Region:Europe

Author(s):Geetanshi

Product Code:KRAA1228

Pages:83

Published On:August 2025

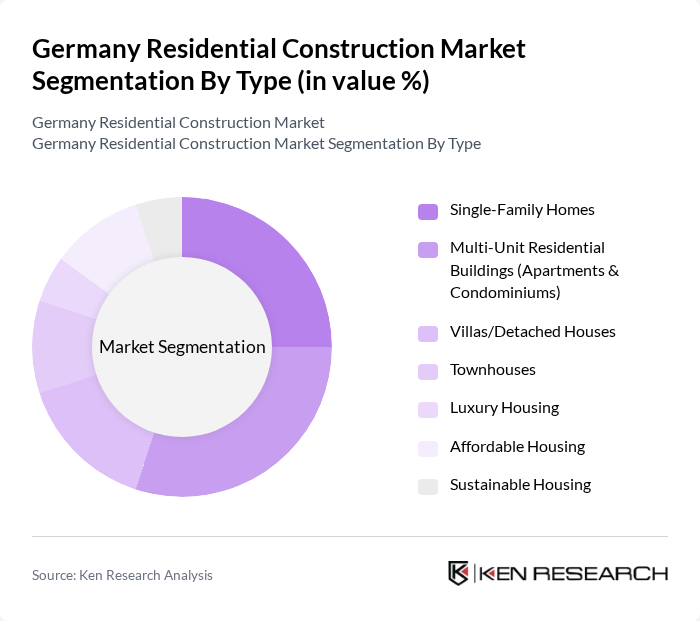

By Type:The residential construction market can be segmented into various types, including Single-Family Homes, Multi-Unit Residential Buildings (Apartments & Condominiums), Villas/Detached Houses, Townhouses, Luxury Housing, Affordable Housing, and Sustainable Housing. Each segment addresses distinct consumer preferences and market demands, reflecting the diverse needs of Germany’s population. Notably, the market is experiencing increased demand for energy-efficient and sustainable housing, driven by regulatory changes and consumer awareness .

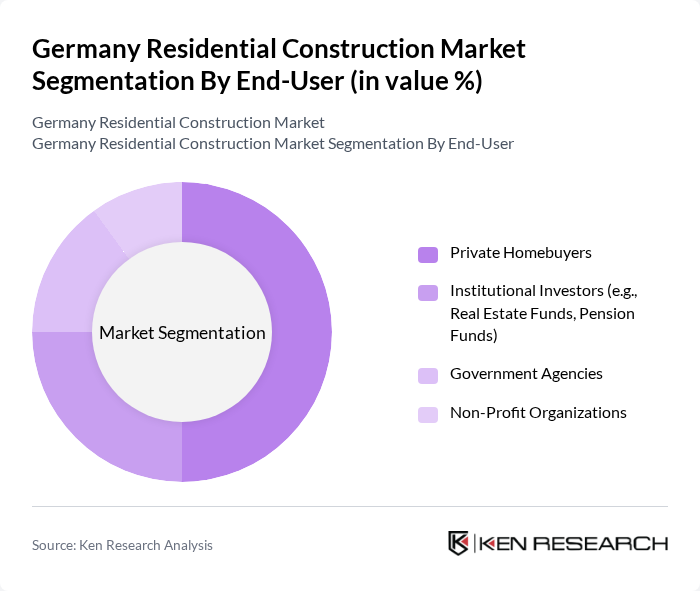

By End-User:The end-user segmentation includes Private Homebuyers, Institutional Investors (e.g., Real Estate Funds, Pension Funds), Government Agencies, and Non-Profit Organizations. Each of these end-users plays a crucial role in shaping the demand for residential construction, influenced by factors such as investment strategies, housing policies, and social objectives. Private homebuyers continue to dominate the market, while institutional investors and government agencies are increasingly active due to incentives for affordable and sustainable housing .

The Germany Residential Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as HOCHTIEF AG, STRABAG SE, Ed. Züblin AG, PORR AG, Bilfinger SE, WOLFF & MÜLLER Holding GmbH & Co. KG, KÖSTER GmbH, BSB Bau- und Spezialbau GmbH, GOLDBECK GmbH, KLEUSBERG GmbH & Co. KG, Vonovia SE, LEG Immobilien SE, Instone Real Estate Group SE, Bauwens GmbH & Co. KG, Bonava Deutschland GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany residential construction market appears promising, driven by ongoing urbanization and supportive government policies. As cities expand, the demand for innovative housing solutions will likely increase, particularly in smart home technologies and energy-efficient designs. Additionally, the emphasis on sustainability will shape construction practices, with a growing number of projects seeking green certifications. These trends indicate a dynamic market landscape, where adaptability and innovation will be key to meeting evolving consumer needs and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Multi-Unit Residential Buildings (Apartments & Condominiums) Villas/Detached Houses Townhouses Luxury Housing Affordable Housing Sustainable Housing |

| By End-User | Private Homebuyers Institutional Investors (e.g., Real Estate Funds, Pension Funds) Government Agencies Non-Profit Organizations |

| By Financing Type | Mortgages Cash Purchases Government Grants/Subsidies Private Investments |

| By Construction Method | Traditional Construction Prefabricated/Modular Construction Sustainable/Energy-Efficient Construction Renovation and Retrofitting |

| By Region | Northern Germany Southern Germany Eastern Germany Western Germany |

| By Project Size | Small Projects Medium Projects Large Projects |

| By Policy Support | Subsidies Tax Exemptions Incentives for Green Building Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Single-Family Home Construction | 100 | Architects, General Contractors |

| Multi-Family Residential Projects | 90 | Real Estate Developers, Project Managers |

| Renovation and Remodeling Services | 80 | Home Improvement Contractors, Interior Designers |

| Green Building Initiatives | 60 | Sustainability Consultants, Building Inspectors |

| Government Housing Programs | 50 | Policy Makers, Housing Authority Officials |

The Germany Residential Construction Market is valued at approximately USD 93 billion, reflecting robust activity in the residential segment despite sector-wide challenges. This valuation is based on a five-year historical analysis and indicates significant investments in housing and infrastructure.