Region:Middle East

Author(s):Rebecca

Product Code:KRAB8176

Pages:80

Published On:October 2025

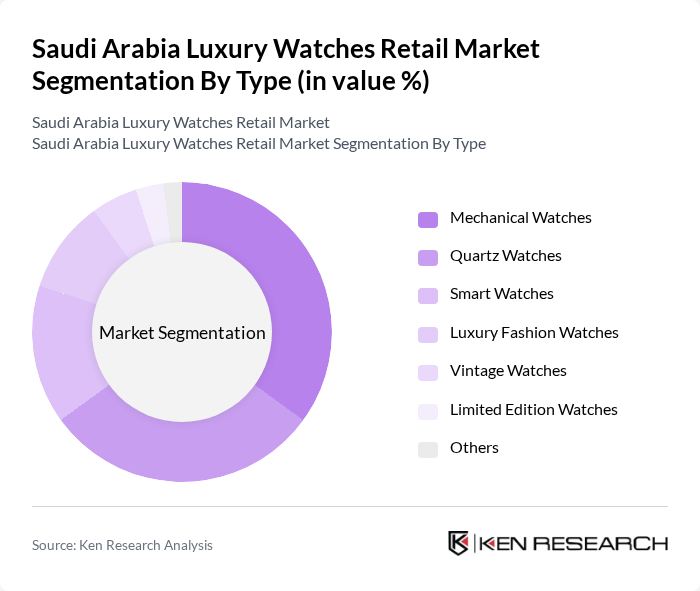

By Type:The luxury watches market can be segmented into various types, including Mechanical Watches, Quartz Watches, Smart Watches, Luxury Fashion Watches, Vintage Watches, Limited Edition Watches, and Others. Among these, Mechanical Watches and Quartz Watches are the most popular due to their craftsmanship and reliability, respectively. The demand for Smart Watches is also increasing as technology integrates with luxury, appealing to tech-savvy consumers.

By End-User:The luxury watches market is segmented by end-user into Men, Women, and Unisex categories. Men’s watches dominate the market due to traditional preferences for luxury timepieces as status symbols. However, the women’s segment is growing rapidly, driven by increasing brand awareness and the introduction of stylish designs tailored for women. Unisex watches are also gaining traction as consumers seek versatile options.

The Saudi Arabia Luxury Watches Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rolex SA, Patek Philippe SA, Audemars Piguet, Omega SA, TAG Heuer, Hublot, Cartier, Montblanc, IWC Schaffhausen, Jaeger-LeCoultre, Chopard, Breguet, Longines, Baume & Mercier, Seiko Holdings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia luxury watches retail market is poised for significant growth, driven by increasing disposable incomes and a cultural shift towards luxury consumption. As e-commerce continues to expand, retailers will have greater opportunities to reach affluent consumers. However, challenges such as economic fluctuations and high import duties may temper growth. The market is expected to adapt by enhancing online shopping experiences and focusing on brand heritage, ensuring resilience in a competitive landscape while catering to evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Watches Quartz Watches Smart Watches Luxury Fashion Watches Vintage Watches Limited Edition Watches Others |

| By End-User | Men Women Unisex |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Luxury Boutiques Department Stores |

| By Price Range | Below SAR 5,000 SAR 5,000 - SAR 15,000 SAR 15,000 - SAR 30,000 Above SAR 30,000 |

| By Brand Origin | Swiss Brands Japanese Brands American Brands Local Brands |

| By Material | Stainless Steel Gold Titanium Leather |

| By Distribution Mode | Direct Sales Distributors Online Marketplaces Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Watch Retailers | 100 | Store Managers, Brand Representatives |

| Affluent Consumers | 150 | High Net-Worth Individuals, Luxury Shoppers |

| Market Analysts | 50 | Industry Experts, Economic Analysts |

| Luxury Watch Enthusiasts | 80 | Collectors, Hobbyists |

| Retail Industry Experts | 60 | Consultants, Retail Strategists |

The Saudi Arabia Luxury Watches Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing disposable income and a rising affluent population interested in luxury consumption.