Region:Middle East

Author(s):Shubham

Product Code:KRAD5529

Pages:83

Published On:December 2025

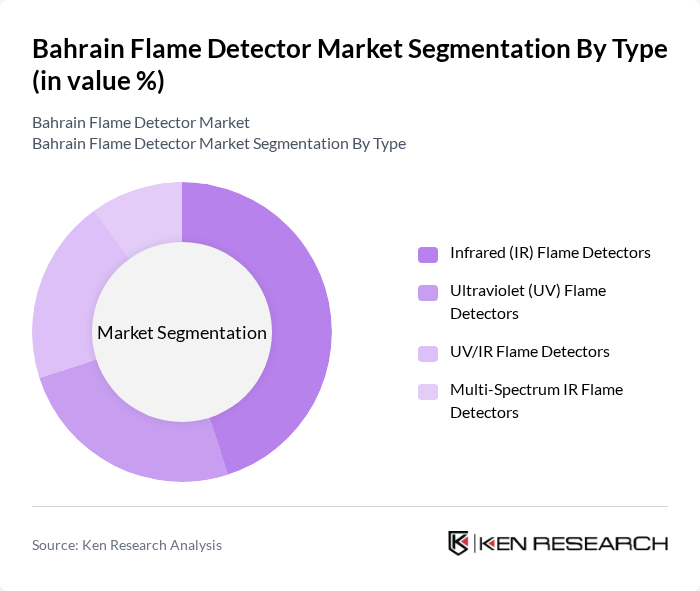

By Type:The flame detector market can be segmented into various types, including Infrared (IR) Flame Detectors, Ultraviolet (UV) Flame Detectors, UV/IR Flame Detectors, and Multi-Spectrum IR Flame Detectors. Among these, Infrared (IR) Flame Detectors are leading the market due to their high sensitivity and reliability in detecting flames in various industrial environments. The increasing adoption of IR detectors in oil and gas facilities, where rapid detection is crucial, has significantly contributed to their dominance. The trend towards automation and integration with other safety systems further enhances their appeal.

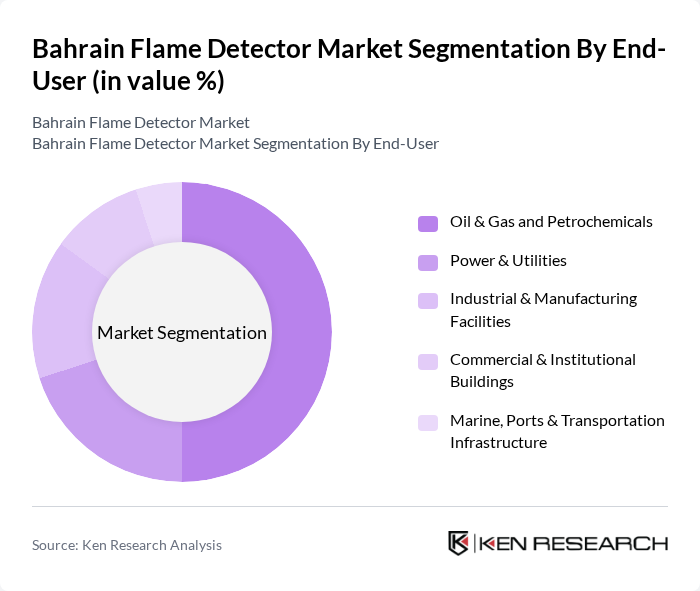

By End-User:The end-user segmentation includes Oil & Gas and Petrochemicals, Power & Utilities, Industrial & Manufacturing Facilities, Commercial & Institutional Buildings, and Marine, Ports & Transportation Infrastructure. The Oil & Gas and Petrochemicals sector is the dominant end-user, driven by the critical need for fire safety in high-risk environments. The stringent safety regulations and the high value of assets in this sector necessitate the deployment of advanced flame detection systems, making it a key driver of market growth.

