Region:Middle East

Author(s):Dev

Product Code:KRAD3230

Pages:86

Published On:November 2025

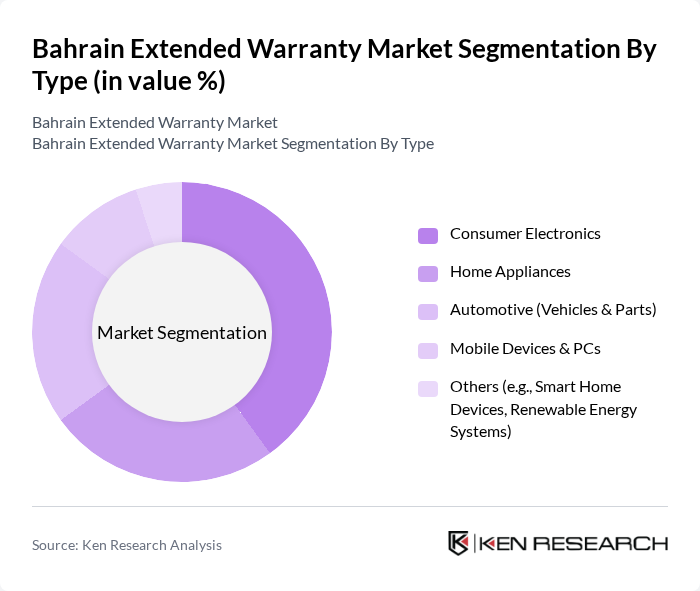

By Type:The market can be segmented into various types, including Consumer Electronics, Home Appliances, Automotive (Vehicles & Parts), Mobile Devices & PCs, and Others (e.g., Smart Home Devices, Renewable Energy Systems). Each segment addresses distinct consumer needs, with Consumer Electronics and Automotive segments showing the strongest demand due to frequent product innovation and higher repair costs. The Others segment, including smart home devices and renewable energy systems, is emerging rapidly as consumers invest in new technologies and sustainable solutions .

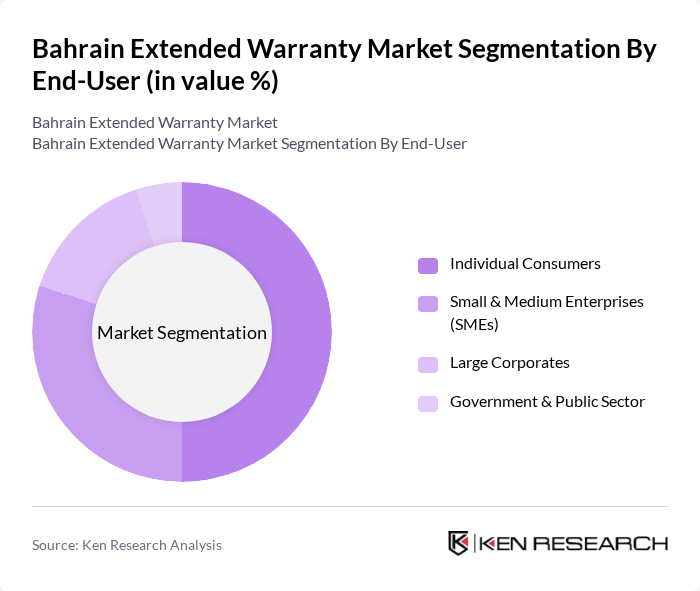

By End-User:The end-user segmentation includes Individual Consumers, Small & Medium Enterprises (SMEs), Large Corporates, and Government & Public Sector. Individual Consumers account for the largest share, driven by increasing awareness and affordability. SMEs and Large Corporates are adopting extended warranties to safeguard business assets and minimize operational risks, while the Government & Public Sector segment is focused on maintaining reliability for critical infrastructure and public services .

The Bahrain Extended Warranty Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ahlia Insurance Company B.S.C., Bahrain National Holding B.S.C., Gulf Insurance Group K.S.C.P. (GIG Bahrain), Takaful International Company B.S.C., Solidarity Bahrain B.S.C., Bahrain Kuwait Insurance Company B.S.C. (BKIC), Arab Insurance Group (ARIG), Allianz Bahrain, American International Group (AIG) Bahrain, MetLife Bahrain, Zurich Insurance Bahrain, AXA Cooperative Insurance (now GIG Gulf), Qatar Insurance Company (QIC) Bahrain, Oman Insurance Company (Sukoon Insurance) Bahrain, National Life & General Insurance Company (NLGIC) Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain extended warranty market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms gain traction, providers are expected to enhance their online presence, facilitating easier access to warranty services. Additionally, the focus on customer experience will likely lead to improved service delivery, fostering greater consumer loyalty. These trends indicate a shift towards more innovative and customer-centric warranty solutions, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer Electronics Home Appliances Automotive (Vehicles & Parts) Mobile Devices & PCs Others (e.g., Smart Home Devices, Renewable Energy Systems) |

| By End-User | Individual Consumers Small & Medium Enterprises (SMEs) Large Corporates Government & Public Sector |

| By Product Category | Major Appliances (Refrigerators, Washing Machines, etc.) Consumer Electronics (TVs, Audio, Cameras, etc.) Automotive (Cars, Motorcycles, Commercial Vehicles) Mobile Devices & PCs Others |

| By Distribution Channel | Manufacturer/Brand Warranty Programs Retailer/Dealer Warranty Programs Online Platforms Insurance Companies/Brokers Others |

| By Duration of Coverage | 2 Years 5 Years More than 5 Years Lifetime/Unlimited |

| By Pricing Model | Fixed Pricing Tiered Pricing Subscription-based Pricing Pay-as-you-go Others |

| By Customer Segment | First-time Buyers Repeat Customers High-value Customers Price-sensitive Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Extended Warranties | 60 | Car Dealership Managers, Warranty Administrators |

| Consumer Electronics Warranties | 50 | Retail Managers, Electronics Sales Representatives |

| Home Appliances Warranty Services | 40 | Product Managers, Customer Support Leads |

| Insurance Providers for Warranties | 40 | Insurance Underwriters, Risk Assessment Analysts |

| Consumer Feedback on Warranty Services | 70 | End Consumers, Warranty Claimants |

The Bahrain Extended Warranty Market is valued at approximately USD 120 million, driven by increasing consumer demand for protection against product failures and rising repair costs across various sectors, including electronics and automobiles.