Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4089

Pages:100

Published On:December 2025

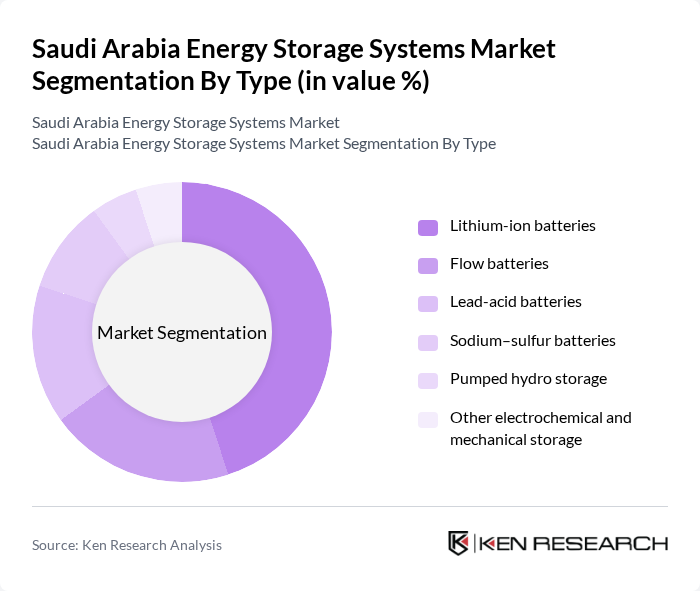

By Type:The market is segmented into various types of energy storage systems, including Lithium-ion batteries, Flow batteries, Lead-acid batteries, Sodium–sulfur batteries, Pumped hydro storage, and Other electrochemical and mechanical storage. Among these, Lithium-ion batteries are leading due to their high energy density, efficiency, and decreasing costs, making them the preferred choice for both residential and commercial applications.

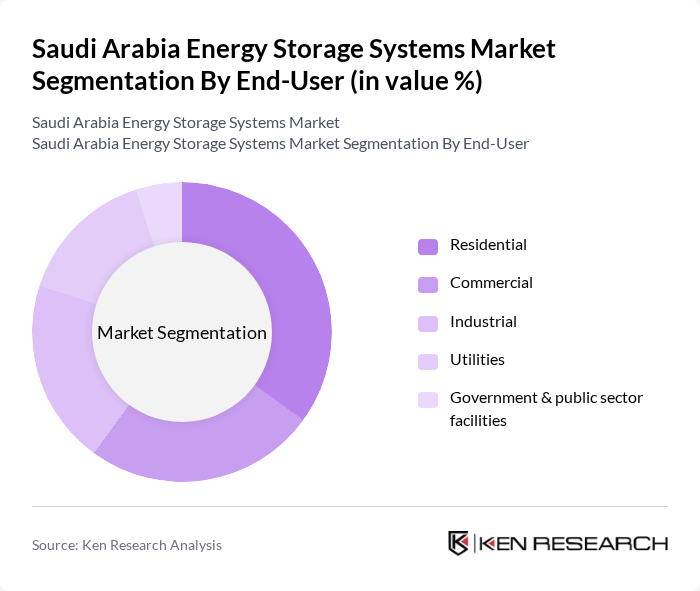

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Utilities, and Government & public sector facilities. The Residential segment is currently emerging as the fastest-growing segment, driven by increasing consumer awareness of energy efficiency and the rising adoption of solar energy systems, which require effective storage solutions to manage energy supply and demand.

The Saudi Arabia Energy Storage Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Electricity Company (SEC), ACWA Power, National Grid SA (a subsidiary of SEC), NEOM Company, Huawei Digital Power, ABB Ltd., Schneider Electric, LG Energy Solution, Tesla, Inc., Fluence Energy, BYD Company Limited, Sungrow Power Supply Co., Ltd., Siemens Energy, General Electric (GE Vernova), JinkoSolar Holding Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the energy storage systems market in Saudi Arabia appears promising, driven by increasing investments in renewable energy and technological advancements. In the future, the integration of smart grid technologies is expected to enhance energy management efficiency, while the expansion of electric vehicle infrastructure will further stimulate demand for energy storage solutions. As the government continues to support energy diversification, the market is likely to witness significant growth, positioning Saudi Arabia as a leader in energy storage innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium-ion batteries Flow batteries Lead-acid batteries Sodium–sulfur batteries Pumped hydro storage Other electrochemical and mechanical storage |

| By End-User | Residential Commercial Industrial Utilities Government & public sector facilities |

| By Region | Central (including Riyadh) Western (including Makkah & Jeddah) Eastern (including Dammam & Eastern Province) Southern Region |

| By Technology | Battery Energy Storage Systems (BESS) Thermal energy storage Mechanical storage (pumped hydro, flywheels) Hydrogen and power-to-X storage Hybrid storage systems |

| By Application | Grid-scale storage (utility & transmission) C&I behind-the-meter storage Residential behind-the-meter storage Microgrids & off-grid systems Ancillary services (frequency & voltage support) |

| By Investment Source | Government & state-owned utilities Private domestic investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Multilateral and development finance |

| By Policy Support | Capital subsidies & grants Tax incentives and exemptions Tendering & capacity auction schemes Grid code & regulatory support for storage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility-Scale Energy Storage Projects | 40 | Project Managers, Energy Analysts |

| Commercial Energy Storage Solutions | 40 | Facility Managers, Operations Directors |

| Residential Energy Storage Systems | 40 | Homeowners, Renewable Energy Installers |

| Research and Development in Energy Storage | 40 | R&D Managers, Technology Developers |

| Government Policy and Regulation Impact | 40 | Policy Makers, Regulatory Affairs Specialists |

The Saudi Arabia Energy Storage Systems Market is valued at approximately USD 1.1 billion, driven by the increasing demand for renewable energy integration and government initiatives aimed at enhancing energy security and grid stability.