Region:Middle East

Author(s):Shubham

Product Code:KRAD3603

Pages:89

Published On:November 2025

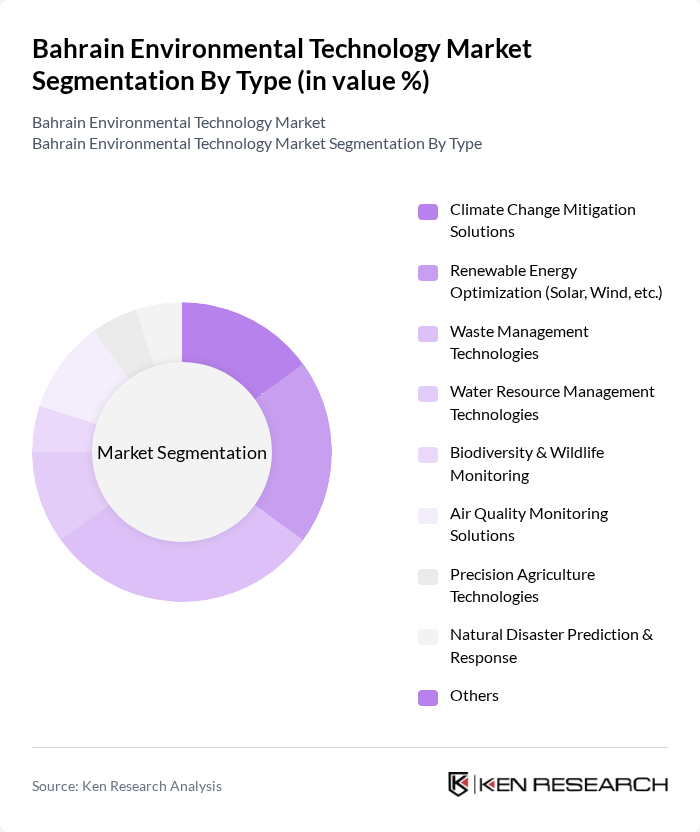

By Type:The market is segmented into various types, including Climate Change Mitigation, Renewable Energy Optimization, Waste Management, Water Resource Management, Biodiversity Monitoring, Air Quality Monitoring, Precision Agriculture, and Natural Disaster Prediction. Among these, Waste Management Technologies are currently leading the market due to increasing waste generation and the need for efficient disposal and recycling methods. The growing emphasis on sustainability and circular economy practices is driving investments in waste management solutions .

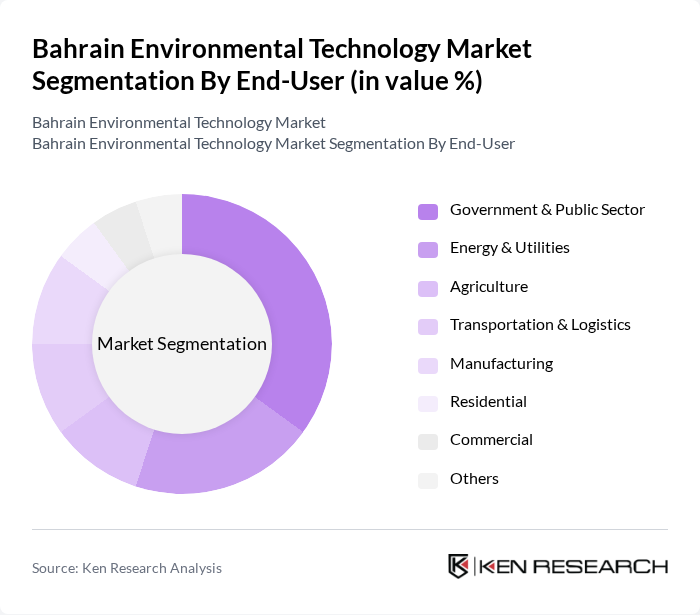

By End-User:The market is segmented by end-users, including Government & Public Sector, Energy & Utilities, Agriculture, Transportation & Logistics, Manufacturing, Residential, and Commercial. The Government & Public Sector segment is currently the largest due to significant investments in environmental initiatives and regulations aimed at promoting sustainability. This segment is expected to continue leading as governments prioritize environmental protection and resource management .

