Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7276

Pages:95

Published On:December 2025

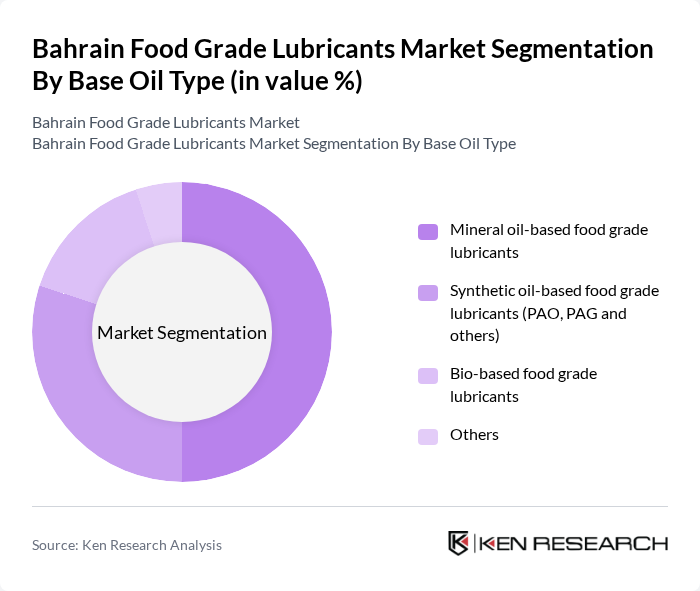

By Base Oil Type:The market is segmented into mineral oil-based food grade lubricants, synthetic oil-based food grade lubricants (PAO, PAG, and others), bio-based food grade lubricants, and others. Among these, mineral oil-based lubricants dominate the market due to their widespread use and cost-effectiveness. However, there is a growing trend towards synthetic and bio-based lubricants as consumers become more environmentally conscious and seek higher performance products.

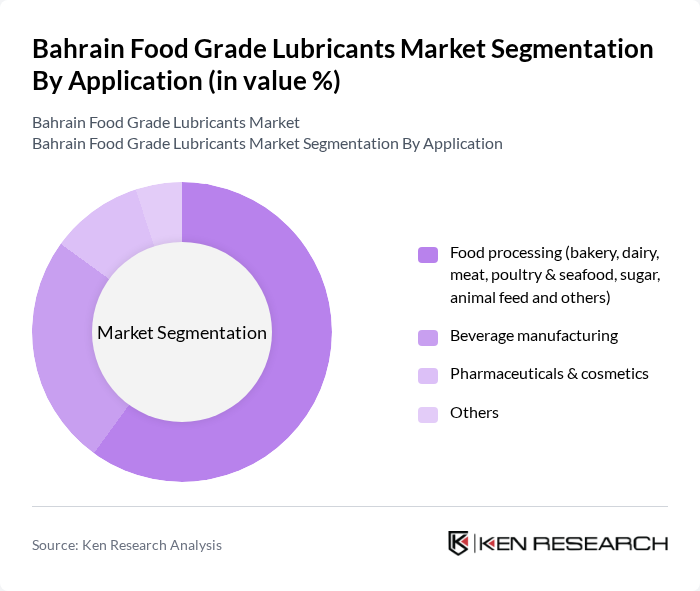

By Application:The applications of food grade lubricants include food processing (covering bakery, dairy, meat, poultry & seafood, sugar, animal feed, and others), beverage manufacturing, pharmaceuticals & cosmetics, and others. The food processing segment is the largest due to the high volume of lubricants required in various food production processes, ensuring machinery operates smoothly without contaminating food products.

The Bahrain Food Grade Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Royal Dutch Shell plc, TotalEnergies SE, Chevron Corporation, FUCHS Petrolub SE, Klüber Lubrication München SE & Co. KG, BP plc (Castrol), Petrochemical Industries Company K.S.C. (PIC) – Kuwait, Saudi Arabian Oil Company (Saudi Aramco – Lubricants & Specialties), Bahrain Petroleum Company (BAPCO Energies), Lubrication Engineers, Inc., Houghton International Inc. (Quaker Houghton), Bel-Ray Company, LLC, BioBlend Renewable Resources, LLC, RSC Bio Solutions, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain food grade lubricants market appears promising, driven by increasing regulatory compliance and a shift towards sustainable practices. As the food processing industry continues to expand, the demand for high-quality lubricants that meet safety standards will rise. Additionally, technological advancements in lubricant formulations are expected to enhance product performance, further supporting market growth. Companies that innovate and adapt to these trends will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Base Oil Type | Mineral oil-based food grade lubricants Synthetic oil-based food grade lubricants (PAO, PAG and others) Bio-based food grade lubricants Others |

| By Application | Food processing (bakery, dairy, meat, poultry & seafood, sugar, animal feed and others) Beverage manufacturing Pharmaceuticals & cosmetics Others |

| By Lubricant Product Type | Hydraulic oils Gear oils Compressor and vacuum pump oils Greases Heat transfer fluids and chain oils Others |

| By Packaging Type | Drums and IBCs (bulk) Small packs (pails, cans) Tote / intermediate bulk containers Others |

| By Distribution Channel | Direct sales to end-users Authorized distributors and dealers Industrial supply and MRO channels Online and e-commerce channels |

| By Industry Standard & Certification Compliance | NSF H1 registered lubricants ISO 21469 and related ISO-certified lubricants Halal certified food grade lubricants Kosher and other certifications |

| By End-Use Facility Size | Large-scale food and beverage processors Medium-sized plants Small processors and SMEs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 60 | Production Managers, Quality Assurance Officers |

| Lubricant Manufacturing Sector | 40 | Product Development Managers, Sales Executives |

| Food Safety Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Specialists |

| Distribution and Supply Chain | 50 | Logistics Coordinators, Supply Chain Managers |

| End-user Feedback from Food Retailers | 40 | Store Managers, Procurement Specialists |

The Bahrain Food Grade Lubricants Market is valued at approximately USD 42 million, reflecting growth driven by the expanding food processing industry and increasing demand for food safety and hygiene standards in the region.