Region:Middle East

Author(s):Dev

Product Code:KRAD5107

Pages:86

Published On:December 2025

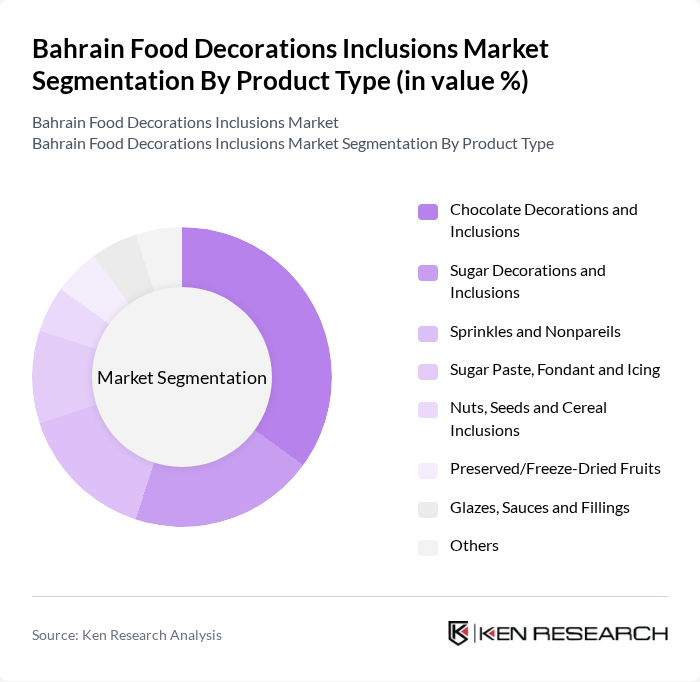

By Product Type:The product type segmentation includes various categories such as chocolate decorations and inclusions, sugar decorations and inclusions, sprinkles and nonpareils, sugar paste, fondant and icing, nuts, seeds and cereal inclusions, preserved/freeze-dried fruits, glazes, sauces and fillings, and others. Among these, chocolate decorations and inclusions are leading the market due to their widespread use in confectionery and bakery products, driven by consumer preferences for rich flavors and appealing aesthetics.

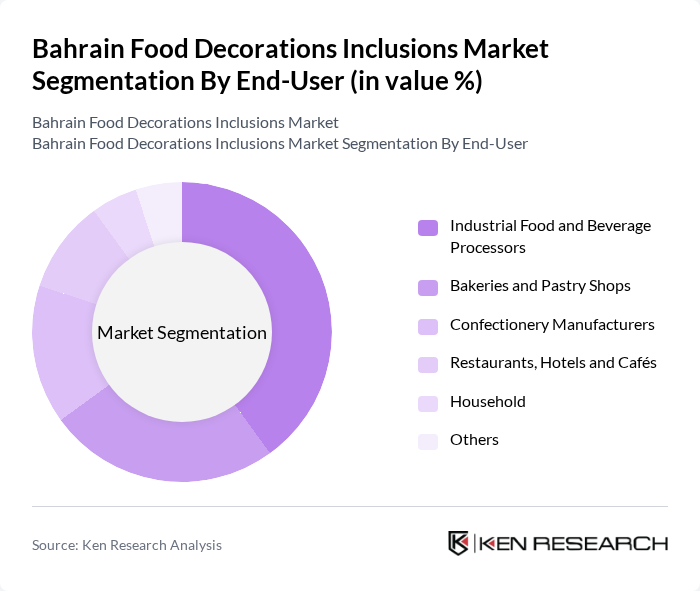

By End-User:The end-user segmentation encompasses industrial food and beverage processors, bakeries and pastry shops, confectionery manufacturers, restaurants, hotels and cafés, households, and others. The industrial food and beverage processors segment is currently dominating the market, driven by the increasing demand for ready-to-eat products and the need for high-quality decorative inclusions in mass production.

