Region:Asia

Author(s):Geetanshi

Product Code:KRAE0597

Pages:95

Published On:December 2025

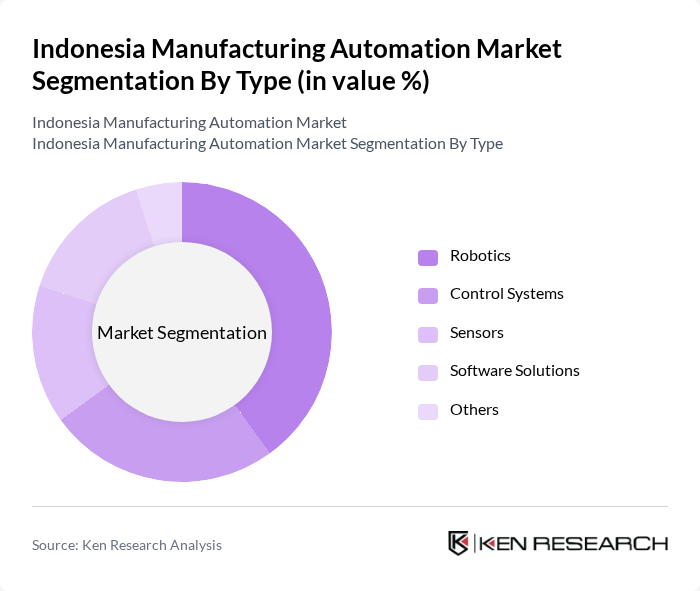

By Type:The market is segmented into various types, including Robotics, Control Systems, Sensors, Software Solutions, and Others. Robotics is currently the leading sub-segment, driven by the increasing need for automation in manufacturing processes to enhance efficiency and reduce operational costs. Control Systems also play a significant role, as they are essential for managing and optimizing manufacturing operations. The demand for Sensors is growing due to the need for real-time data collection and monitoring, while Software Solutions are increasingly being adopted for process management and analytics.

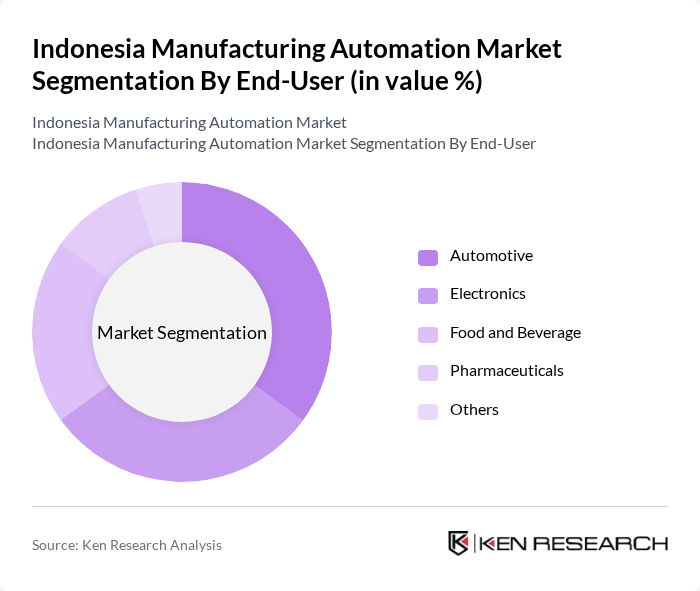

By End-User:The end-user segmentation includes Automotive, Electronics, Food and Beverage, Pharmaceuticals, and Others. The Automotive sector is the dominant end-user, driven by the need for automation in assembly lines and production processes to enhance efficiency and reduce costs. The Electronics sector follows closely, as manufacturers seek to improve precision and speed in production. The Food and Beverage industry is also increasingly adopting automation to ensure quality control and compliance with safety standards, while Pharmaceuticals are leveraging automation for precision and regulatory compliance.

The Indonesia Manufacturing Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Indonesia, Schneider Electric Indonesia, Rockwell Automation Indonesia, Mitsubishi Electric Indonesia, ABB Indonesia, Honeywell Indonesia, Yokogawa Indonesia, Omron Indonesia, Fanuc Indonesia, KUKA Indonesia, Bosch Rexroth Indonesia, National Instruments Indonesia, Emerson Electric Indonesia, Festo Indonesia, and Beckhoff Automation Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian manufacturing automation market appears promising, driven by technological advancements and government support. As companies increasingly adopt AI and IoT technologies, operational efficiency is expected to improve significantly. Additionally, the shift towards cloud-based solutions will facilitate real-time data analysis, enhancing decision-making processes. With a growing emphasis on sustainability, manufacturers are likely to invest in eco-friendly automation solutions, aligning with global trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Robotics Control Systems Sensors Software Solutions Others |

| By End-User | Automotive Electronics Food and Beverage Pharmaceuticals Others |

| By Industry Vertical | Aerospace Chemical Textile Metal and Mining Others |

| By Automation Level | Fully Automated Semi-Automated Manual Others |

| By Application | Assembly Line Automation Material Handling Quality Control Packaging Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Tax Incentives Grants and Subsidies Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Automation | 100 | Plant Managers, Automation Engineers |

| Electronics Assembly Line Automation | 80 | Production Supervisors, Quality Control Managers |

| Food Processing Automation Solutions | 70 | Operations Managers, Safety Compliance Officers |

| Textile Manufacturing Automation | 60 | Supply Chain Managers, Production Planners |

| Pharmaceutical Manufacturing Automation | 90 | Regulatory Affairs Managers, R&D Directors |

The Indonesia Manufacturing Automation Market is valued at approximately USD 80 billion, reflecting a significant growth driven by the demand for operational efficiency and the adoption of advanced technologies such as robotics, IoT, and AI in manufacturing processes.