Region:Middle East

Author(s):Rebecca

Product Code:KRAD4330

Pages:98

Published On:December 2025

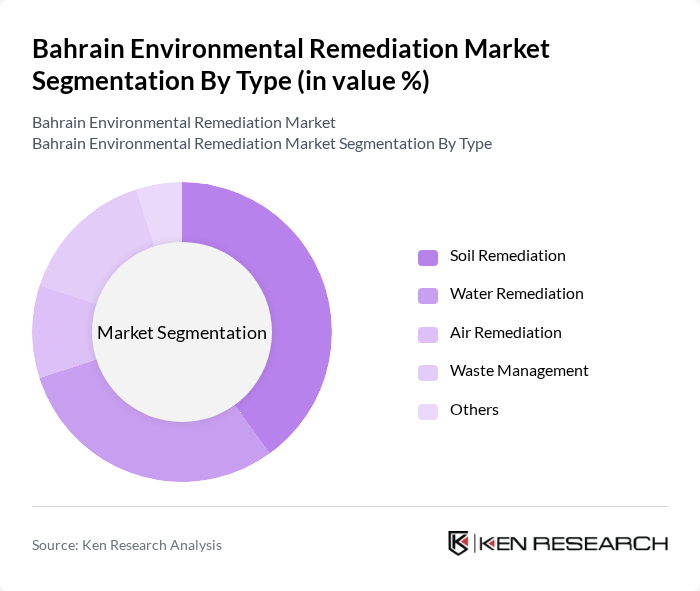

By Type:The market is segmented into various types of remediation services, including soil remediation, water remediation, air remediation, waste management, and others. Among these, soil remediation is currently the leading sub-segment due to the increasing contamination of land from industrial activities and urban development. The growing awareness of soil health and its impact on agriculture and human health has led to a surge in demand for soil remediation services. Water remediation also plays a significant role, driven by the need to ensure safe drinking water and protect aquatic ecosystems.

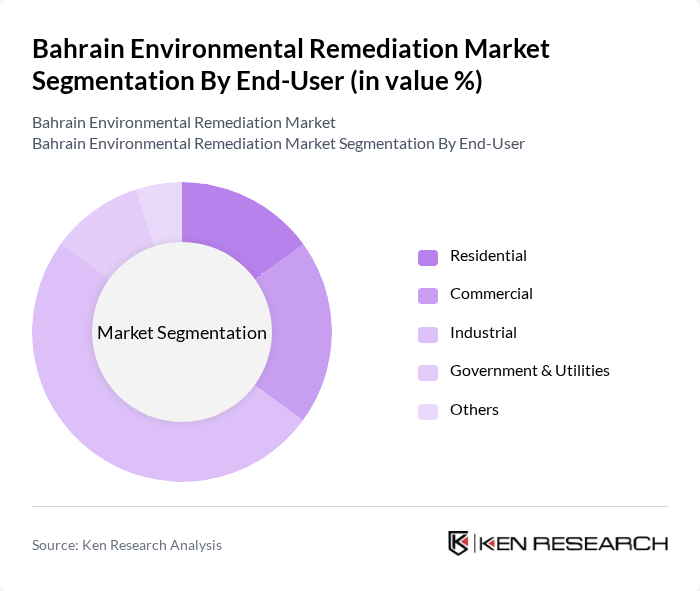

By End-User:The end-user segmentation includes residential, commercial, industrial, government & utilities, and others. The industrial segment dominates the market, driven by stringent regulations and the need for compliance with environmental standards. Industries are increasingly investing in remediation technologies to mitigate their environmental impact and ensure sustainable operations. The government & utilities segment is also significant, as public sector initiatives often lead to large-scale remediation projects.

The Bahrain Environmental Remediation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Environmental Solutions, EnviroServe, AECOM, Veolia Environmental Services, SUEZ Recycling and Recovery, Dulsco, Clean Harbors, Intertek, Ramboll, ERM, Tetra Tech, Golder Associates, Jacobs Engineering, KBR, Inc., WSP Global contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain environmental remediation market appears promising, driven by increasing regulatory pressures and a growing public commitment to sustainability. As the government continues to invest in green initiatives, the demand for innovative remediation technologies is expected to rise. Additionally, partnerships with international firms may enhance local capabilities, fostering knowledge transfer and improving service delivery. Overall, the market is poised for growth, with significant opportunities for companies that can navigate the challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Soil Remediation Water Remediation Air Remediation Waste Management Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Technology | Bioremediation Chemical Remediation Physical Remediation Thermal Remediation Others |

| By Application | Industrial Cleanup Site Restoration Hazardous Waste Management Environmental Monitoring Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Waste Remediation | 85 | Environmental Managers, Compliance Officers |

| Soil and Groundwater Remediation | 75 | Geologists, Environmental Engineers |

| Hazardous Waste Management | 65 | Waste Management Supervisors, Safety Officers |

| Construction Site Remediation | 55 | Project Managers, Site Engineers |

| Public Sector Environmental Initiatives | 80 | Government Officials, Policy Advisors |

The Bahrain Environmental Remediation Market is valued at approximately USD 15 million, reflecting the growth driven by increasing environmental awareness, national sustainability goals, and the need for integrated waste and contaminated land management solutions.