The Bahrain Environmental Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain National Gas Company (BANAGAS), Gulf Petrochemical Industries Company (GPIC), Electricity and Water Authority (EWA), EcoMENA, Aluminium Bahrain B.S.C. (Alba), Bahrain Environmental Management Company, National Oil and Gas Authority (NOGA), Bahrain Recycling Company, Green Energy Solutions, Sustainable Energy Authority (SEA), Bahrain Economic Development Board (EDB), Bahrain Petroleum Company (BAPCO), Enviromena Power Systems, Bee'ah Bahrain, CleanTech Arabia contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain environmental technology market appears promising, driven by increasing government support and a growing emphasis on sustainability. As the nation aims to diversify its economy, investments in renewable energy and waste management are expected to rise significantly. Furthermore, the integration of smart technologies and AI in environmental monitoring will enhance operational efficiencies. These trends indicate a robust market evolution, positioning Bahrain as a regional leader in environmental technology solutions in future.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Climate Change Mitigation, Renewable Energy Optimization, Waste Management, Water Resource Management, Biodiversity Monitoring, Air Quality Monitoring, Precision Agriculture, Disaster Prediction) | Climate Change Mitigation Solutions Renewable Energy Optimization (Solar, Wind, etc.) Waste Management Technologies Water Resource Management Technologies Biodiversity & Wildlife Monitoring Air Quality Monitoring Solutions Precision Agriculture Technologies Natural Disaster Prediction & Response Others |

| By End-User (Government & Public Sector, Energy & Utilities, Agriculture, Transportation & Logistics, Manufacturing, Residential, Commercial) | Government & Public Sector Energy & Utilities Agriculture Transportation & Logistics Manufacturing Residential Commercial Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Technology (Machine Learning, Computer Vision, Predictive Analytics, IoT, Photovoltaic, CSP, Onshore/Offshore Wind, Biomass Gasification) | Machine Learning Computer Vision Predictive Analytics Internet of Things (IoT) Photovoltaic Concentrated Solar Power (CSP) Onshore Wind Offshore Wind Biomass Gasification Others |

| By Application (Climate Change Mitigation, Renewable Energy Optimization, Waste Management, Water Management, Biodiversity Monitoring, Air Quality Monitoring, Disaster Prediction & Response, Grid-Connected, Off-Grid, Rooftop Installations, Utility-Scale Projects) | Climate Change Mitigation Renewable Energy Optimization Waste Management Water Management Biodiversity Monitoring Air Quality Monitoring Disaster Prediction & Response Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Others |

| By Investment Source (Domestic Investments, Foreign Direct Investments (FDI), Public-Private Partnerships (PPP), Government Grants) | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support (Subsidies for Renewable Energy, Tax Exemptions for Green Technologies, Renewable Energy Certificates (RECs), Others) | Subsidies for Renewable Energy Tax Exemptions for Green Technologies Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management Technologies | 100 | City Planners, Waste Management Directors |

| Water Treatment Solutions | 60 | Water Resource Managers, Environmental Engineers |

| Air Quality Monitoring Systems | 50 | Environmental Scientists, Compliance Officers |

| Renewable Energy Technologies | 70 | Energy Managers, Sustainability Coordinators |

| Green Building Technologies | 40 | Architects, Construction Project Managers |

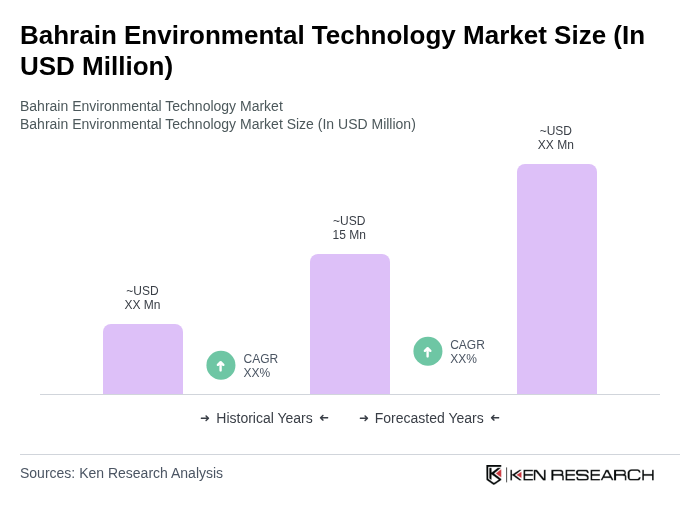

The Bahrain Environmental Technology Market is valued at approximately USD 15 million, reflecting a five-year historical analysis driven by government initiatives, public awareness, and the adoption of innovative technologies aimed at sustainability and environmental protection.