Region:Middle East

Author(s):Shubham

Product Code:KRAB7602

Pages:100

Published On:October 2025

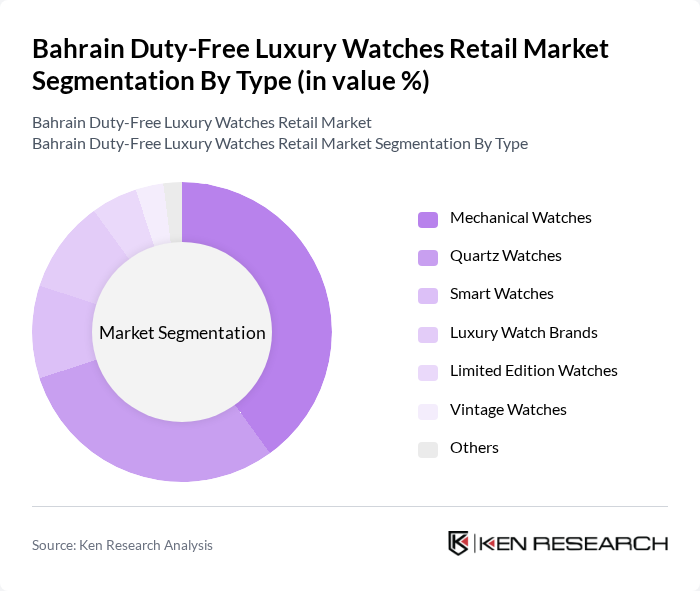

By Type:

The luxury watches market is segmented into various types, including Mechanical Watches, Quartz Watches, Smart Watches, Luxury Watch Brands, Limited Edition Watches, Vintage Watches, and Others. Among these, Mechanical Watches dominate the market due to their craftsmanship and appeal to collectors and enthusiasts. The intricate designs and traditional watchmaking techniques resonate with consumers seeking exclusivity and heritage. Quartz Watches also hold a significant share, favored for their accuracy and affordability, making them popular among a broader audience.

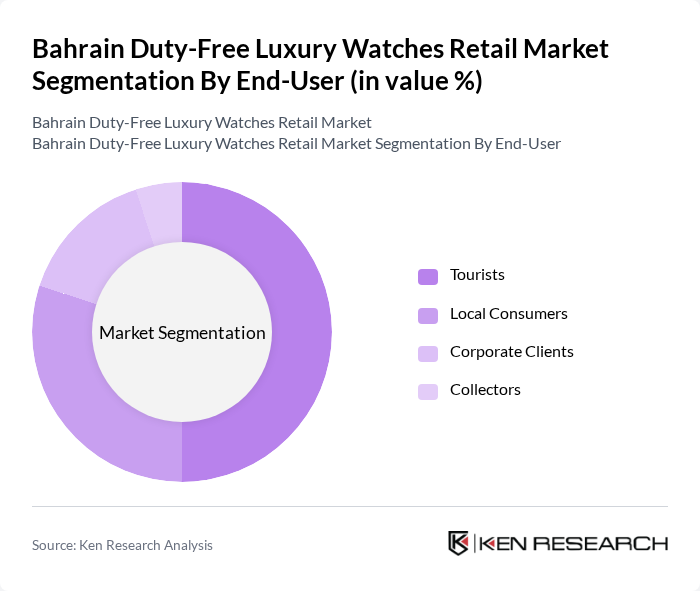

By End-User:

The end-user segmentation includes Tourists, Local Consumers, Corporate Clients, and Collectors. Tourists represent the largest segment, driven by the allure of duty-free shopping and the availability of exclusive luxury watches. Local Consumers also contribute significantly, as the growing affluent population seeks to invest in luxury timepieces. Corporate Clients often purchase luxury watches as gifts or incentives, while Collectors focus on acquiring unique and limited-edition pieces, further driving demand in this niche market.

The Bahrain Duty-Free Luxury Watches Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rolex SA, Omega SA, TAG Heuer, Patek Philippe, Audemars Piguet, Hublot, Cartier, Montblanc, IWC Schaffhausen, Jaeger-LeCoultre, Panerai, Breguet, Chopard, Longines, Tissot contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain duty-free luxury watches retail market appears promising, driven by increasing tourism and a growing affluent population. As e-commerce continues to expand, retailers are likely to enhance their online presence, catering to tech-savvy consumers. Additionally, the trend towards sustainable luxury is expected to shape product offerings, with brands focusing on eco-friendly materials and practices. These developments will create a dynamic retail environment, fostering growth and innovation in the luxury watch sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Watches Quartz Watches Smart Watches Luxury Watch Brands Limited Edition Watches Vintage Watches Others |

| By End-User | Tourists Local Consumers Corporate Clients Collectors |

| By Sales Channel | Airport Retail Online Retail In-Store Retail Duty-Free Shops |

| By Price Range | Under $500 $500 - $1,000 $1,000 - $5,000 Above $5,000 |

| By Brand Prestige | High-End Luxury Brands Mid-Tier Luxury Brands Emerging Luxury Brands |

| By Occasion | Gifting Personal Use Collecting |

| By Distribution Mode | Direct Sales Indirect Sales Online Marketplaces Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Watch Retailers | 100 | Store Managers, Brand Representatives |

| Affluent Consumers | 150 | Luxury Watch Owners, High-Income Individuals |

| Market Analysts | 50 | Industry Experts, Economic Analysts |

| Tourism Sector Stakeholders | 40 | Travel Agents, Hotel Managers |

| Luxury Brand Marketing Executives | 30 | Marketing Directors, Brand Managers |

The Bahrain Duty-Free Luxury Watches Retail Market is valued at approximately USD 150 million, reflecting a significant growth driven by increasing international travel, a rising affluent population, and heightened demand for luxury goods.