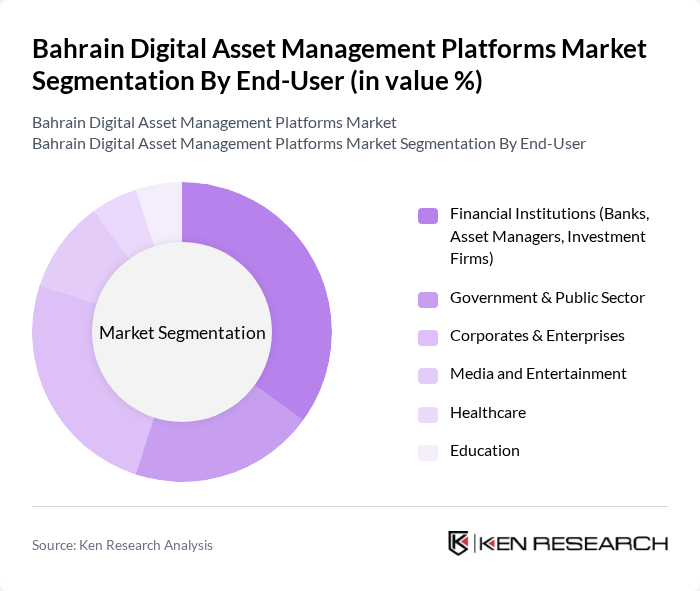

By End-User:The end-user segmentation includes Financial Institutions, Government & Public Sector, Corporates & Enterprises, Media and Entertainment, Healthcare, and Education. Each sector has unique requirements for digital asset management, driving the demand for tailored solutions. The retail, media, and entertainment industries are particularly significant drivers of DAM adoption, as these sectors require sophisticated systems to manage vast libraries of multimedia content and deliver engaging digital experiences to customers.

The Bahrain Digital Asset Management Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Financial Exchange (BFX), Investcorp, SICO BSC, Al Salam Bank, Bahrain Islamic Bank, Gulf International Bank (GIB), Bank of Bahrain and Kuwait (BBK), Bahrain Stock Exchange (Bahrain Bourse), Arqaam Capital, EFG Hermes, Abu Dhabi Investment Authority (ADIA), QInvest, BMB Investment Bank, KAMCO Investment Company, Al Baraka Banking Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital asset management market in Bahrain appears promising, driven by technological advancements and increasing digitalization across sectors. As businesses continue to prioritize digital transformation, the integration of AI and machine learning into asset management solutions will enhance efficiency and user experience. Furthermore, the expansion of e-commerce and online services will necessitate robust digital asset management systems, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Platforms On-Premise Solutions Hybrid Models Open Source Platforms |

| By End-User | Financial Institutions (Banks, Asset Managers, Investment Firms) Government & Public Sector Corporates & Enterprises Media and Entertainment Healthcare Education |

| By Application | Digital Asset Storage & Custody Trading & Exchange Integration Digital Rights Management Analytics and Reporting Compliance & Regulatory Reporting |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Industry Vertical | Financial Services Telecommunications Retail & E-commerce Government Healthcare |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Others | Niche Solutions Custom Integrations Consulting Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Investors in Digital Assets | 65 | Investment Managers, Portfolio Analysts |

| Retail Users of Digital Asset Platforms | 120 | Individual Investors, Cryptocurrency Enthusiasts |

| Regulatory Bodies and Compliance Officers | 45 | Compliance Managers, Regulatory Analysts |

| Technology Providers for Digital Asset Management | 75 | Product Managers, Technology Consultants |

| Financial Advisors and Wealth Managers | 65 | Financial Planners, Wealth Management Advisors |

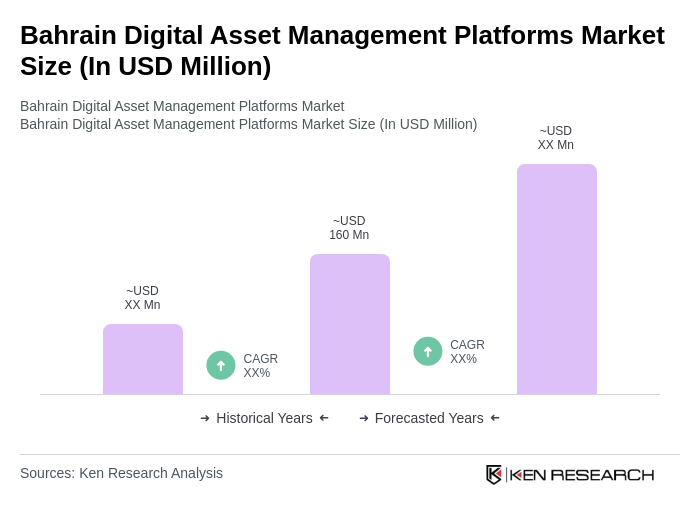

The Bahrain Digital Asset Management Platforms Market is valued at approximately USD 160 million, reflecting a significant growth trend driven by the increasing adoption of digital assets across various sectors, including finance and entertainment.