Region:Middle East

Author(s):Shubham

Product Code:KRAC4343

Pages:81

Published On:October 2025

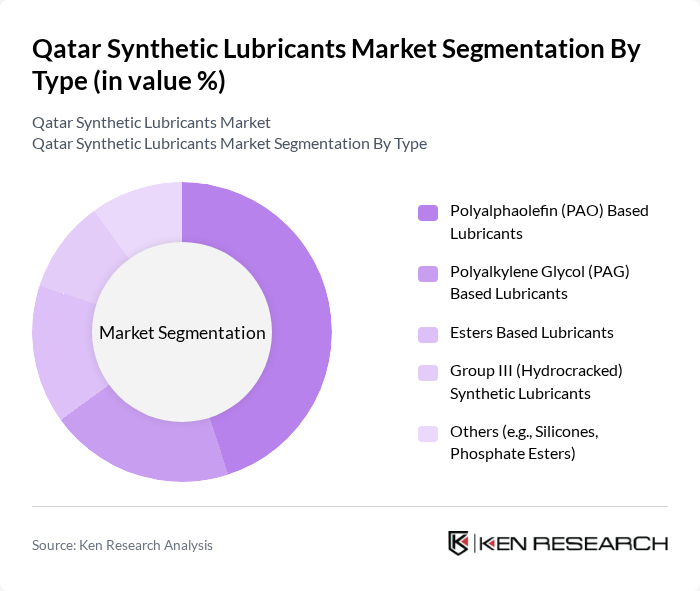

By Type:The market is segmented into Polyalphaolefin (PAO) Based Lubricants, Polyalkylene Glycol (PAG) Based Lubricants, Esters Based Lubricants, Group III (Hydrocracked) Synthetic Lubricants, and Others (e.g., Silicones, Phosphate Esters). PAO-based lubricants maintain a leading share due to their superior thermal stability, oxidation resistance, and low-temperature performance, making them the preferred choice for both automotive and industrial applications where reliability and longevity are critical .

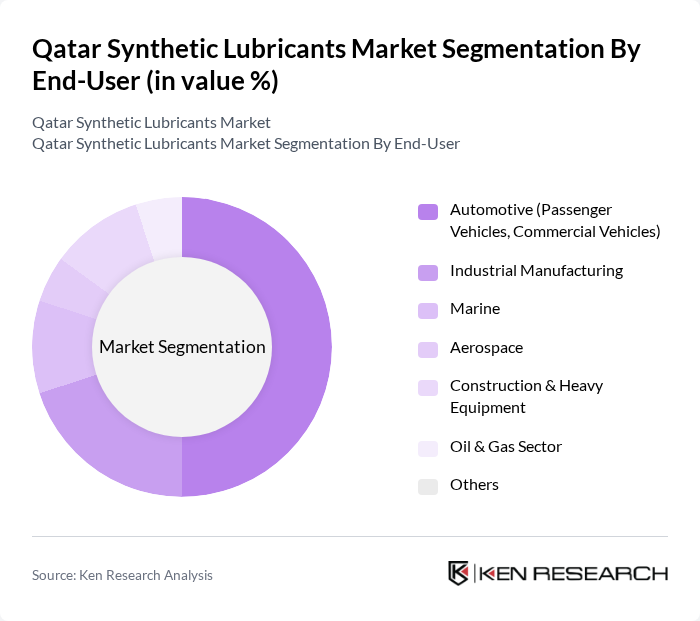

By End-User:The end-user segmentation includes Automotive (Passenger Vehicles, Commercial Vehicles), Industrial Manufacturing, Marine, Aerospace, Construction & Heavy Equipment, Oil & Gas Sector, and Others. The automotive sector is the dominant end-user, driven by the rising number of vehicles, increased preference for premium and luxury cars, and the need for lubricants that ensure optimal engine performance and fuel efficiency. Industrial manufacturing and construction sectors also contribute significantly, reflecting Qatar’s ongoing infrastructure development and industrial diversification .

The Qatar Synthetic Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Lubricants Company (QALCO), WOQOD (Qatar Fuel Company), Gulf Oil International, TotalEnergies Marketing Middle East, Castrol Limited (BP p.l.c.), ExxonMobil Corporation, Fuchs Petrolub SE, Chevron Corporation, Shell Global, Idemitsu Kosan Co., Ltd., Motul, Valvoline Inc., Amsoil Inc., Liqui Moly GmbH, and Petronas Lubricants International contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar synthetic lubricants market appears promising, driven by increasing environmental regulations and a shift towards sustainable practices. As the automotive industry embraces electric vehicles, the demand for specialized lubricants tailored for these technologies is expected to rise. Additionally, advancements in digital supply chain management will enhance efficiency and reduce costs, making synthetic lubricants more accessible. Overall, the market is poised for growth as consumers and industries prioritize performance and sustainability in their lubricant choices.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyalphaolefin (PAO) Based Lubricants Polyalkylene Glycol (PAG) Based Lubricants Esters Based Lubricants Group III (Hydrocracked) Synthetic Lubricants Others (e.g., Silicones, Phosphate Esters) |

| By End-User | Automotive (Passenger Vehicles, Commercial Vehicles) Industrial Manufacturing Marine Aerospace Construction & Heavy Equipment Oil & Gas Sector Others |

| By Application | Engine Oils Transmission & Gear Oils Hydraulic Fluids Compressor Oils Metalworking Fluids Greases Others |

| By Distribution Channel | Direct Sales (OEMs, Industrial Contracts) Authorized Distributors Retail Outlets Online Sales Others |

| By Packaging Type | Bulk Packaging (Drums, Barrels) Small Containers (1L, 4L, 5L, etc.) Intermediate Bulk Containers (IBC) Pails Others |

| By Price Range | Economy Mid-range Premium Ultra-Premium |

| By Brand Origin | International Brands Regional Brands Local Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Synthetic Lubricants | 100 | Fleet Managers, Automotive Service Center Owners |

| Industrial Lubricants | 80 | Plant Managers, Maintenance Supervisors |

| Marine Lubricants | 50 | Marine Operations Managers, Ship Maintenance Engineers |

| Consumer Retail Lubricants | 60 | Retail Managers, Product Category Managers |

| Research & Development in Lubricants | 40 | R&D Directors, Product Development Engineers |

The Qatar Synthetic Lubricants Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This valuation highlights the growing demand for high-performance lubricants across various sectors, including automotive and industrial manufacturing.