GCC Plumbing Fixtures Market Overview

- The GCC Plumbing Fixtures Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by rapid urbanization, increased construction activities, and a rising demand for water-efficient products. The market has seen a significant uptick in investments in infrastructure and residential projects, which has further fueled the demand for plumbing fixtures across the region. The region’s construction sector is also being propelled by tourism, hospitality, and government-backed infrastructure initiatives, leading to robust demand for modern plumbing solutions.

- Key players in this market include the United Arab Emirates, Saudi Arabia, and Qatar. The UAE leads due to its extensive construction projects and luxury developments, while Saudi Arabia benefits from its Vision 2030 initiative, which emphasizes infrastructure development. Qatar's hosting of major events and investments in hospitality and public infrastructure have also spurred growth in the plumbing fixtures sector.

- The UAE Cabinet Decision No. 36 of 2022, issued by the United Arab Emirates Cabinet, mandates the use of water-efficient plumbing fixtures in all new construction projects. This regulation requires compliance with specific water consumption thresholds for fixtures such as faucets, showers, and toilets, and is enforced through mandatory product certification and building code inspections. The initiative aims to reduce water consumption and promote sustainability and environmental conservation in the region.

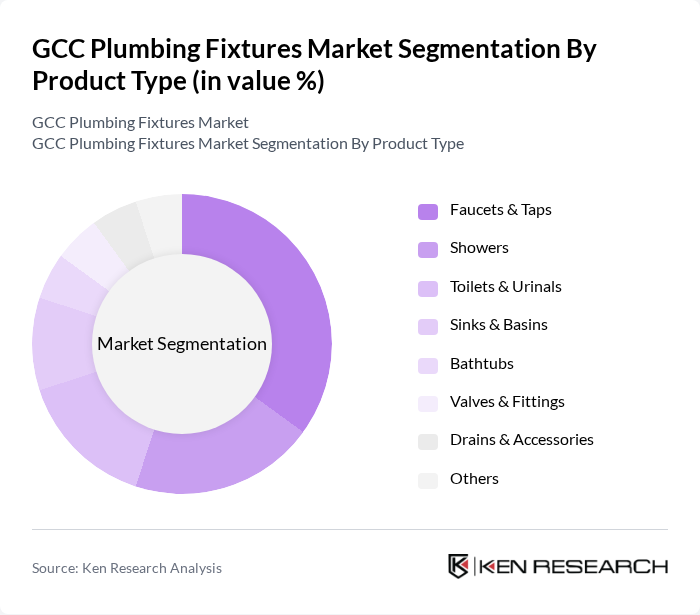

GCC Plumbing Fixtures Market Segmentation

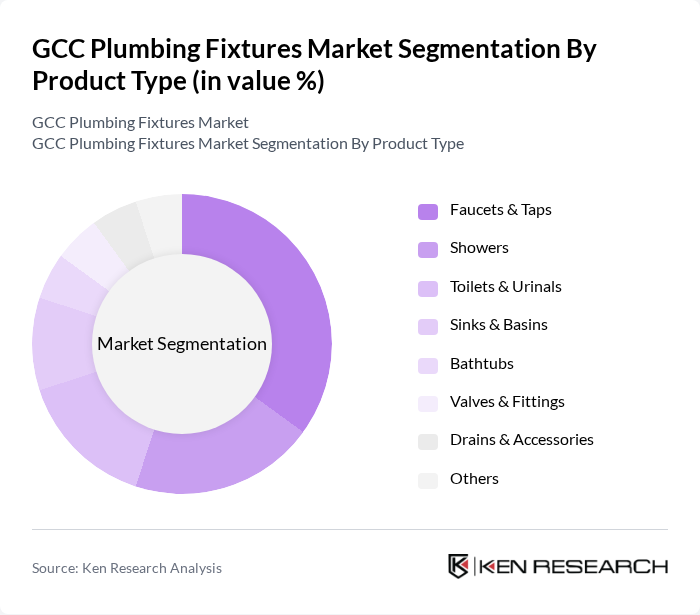

By Product Type:The product type segmentation includes various categories such as Faucets & Taps, Showers, Toilets & Urinals, Sinks & Basins, Bathtubs, Valves & Fittings, Drains & Accessories, and Others. Among these, Faucets & Taps are the fastest-growing segment due to their essential role in both residential and commercial settings. The increasing trend towards modern and stylish designs, coupled with the demand for water-saving technologies and sensor-based fixtures, has led to a surge in the popularity of this sub-segment.

