Region:Asia

Author(s):Shubham

Product Code:KRAA8475

Pages:91

Published On:November 2025

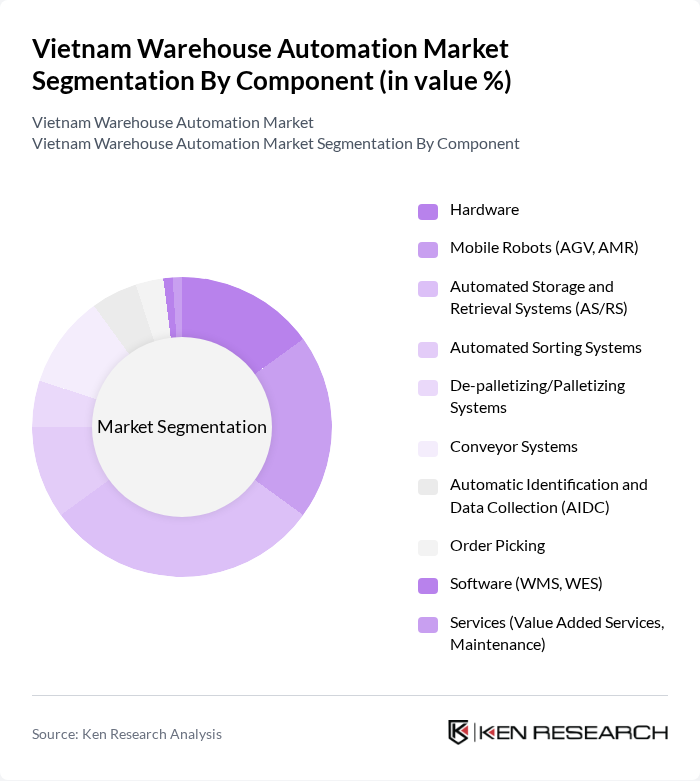

By Component:The components of warehouse automation include various technologies and systems that enhance operational efficiency. The subsegments in this category are Hardware, Mobile Robots (AGV, AMR), Automated Storage and Retrieval Systems (AS/RS), Automated Sorting Systems, De-palletizing/Palletizing Systems, Conveyor Systems, Automatic Identification and Data Collection (AIDC), Order Picking, Software (WMS, WES), and Services (Value Added Services, Maintenance). Among these, theAutomated Storage and Retrieval Systems (AS/RS)subsegment is currently leading the market due to its ability to optimize space utilization and improve inventory management. The increasing need for efficient storage solutions in warehouses is driving the demand for AS/RS systems. Recent deployments of AS/RS and mobile robots in urban fulfillment centers have significantly improved throughput and space efficiency, especially in high-density cities .

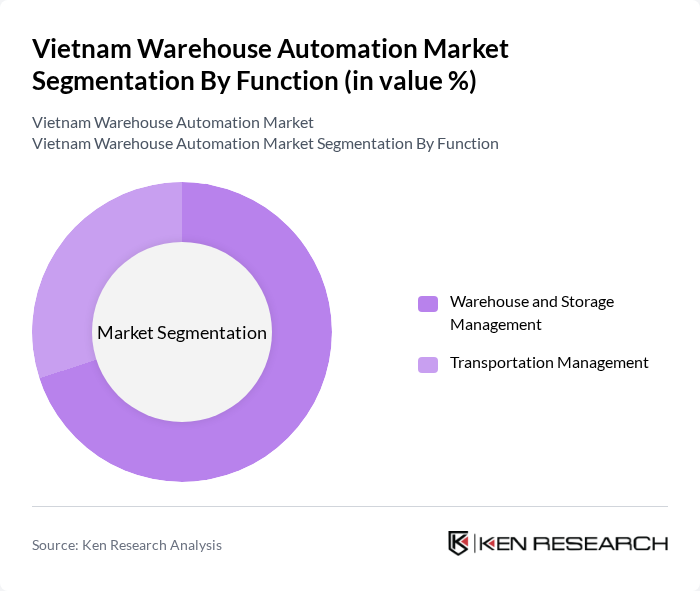

By Function:The functions of warehouse automation encompass various operational aspects, primarily focusing on Warehouse and Storage Management and Transportation Management. TheWarehouse and Storage Managementfunction is currently the dominant segment, driven by the need for efficient inventory control and space optimization. As businesses increasingly seek to streamline their operations and reduce costs, the demand for advanced warehouse management solutions continues to rise. The adoption of integrated warehouse management systems (WMS) and real-time slotting technologies is accelerating, particularly in e-commerce and third-party logistics operations .

The Vietnam Warehouse Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SSI Schaefer, Dematic, Honeywell Intelligrated, Vanderlande, KION Group, Daifuku, Murata Machinery, Knapp AG, Swisslog, TGW Logistics Group, Interroll, Siemens Logistics, Mitsubishi Logisnext, Vinatech Group, Goldbell Equipment Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam warehouse automation market appears promising, driven by ongoing technological advancements and increasing investments in logistics infrastructure. As companies continue to embrace automation to enhance operational efficiency, the integration of AI and IoT technologies will play a crucial role in optimizing warehouse operations. Additionally, the growing emphasis on sustainability and energy efficiency will further propel the adoption of innovative automation solutions, positioning Vietnam as a competitive player in the global logistics landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware Mobile Robots (AGV, AMR) Automated Storage and Retrieval Systems (AS/RS) Automated Sorting Systems De-palletizing/Palletizing Systems Conveyor Systems Automatic Identification and Data Collection (AIDC) Order Picking Software (WMS, WES) Services (Value Added Services, Maintenance) |

| By Function | Warehouse and Storage Management Transportation Management |

| By Enterprise Size | Small and Medium-sized Enterprises Large Enterprises |

| By Industry Vertical | Manufacturing Healthcare and Pharmaceuticals Fast-Moving Consumer Goods (FMCG) Retail and E-Commerce Third-Party Logistics (3PL) Aerospace and Defense Oil, Gas and Energy Chemicals Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehouse Automation | 50 | Warehouse Managers, Operations Directors |

| Manufacturing Sector Automation | 40 | Production Managers, Supply Chain Managers |

| Logistics Service Providers | 40 | Logistics Managers, IT Managers |

| Food and Beverage Distribution | 40 | Quality Control Managers, Distribution Supervisors |

| E-commerce Fulfillment Centers | 50 | E-commerce Operations Managers, Technology Managers |

The Vietnam Warehouse Automation Market is valued at approximately USD 900 million, reflecting significant growth driven by the expansion of e-commerce, demand for efficient supply chain management, and the adoption of advanced logistics technologies.