Region:Middle East

Author(s):Rebecca

Product Code:KRAE2929

Pages:99

Published On:February 2026

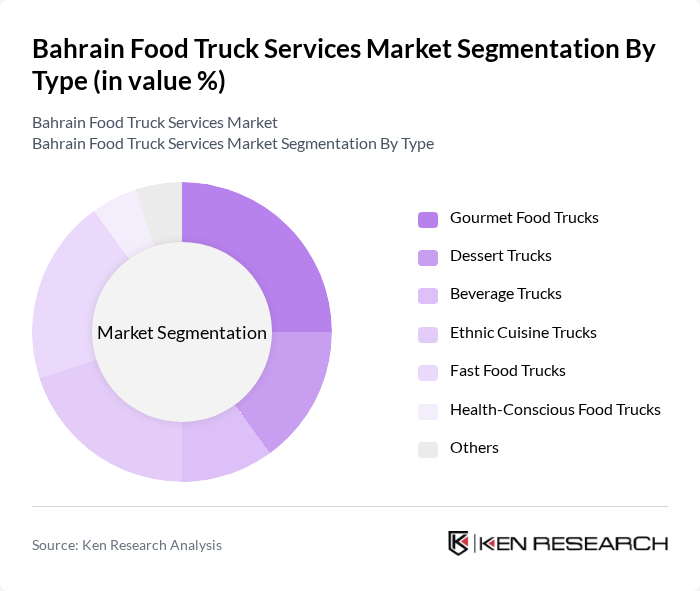

By Type:The food truck services market can be segmented into various types, including gourmet food trucks, dessert trucks, beverage trucks, ethnic cuisine trucks, fast food trucks, health-conscious food trucks, and others. Each type caters to specific consumer preferences and trends, with gourmet and health-conscious options gaining traction due to changing dietary habits and a growing interest in quality and sustainability.

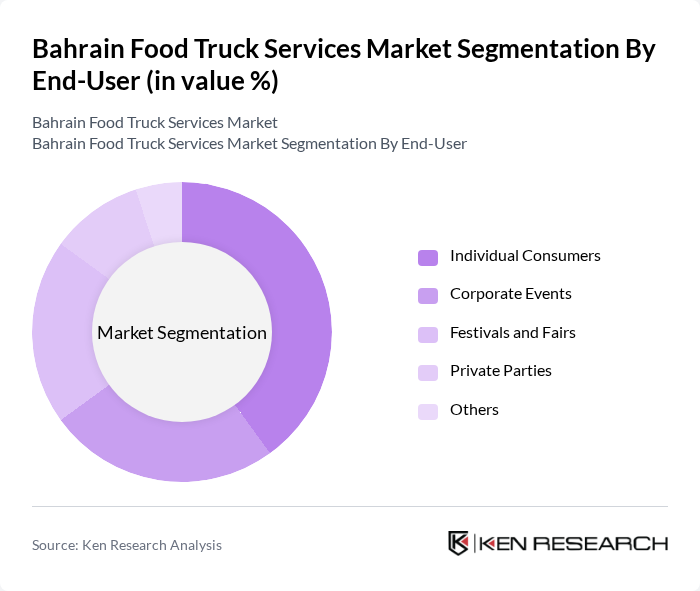

By End-User:The end-user segmentation includes individual consumers, corporate events, festivals and fairs, private parties, and others. Individual consumers represent a significant portion of the market, driven by the convenience and variety offered by food trucks. Corporate events and festivals also play a crucial role, as they provide opportunities for food trucks to reach larger audiences and showcase their offerings.

The Bahrain Food Truck Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Food Truck Bahrain, The Food Truck Company, Gourmet on Wheels, Street Eats Bahrain, Bahrain Foodies, The Rolling Kitchen, Taste of Bahrain, Foodie Truck, Urban Bites, The Snack Shack, Mobile Munchies, Flavor on Wheels, The Hungry Traveler, Bahrain Bites, The Food Cart contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain food truck services market appears promising, driven by evolving consumer preferences and a vibrant event culture. As the demand for unique dining experiences continues to rise, food trucks are likely to adapt by offering innovative menus and leveraging technology for operations. Additionally, the government's ongoing support for small businesses will further enhance market dynamics, fostering a competitive landscape that encourages growth and sustainability in the food truck sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Gourmet Food Trucks Dessert Trucks Beverage Trucks Ethnic Cuisine Trucks Fast Food Trucks Health-Conscious Food Trucks Others |

| By End-User | Individual Consumers Corporate Events Festivals and Fairs Private Parties Others |

| By Location | Urban Areas Suburban Areas Tourist Attractions Event Venues Others |

| By Cuisine Type | Middle Eastern Cuisine Asian Cuisine Western Cuisine Fusion Cuisine Others |

| By Service Type | On-Site Service Catering Services Delivery Services Others |

| By Payment Method | Cash Payments Card Payments Mobile Payments Others |

| By Customer Demographics | Age Groups Income Levels Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Truck Operators | 100 | Owners, Managers |

| Consumer Preferences | 150 | Food Enthusiasts, Local Residents |

| Regulatory Insights | 30 | Government Officials, Licensing Authorities |

| Event Organizers | 40 | Festival Coordinators, Event Planners |

| Supply Chain Partners | 50 | Food Suppliers, Distributors |

The Bahrain Food Truck Services Market is valued at approximately USD 50 million, reflecting a growing trend towards street food culture and casual dining experiences, particularly in urban areas like Manama and Muharraq.