The Bahrain Flame Detector Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc. (Honeywell Fire, Honeywell Analytics), Johnson Controls International plc (incl. Tyco Fire & Security), Siemens AG (Siemens Smart Infrastructure / Fire Safety), Emerson Electric Co. (Emerson Automation Solutions), MSA Safety Incorporated, Teledyne Gas & Flame Detection (Teledyne Technologies), Spectrex, Inc. (A Halma Company), Drägerwerk AG & Co. KGaA, SENSE-WARE Fire and Gas Detection B.V., R. STAHL AG, SICK AG, Schneider Electric SE, Bosch Building Technologies, NAFFCO (National Fire Fighting Manufacturing FZCO), Gulf Security & Safety Companies (Local System Integrators / Distributors) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain flame detector market is poised for significant growth, driven by increasing industrial safety regulations and technological advancements. As the government continues to enforce stringent fire safety standards, businesses will increasingly invest in advanced flame detection systems. Additionally, the integration of IoT and AI technologies is expected to enhance system capabilities, making them more attractive to various sectors. This evolving landscape presents opportunities for innovation and expansion, particularly in high-risk industries such as oil and gas.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrared (IR) Flame Detectors Ultraviolet (UV) Flame Detectors UV/IR Flame Detectors Multi-Spectrum IR Flame Detectors |

| By End-User | Oil & Gas and Petrochemicals Power & Utilities Industrial & Manufacturing Facilities Commercial & Institutional Buildings Marine, Ports & Transportation Infrastructure |

| By Industry Vertical | Upstream Oil & Gas (Onshore/Offshore) Refineries & Petrochemical Plants LNG Terminals & Storage Facilities Chemical Processing & Fertilizers Metals, Mining & Heavy Industries |

| By Technology | Conventional (Standalone / Analog) Flame Detectors Addressable & Networked Flame Detectors Wireless & IoT-Enabled Flame Detectors SIL-Certified and ATEX / IECEx-Certified Flame Detectors |

| By Application | Process Area & Equipment Protection Tank Farms, Loading Racks & Pipelines Control Rooms, Substations & MCC Areas Warehouses, Logistics Yards & Airports/Ports |

| By Investment Source | CAPEX Projects in Oil & Gas and Petrochemicals OPEX-led Maintenance, Retrofit & Upgrade Spending Government and State-Owned Enterprise Projects PPP and Private Industrial Investments |

| By Policy Support | Compliance with Bahrain Civil Defence Codes & NFPA Standards Industrial Safety & Major Hazard Regulations Insurance-Driven Fire Protection Requirements Environmental and ESG-Linked Safety Investments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Flame Detection | 100 | Safety Managers, Operations Directors |

| Manufacturing Facility Safety Systems | 80 | Plant Managers, Safety Compliance Officers |

| Hospitality Industry Fire Safety | 60 | Facility Managers, Risk Assessment Specialists |

| Commercial Building Fire Detection | 70 | Building Managers, Fire Safety Inspectors |

| Public Sector Fire Safety Initiatives | 50 | Government Safety Officials, Policy Makers |

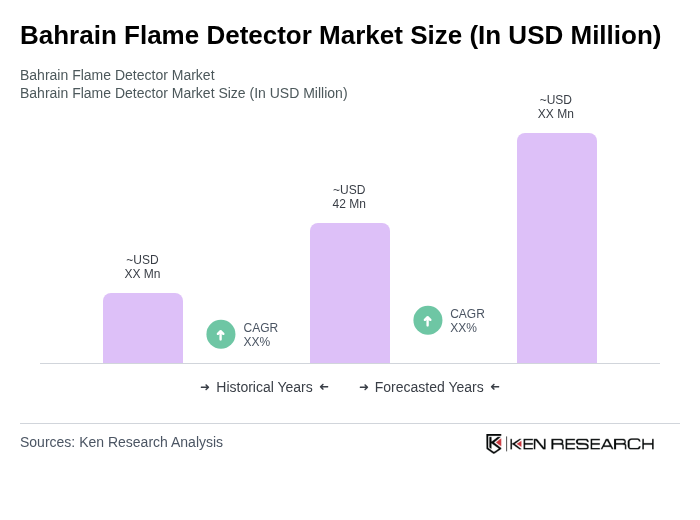

The Bahrain Flame Detector Market is valued at approximately USD 42 million, reflecting a five-year historical analysis. This growth is driven by increasing safety regulations and the expansion of industrial sectors, particularly in oil and gas.