Region:Global

Author(s):Rebecca

Product Code:KRAE2932

Pages:95

Published On:February 2026

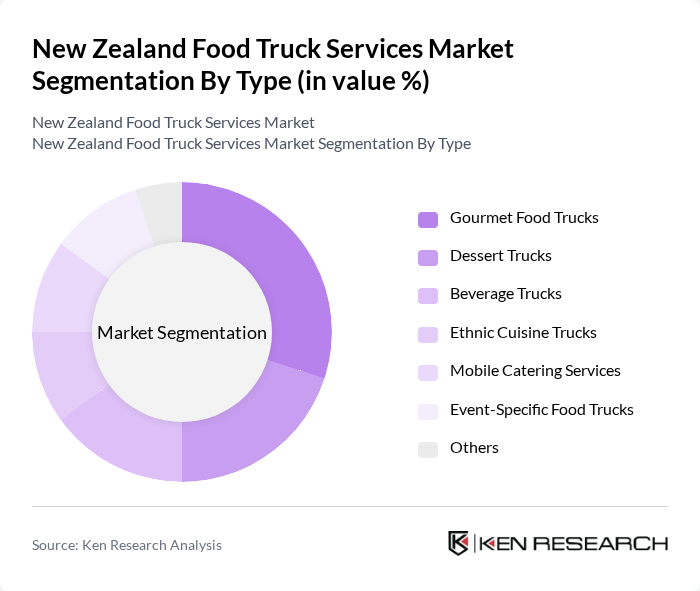

By Type:The food truck services market can be segmented into various types, including gourmet food trucks, dessert trucks, beverage trucks, ethnic cuisine trucks, mobile catering services, event-specific food trucks, and others. Each of these subsegments caters to different consumer preferences and occasions, contributing to the overall market dynamics.

The gourmet food trucks segment dominates the market, driven by the growing consumer preference for high-quality, unique culinary experiences. These trucks often feature innovative menus and locally sourced ingredients, appealing to food enthusiasts and health-conscious consumers. The trend towards gourmet offerings has led to increased customer loyalty and repeat business, solidifying their position as market leaders.

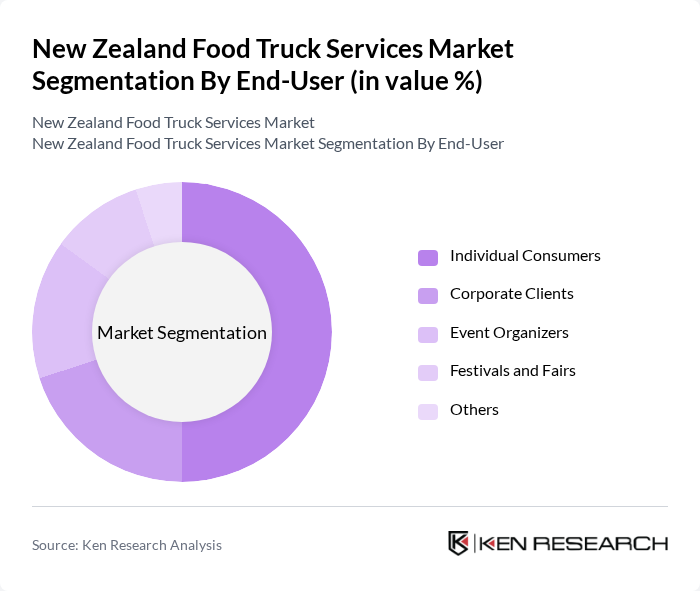

By End-User:The end-user segmentation includes individual consumers, corporate clients, event organizers, festivals and fairs, and others. Each group has distinct needs and preferences, influencing the types of food trucks that thrive in the market.

Individual consumers represent the largest segment, as food trucks cater to the everyday dining needs of the public. The convenience, affordability, and variety offered by food trucks make them a popular choice for lunch breaks, casual outings, and social gatherings. This segment's growth is further supported by the increasing trend of food truck events and festivals, which attract large crowds and enhance consumer engagement.

The New Zealand Food Truck Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Rolling Pin, Eat My Lunch, The Fish and Chip Shop, Taco Loco, Little Yellow Food Truck, The Coffee Guy, BurgerFuel, The Good Food Truck, Waffle On Wheels, The Sweet Spot, The Gourmet Sausage, The Vegan Van, The Pizza Cart, The Curry Truck, The BBQ Bus contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand food truck market appears promising, driven by evolving consumer preferences and technological advancements. As more consumers seek unique dining experiences, food trucks are likely to expand their offerings, incorporating gourmet and health-conscious options. Additionally, the integration of mobile payment solutions and online ordering systems will enhance customer convenience, further solidifying the food truck's position in the competitive food service landscape. Sustainability practices will also play a crucial role in shaping future operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Gourmet Food Trucks Dessert Trucks Beverage Trucks Ethnic Cuisine Trucks Mobile Catering Services Event-Specific Food Trucks Others |

| By End-User | Individual Consumers Corporate Clients Event Organizers Festivals and Fairs Others |

| By Region | Auckland Wellington Christchurch Hamilton Others |

| By Cuisine Type | Asian Cuisine European Cuisine American Cuisine Fusion Cuisine Others |

| By Service Model | On-Site Catering Delivery Services Pop-Up Events Others |

| By Customer Demographics | Age Groups Income Levels Lifestyle Preferences Others |

| By Payment Method | Cash Payments Card Payments Mobile Payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Food Truck Operations | 100 | Food Truck Owners, City Planners |

| Rural Food Truck Services | 70 | Food Truck Operators, Local Business Owners |

| Consumer Preferences in Food Trucks | 150 | Food Truck Customers, Event Attendees |

| Regulatory Impact on Food Truck Operations | 50 | Local Government Officials, Health Inspectors |

| Market Trends and Innovations | 80 | Industry Experts, Food Service Consultants |

The New Zealand Food Truck Services Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by consumer demand for diverse culinary experiences and the increasing popularity of food festivals and events.