Region:Middle East

Author(s):Dev

Product Code:KRAD5076

Pages:86

Published On:December 2025

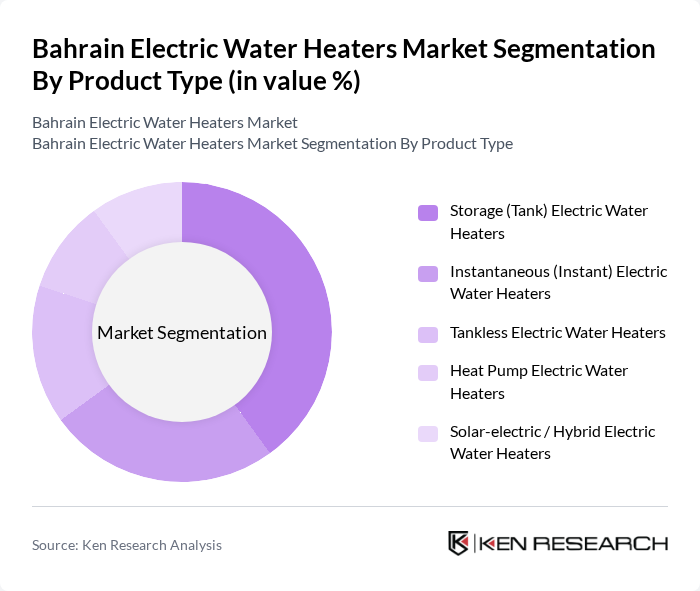

By Product Type:The market can be segmented into various product types, including Storage (Tank) Electric Water Heaters, Instantaneous (Instant) Electric Water Heaters, Tankless Electric Water Heaters, Heat Pump Electric Water Heaters, and Solar-electric / Hybrid Electric Water Heaters. Each of these subsegments caters to different consumer needs and preferences, with storage tank units generally preferred for mainstream residential use, while instant, tankless, and solar-electric / hybrid solutions are increasingly adopted in high-end residential, hospitality, and green-building projects seeking space savings and higher energy performance.

The Storage (Tank) Electric Water Heaters segment dominates the market due to their widespread use in residential settings, where consumers prefer the reliability of having a ready supply of hot water and benefit from lower upfront costs compared with more advanced technologies. This preference is driven by the need for consistent hot water availability, especially in larger households, as well as familiarity of local installers and distributors with tank-based systems. Additionally, advancements in insulation technology, smarter controls, and corrosion-resistant materials—mirroring trends in the broader GCC electric water heater market—have improved the energy efficiency and durability of these units, making them more appealing to cost-conscious consumers and project developers.

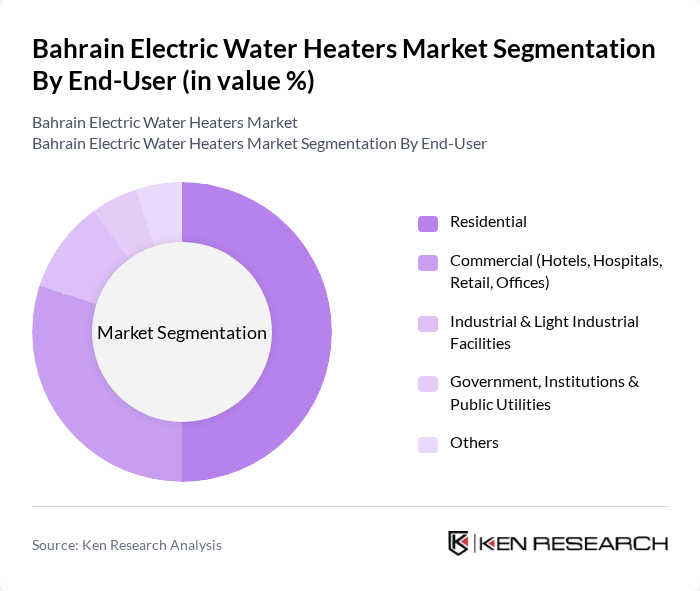

By End-User:The market is segmented by end-user into Residential, Commercial (Hotels, Hospitals, Retail, Offices), Industrial & Light Industrial Facilities, Government, Institutions & Public Utilities, and Others. Each segment has unique requirements and influences on the market dynamics, with residential and hospitality segments driving volume, while commercial and institutional projects increasingly specify higher-efficiency and sometimes solar-integrated water-heating solutions in line with GCC building and sustainability programs.

The Residential segment leads the market, accounting for a significant share due to the high demand for electric water heaters in homes across Bahrain and the wider GCC, where rising urbanization and housing development directly increase installations. This is driven by the growing population, the trend of modernizing residential facilities with energy-efficient appliances, and the penetration of smart-home features such as programmable thermostats and remote control for water heaters. Additionally, the increasing awareness of energy conservation, government-backed energy-efficiency labeling initiatives, and the availability of various models tailored to different household sizes and budgets further bolster this segment's dominance.

The Bahrain Electric Water Heaters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ariston Thermo Group (Ariston), A. A. Bin Hindi Group (Bin Hindi Technical & Trading / Ariston Distributor), Rheem Manufacturing Company, A. A. Almoayyed & Sons, Almoayyed International Group, Kanoo Electrical & Mechanical Company (YBA Kanoo), Al Zayani Commercial Services, ELYSÉES Electric Water Heaters, Bradford White Corporation, Bosch Thermotechnology (Robert Bosch GmbH), JOVEN Electric Co. Sdn. Bhd., RAK Therm LLC, Jaquar & Company Pvt. Ltd. (Water Heaters Division), ACICO Industries Company (Water Heater Manufacturing – GCC), Al-Mahroos (F. A. Al-Mahroos BSC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain electric water heaters market appears promising, driven by increasing consumer awareness of energy efficiency and sustainability. As urbanization continues to rise, the demand for modern, efficient heating solutions is expected to grow. Additionally, advancements in technology, such as IoT integration, will likely enhance product offerings, making them more appealing to tech-savvy consumers. The government's commitment to renewable energy will further support market growth, creating a favorable environment for innovation and investment in electric water heating solutions.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Storage (Tank) Electric Water Heaters Instantaneous (Instant) Electric Water Heaters Tankless Electric Water Heaters Heat Pump Electric Water Heaters Solar?electric / Hybrid Electric Water Heaters |

| By End-User | Residential Commercial (Hotels, Hospitals, Retail, Offices) Industrial & Light Industrial Facilities Government, Institutions & Public Utilities Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Technology | Electric Resistance Heating Heat Pump Technology Solar-Assisted Electric Heating Smart / Wi?Fi-Enabled Electric Heating Others |

| By Installation Type | Wall-Mounted Electric Water Heaters Floor-Standing Electric Water Heaters Under-Sink & Point-of-Use Electric Water Heaters |

| By Distribution Channel | Organized Retail & Electronics Stores HVAC & Plumbing Contractors / Project Sales Online / E-commerce Channels Others |

| By Price Band | Economy Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Electric Water Heater Users | 120 | Homeowners, Renters |

| Commercial Electric Water Heater Users | 90 | Facility Managers, Business Owners |

| Retailers of Electric Water Heaters | 60 | Store Managers, Sales Representatives |

| Installation Service Providers | 50 | Technicians, Service Managers |

| Energy Policy Makers | 40 | Government Officials, Energy Consultants |

The Bahrain Electric Water Heaters Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by urbanization, rising disposable incomes, and a demand for energy-efficient appliances in residential and commercial sectors.