Region:Middle East

Author(s):Shubham

Product Code:KRAA8561

Pages:95

Published On:November 2025

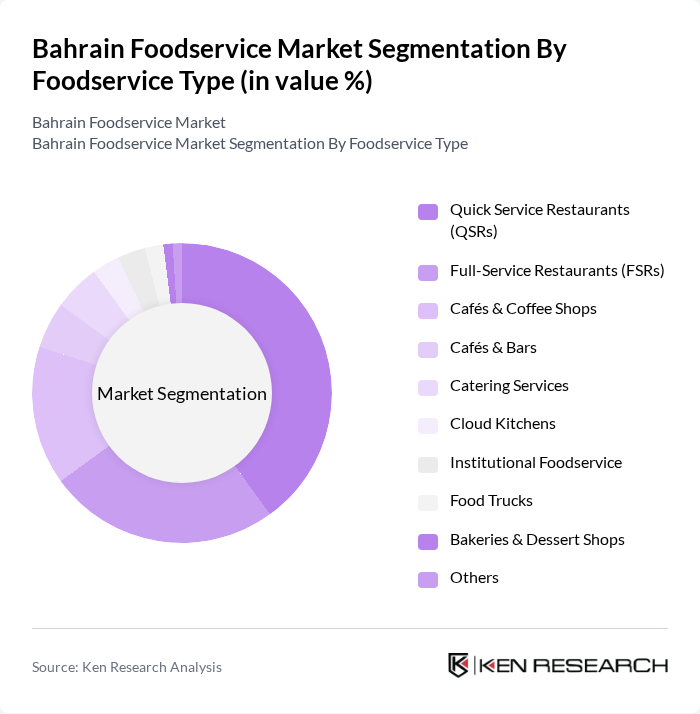

By Foodservice Type:The foodservice market in Bahrain is segmented into various types, including Quick Service Restaurants (QSRs), Full-Service Restaurants (FSRs), Cafés & Coffee Shops, Cafés & Bars, Catering Services, Cloud Kitchens, Institutional Foodservice, Food Trucks, Bakeries & Dessert Shops, and Others. Among these, Quick Service Restaurants (QSRs) have emerged as the dominant segment due to their convenience, affordability, and the growing trend of fast food consumption among the busy urban population. The increasing preference for quick meals, especially among working professionals and families, has significantly contributed to the growth of this segment. The QSR segment is further bolstered by the rapid expansion of both local and international chains, as well as the integration of digital ordering and delivery platforms .

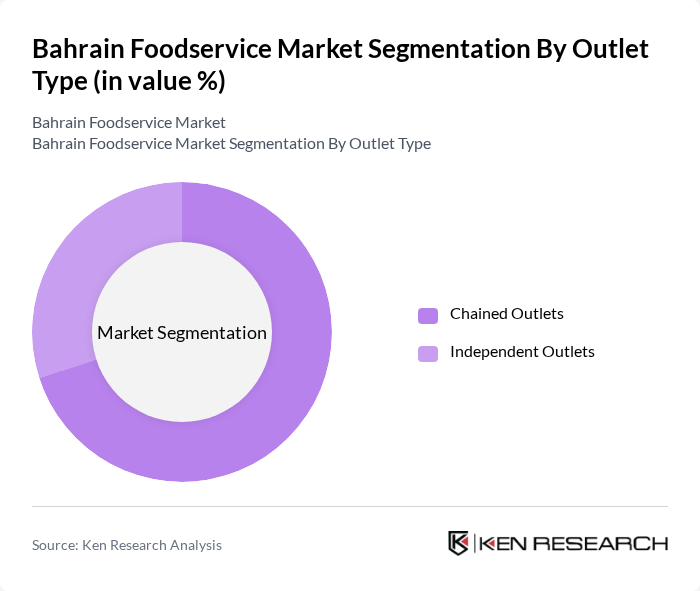

By Outlet Type:The market is also segmented by outlet type, which includes Chained Outlets and Independent Outlets. Chained outlets dominate the market due to their established brand recognition, standardized service quality, and extensive marketing strategies. Consumers often prefer these outlets for their reliability and familiarity, which drives foot traffic and sales. Independent outlets, while offering unique and diverse culinary experiences, face challenges in competing with the marketing power and operational efficiencies of larger chains. The growth of chained outlets is further supported by their ability to rapidly adapt to digital ordering trends and implement loyalty programs .

The Bahrain Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americana Restaurants (operator of KFC, Pizza Hut, Hardee's, Krispy Kreme, TGI Fridays in Bahrain), Al Abraaj Restaurants Group, McDonald's Bahrain (Fakhro Restaurants Company W.L.L.), Yum! Brands Bahrain (KFC, Pizza Hut), Alshaya Group (Starbucks, Shake Shack, The Cheesecake Factory, PF Chang's, Texas Roadhouse, Asha's, etc.), Nando's Bahrain, Paul Bakery & Restaurant Bahrain, Jasmis Corporation (Jasmi's), Burger King Bahrain (HANA International Company), Chili's Bahrain (Bahrain Family Leisure Company), Tim Hortons Bahrain, Cinnabon Bahrain, Al Baik Bahrain, Papa John's Bahrain, Foodvest Holding (operator of Caribou Coffee, Fuddruckers, Zaatar W Zeit, etc.) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain foodservice market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. The integration of digital ordering systems and the rise of plant-based menus are expected to reshape the dining landscape. Additionally, sustainability practices will gain traction, influencing consumer choices. As the market adapts to these trends, foodservice providers must innovate and align their offerings with changing demands to remain competitive and capture emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Foodservice Type | Quick Service Restaurants (QSRs) Full-Service Restaurants (FSRs) Cafés & Coffee Shops Cafés & Bars Catering Services Cloud Kitchens Institutional Foodservice Food Trucks Bakeries & Dessert Shops Others |

| By Outlet Type | Chained Outlets Independent Outlets |

| By Cuisine Type | Middle Eastern Cuisine Asian Cuisine Western Cuisine Fast Food Vegetarian/Vegan Options Non-Vegetarian Cuisine Organic/Gluten-Free Cuisine Others |

| By Distribution Channel | Online Delivery In-Store Dining Takeaway/Drive-Thru Others |

| By Location | Urban Areas Suburban Areas Rural Areas Tourist Areas Leisure (Hotels, Resorts) Lodging (Restaurants in Hotels/Guesthouses) Retail (Supermarkets, Hypermarkets) Standalone Travel (Airports, Transport Hubs) Others |

| By Pricing Model | Premium Pricing Mid-Range Pricing Budget Pricing Others |

| By Customer Demographics | Age Groups Income Levels Family Size Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full-Service Restaurants | 100 | Restaurant Owners, Managers |

| Fast Food Chains | 70 | Franchise Operators, Area Managers |

| Cafes and Coffee Shops | 60 | Business Owners, Baristas |

| Food Delivery Services | 50 | Operations Managers, Marketing Heads |

| Event Catering Services | 40 | Catering Managers, Event Planners |

The Bahrain Foodservice Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by increasing consumer demand for diverse dining options, food delivery services, and a growing expatriate population.