Region:Europe

Author(s):Geetanshi

Product Code:KRAA2312

Pages:99

Published On:August 2025

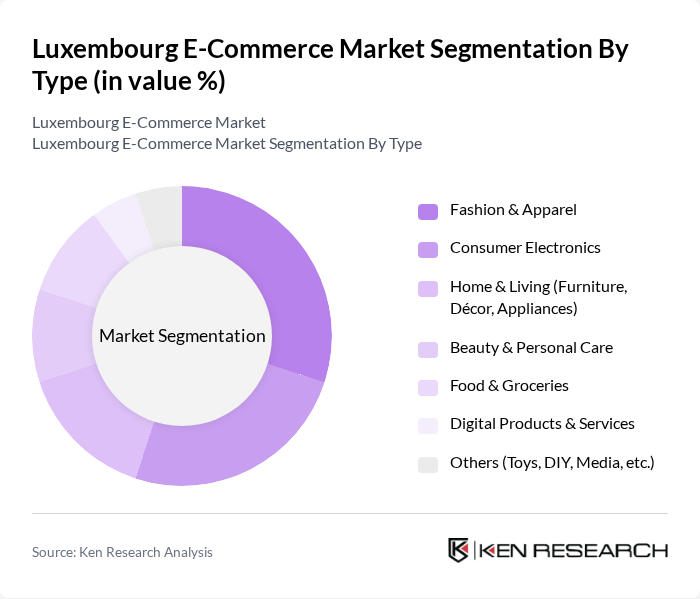

By Type:

The e-commerce market in Luxembourg is segmented into Fashion & Apparel, Consumer Electronics, Home & Living, Beauty & Personal Care, Food & Groceries, Digital Products & Services, and Others. Fashion & Apparel is the leading subsegment, driven by changing consumer preferences, the influence of social media marketing, and the convenience of browsing and purchasing clothing and accessories online. Consumer Electronics and Home & Living also hold significant shares, reflecting strong demand for technology products and home improvement items. The increasing use of mobile devices and secure online payment options further support growth across all segments .

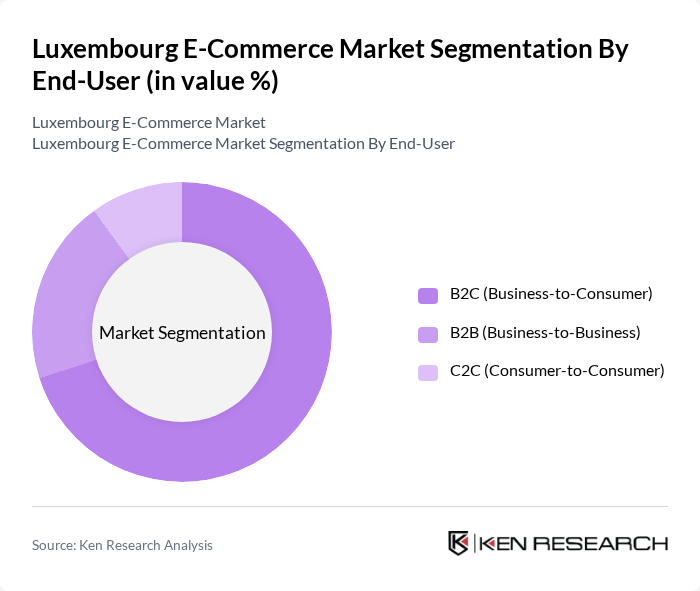

By End-User:

The e-commerce market is also segmented by end-user into B2C (Business-to-Consumer), B2B (Business-to-Business), and C2C (Consumer-to-Consumer). The B2C segment is the most dominant, catering directly to consumers who prefer the convenience of shopping online for a wide range of products. The increasing number of online retailers, the growing trend of direct-to-consumer sales, and high internet penetration have further propelled this segment's growth. B2B and C2C segments are expanding as businesses digitize procurement and consumers engage in peer-to-peer transactions .

The Luxembourg E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Luxembourg S.à r.l., eBay S.à r.l., Fnac Darty S.A., Cdiscount S.A., Zalando SE, Vanden Borre S.A., LuxCaddy S.à r.l., Auchan Luxembourg S.A., Carrefour S.A., Lidl Stiftung & Co. KG, Delhaize Group, Colruyt Group, MediaMarktSaturn Retail Group, Coolblue B.V., and Allegro.eu SA Group contribute to innovation, geographic expansion, and service delivery in this space .

The Luxembourg e-commerce market is poised for continued growth, driven by technological advancements and evolving consumer behaviors. As digital payment solutions become more integrated and user-friendly, online shopping will likely become even more prevalent. Additionally, the increasing focus on sustainability and ethical consumption will shape purchasing decisions, prompting retailers to adapt their strategies. Companies that leverage data analytics and enhance customer experiences will be well-positioned to thrive in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion & Apparel Consumer Electronics Home & Living (Furniture, Décor, Appliances) Beauty & Personal Care Food & Groceries Digital Products & Services Others (Toys, DIY, Media, etc.) |

| By End-User | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) |

| By Sales Channel | Direct-to-Consumer (D2C) Websites Online Marketplaces Social Commerce Platforms Mobile Applications |

| By Payment Method | Credit/Debit Cards E-Wallets (PayPal, Apple Pay, etc.) Bank Transfers Cash on Delivery |

| By Delivery Method | Standard Shipping Express Delivery Click & Collect (Pick-up Points) |

| By Customer Demographics | Age Group Gender Income Level |

| By Product Lifecycle Stage | Introduction Growth Maturity Decline |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer E-commerce Behavior | 120 | Online Shoppers, Frequent Buyers |

| SME E-commerce Adoption | 60 | Business Owners, E-commerce Managers |

| Logistics and Fulfillment Insights | 40 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 50 | Industry Experts, Market Analysts |

| Consumer Preferences in Online Shopping | 80 | General Consumers, Tech-Savvy Shoppers |

The Luxembourg e-commerce market is valued at approximately USD 1.6 billion, reflecting significant growth driven by increased internet and smartphone penetration, mobile commerce, and consumer preference for online shopping.