Region:Asia

Author(s):Rebecca

Product Code:KRAE2926

Pages:81

Published On:February 2026

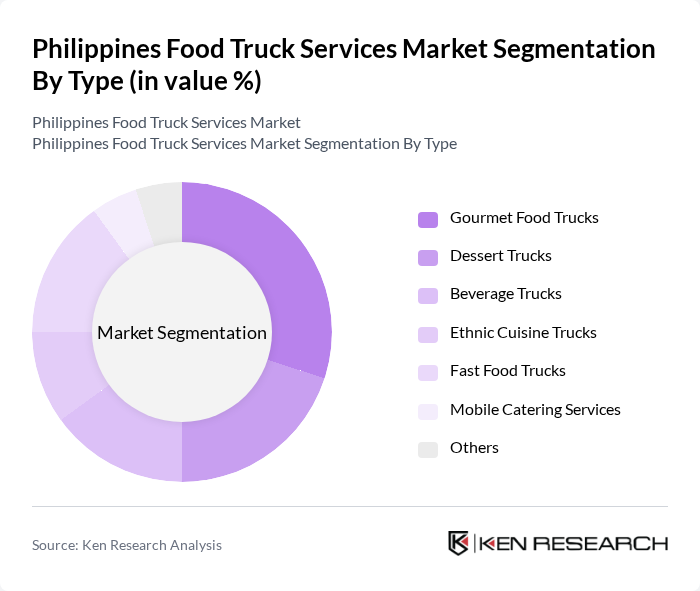

By Type:The food truck services market can be segmented into various types, including gourmet food trucks, dessert trucks, beverage trucks, ethnic cuisine trucks, fast food trucks, mobile catering services, and others. Each type caters to different consumer preferences and occasions, contributing to the overall market dynamics.

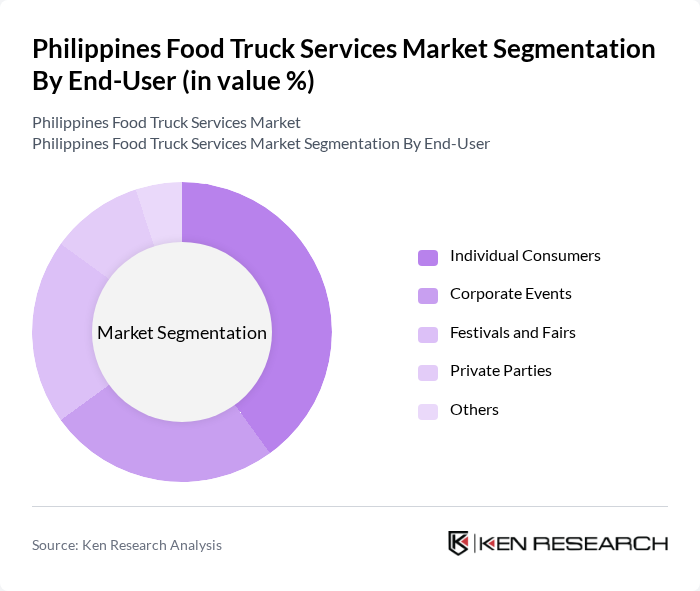

By End-User:The end-user segmentation includes individual consumers, corporate events, festivals and fairs, private parties, and others. Each segment reflects different consumer needs and preferences, influencing the types of food trucks that thrive in the market.

The Philippines Food Truck Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Lost Bread, Elait, The Good Food Truck, Kanto Freestyle Breakfast, The Food Truck Project, Bente Dos, The Rolling Tacos, The Hungry Nomad, The Grilled Cheese Truck, The BBQ Bus, The Sweet Spot, The Vegan Food Truck, The Burger Joint, The Pizza Cart, The Seafood Shack contribute to innovation, geographic expansion, and service delivery in this space.

The future of the food truck services market in the Philippines appears promising, driven by evolving consumer preferences and urban lifestyle changes. As more Filipinos seek convenient dining options, food trucks are likely to become integral to the culinary landscape. Innovations in menu offerings, such as health-conscious and locally sourced ingredients, will attract a broader customer base. Furthermore, the integration of technology, including mobile payments and online ordering, will enhance customer engagement and streamline operations, positioning food trucks for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Gourmet Food Trucks Dessert Trucks Beverage Trucks Ethnic Cuisine Trucks Fast Food Trucks Mobile Catering Services Others |

| By End-User | Individual Consumers Corporate Events Festivals and Fairs Private Parties Others |

| By Location | Urban Areas Suburban Areas Rural Areas Event Venues Others |

| By Cuisine Type | Filipino Cuisine Asian Cuisine Western Cuisine Fusion Cuisine Others |

| By Service Model | On-Site Catering Pre-Order Services Walk-Up Services Delivery Services Others |

| By Payment Method | Cash Payments Credit/Debit Cards Mobile Payments Online Pre-Payments Others |

| By Marketing Channel | Social Media Marketing Event Sponsorships Local Partnerships Traditional Advertising Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Food Truck Operators | 100 | Food Truck Owners, Managers |

| Consumer Preferences in Food Trucks | 150 | Food Enthusiasts, Regular Customers |

| Event-Based Food Truck Services | 80 | Event Organizers, Catering Managers |

| Regulatory Impact on Food Trucks | 60 | Local Government Officials, Health Inspectors |

| Market Trends and Innovations | 70 | Industry Analysts, Food Trend Experts |

The Philippines Food Truck Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, increasing demand for convenient dining options, and a vibrant food culture that embraces diverse culinary experiences.