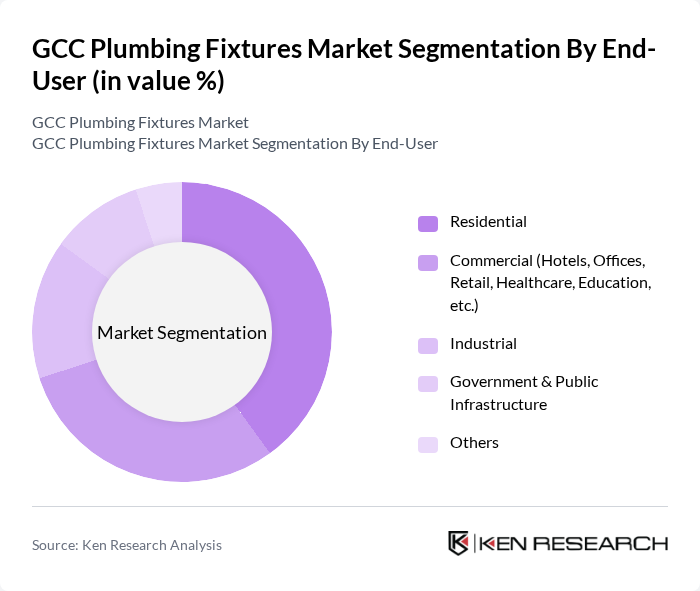

By End-User:The end-user segmentation encompasses Residential, Commercial (Hotels, Offices, Retail, Healthcare, Education, etc.), Industrial, Government & Public Infrastructure, and Others. The Residential segment is the largest, driven by the growing population, rising disposable incomes, and increased investments in home renovations and new constructions. The trend towards smart homes, eco-friendly fixtures, and water conservation is also propelling this segment's growth.

GCC Plumbing Fixtures Market Competitive Landscape

The GCC Plumbing Fixtures Market is characterized by a dynamic mix of regional and international players. Leading participants such as RAK Ceramics PJSC, Saudi Ceramics Company, Kohler Co., Grohe AG, Jaquar Group, LIXIL Group Corporation (INAX, American Standard), TOTO Ltd., Geberit AG, Ideal Standard International, Hansgrohe SE, Duravit AG, Villeroy & Boch AG, Al Shamsi Holdings (Bagno Design), Almutlaq Group (Saudi Arabia), Al Hashimya Group (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

GCC Plumbing Fixtures Market Industry Analysis

Growth Drivers

- Increasing Urbanization:The GCC region is experiencing rapid urbanization, with urban populations projected to reach 90% in future. This shift is driving demand for plumbing fixtures in residential and commercial buildings. For instance, the UAE's urban population is expected to grow from 9.3 million to 10.5 million in future, necessitating enhanced plumbing infrastructure. This urban expansion fuels the need for modern plumbing solutions, thereby boosting the market for plumbing fixtures significantly.

- Rising Construction Activities:The GCC construction sector is set to witness substantial growth, with investments projected to reach $200 billion in future. Major projects, including the Saudi Vision 2030 initiative, are driving this surge. In Qatar, the construction of infrastructure for the FIFA World Cup has already increased demand for plumbing fixtures. This construction boom is expected to create a robust market for plumbing fixtures, as new buildings require modern and efficient plumbing systems.

- Growing Demand for Water-Efficient Fixtures:With water scarcity becoming a pressing issue, the GCC is focusing on water conservation. The market for water-efficient plumbing fixtures is projected to grow, with the UAE aiming to reduce water consumption by 30% in future. This initiative is supported by government regulations promoting the use of water-saving technologies. As a result, manufacturers are increasingly developing innovative, water-efficient products to meet this rising demand, further driving market growth.

Market Challenges

- High Installation Costs:The installation of advanced plumbing fixtures often incurs significant costs, which can deter consumers and builders. For instance, the average installation cost for high-efficiency fixtures can exceed $1,500 per unit, making them less accessible for budget-conscious projects. This financial barrier can slow down the adoption of modern plumbing solutions, particularly in lower-income segments of the GCC market, impacting overall market growth.

- Regulatory Compliance Issues:Navigating the complex regulatory landscape in the GCC can pose challenges for plumbing fixture manufacturers. Compliance with various building codes and water efficiency standards can be cumbersome and costly. For example, the introduction of new environmental regulations in Saudi Arabia requires manufacturers to adapt quickly, often leading to increased operational costs. These compliance challenges can hinder market entry for new players and slow down innovation in the sector.

GCC Plumbing Fixtures Market Future Outlook

The GCC plumbing fixtures market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As smart home technologies gain traction, the integration of IoT in plumbing fixtures is expected to enhance efficiency and user experience. Additionally, the increasing focus on eco-friendly materials will likely reshape product offerings, aligning with consumer preferences for sustainable solutions. These trends indicate a dynamic market landscape, fostering innovation and growth opportunities for industry players in the coming years.

Market Opportunities

- Expansion in Smart Home Technologies:The rise of smart home technologies presents a lucrative opportunity for plumbing fixture manufacturers. With the smart home market projected to reach $100 billion in future in the GCC, integrating smart plumbing solutions can enhance convenience and efficiency. This trend encourages manufacturers to innovate and develop connected fixtures that appeal to tech-savvy consumers, driving market growth.

- Increasing Focus on Sustainable Products:As environmental awareness grows, there is a significant opportunity for manufacturers to develop sustainable plumbing fixtures. The GCC's commitment to reducing carbon footprints and promoting green building practices is driving demand for eco-friendly products. Companies that prioritize sustainability in their offerings can capture a larger market share, appealing to environmentally conscious consumers and aligning with government initiatives.