The Bahrain Food Decorations Inclusions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barry Callebaut Group (Regional Operations Serving Bahrain), Cargill Cocoa & Chocolate (Middle East Operations), Puratos Group (Gulf Region), Dawn Foods (Middle East & North Africa), Bakels Group (Middle East), Dr. Oetker (Middle East & Africa), Kerry Group (Taste & Nutrition – Middle East), IFFCO Group (Confectionery and Bakery Ingredients), Almarai Company (Bakery & Dessert Products), Americana Group (Bakery and Dessert Retail Concepts), Lulu Group International (Private-Label Bakery & Confectionery), Bahrain Flour Mills Company (Bakery Mixes and Ingredients), Trafco Group B.S.C. (Food Distribution in Bahrain), Bahrain Duty Free Shop Complex (Travel Retail for Confectionery), Select Local Artisan Bakeries and Chocolatiers (Manama & Muharraq) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain food decorations market appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly prioritize aesthetics in food, the demand for innovative decoration solutions is expected to rise. Additionally, the integration of e-commerce platforms will facilitate greater accessibility to a wider range of products, enhancing market growth. Companies that adapt to these trends and invest in sustainable practices will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Chocolate Decorations and Inclusions Sugar Decorations and Inclusions Sprinkles and Nonpareils Sugar Paste, Fondant and Icing Nuts, Seeds and Cereal Inclusions Preserved/Freeze-Dried Fruits Glazes, Sauces and Fillings Others |

| By End-User | Industrial Food and Beverage Processors Bakeries and Pastry Shops Confectionery Manufacturers Restaurants, Hotels and Cafés Household Others |

| By Application | Bakery (Cakes, Pastries, Biscuits) Confectionery (Chocolate, Sugar Confectionery) Dairy and Ice Cream Desserts and Ready-to-Eat Meals Beverages Others |

| By Distribution Channel | Business-to-Business (B2B) Business-to-Consumer (B2C) – Supermarkets/Hypermarkets B2C – Convenience and Specialty Stores B2C – Online Retail and Marketplaces Others |

| By Ingredient Origin | Conventional Ingredients Natural and Clean-Label Ingredients Organic Ingredients Plant-Based and Allergen-Free Inclusions Others |

| By Packaging Type | Bulk Industrial Packaging Foodservice Packs Retail Packs Single-Serve and Portion Packs Others |

| By Price Range | Premium Mid-range Economy Private Label and Value Packs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bakery Sector Insights | 100 | Bakers, Shop Owners, Product Developers |

| Catering Services Feedback | 80 | Catering Managers, Event Planners, Chefs |

| Consumer Preferences Survey | 120 | Households, Event Organizers, Food Enthusiasts |

| Retail Market Analysis | 70 | Retail Managers, Merchandisers, Marketing Executives |

| Food Decoration Trends | 90 | Food Stylists, Influencers, Social Media Managers |

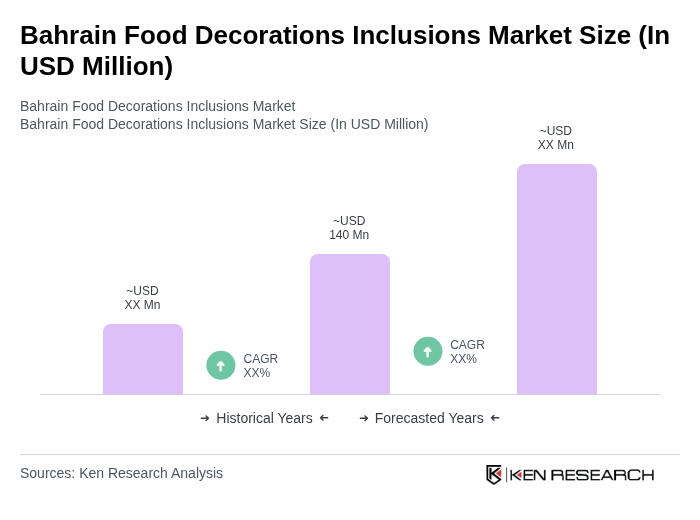

The Bahrain Food Decorations Inclusions Market is valued at approximately USD 140 million, reflecting a robust growth trajectory driven by increasing consumer demand for visually appealing food products, particularly in the bakery and confectionery sectors.