Region:Middle East

Author(s):Shubham

Product Code:KRAC3575

Pages:84

Published On:October 2025

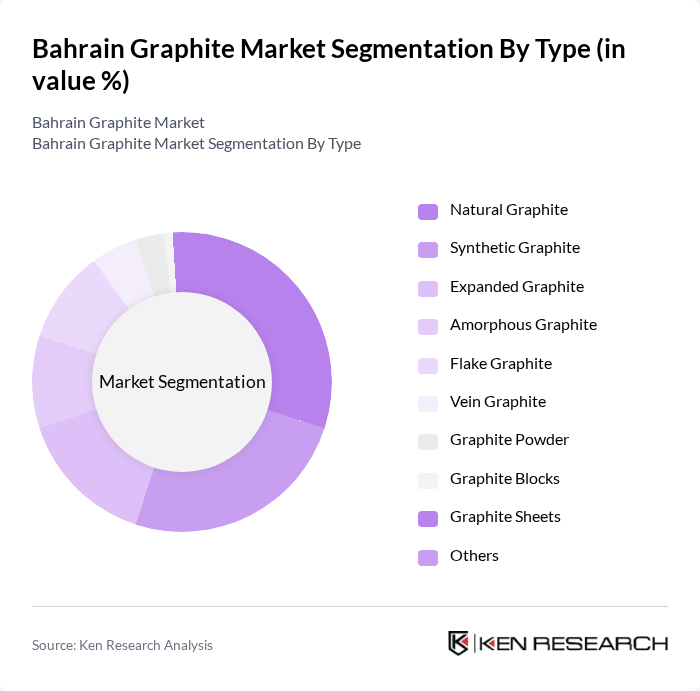

By Type:The graphite market is segmented into Natural Graphite, Synthetic Graphite, Expanded Graphite, Amorphous Graphite, Flake Graphite, Vein Graphite, Graphite Powder, Graphite Blocks, Graphite Sheets, and Others. Each type serves distinct applications: Natural and Flake Graphite are widely used in battery anodes and refractories; Synthetic Graphite is preferred for high-performance batteries and electrodes; Expanded Graphite finds applications in sealing and insulation; Amorphous Graphite is used in lubricants and coatings; Vein Graphite is valued for its purity in specialty applications; Graphite Powder, Blocks, and Sheets are utilized in metallurgy, electronics, and industrial manufacturing .

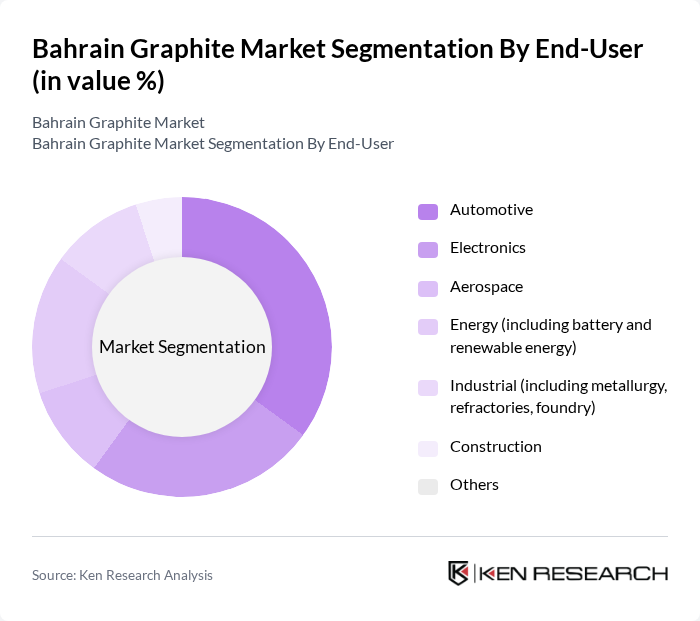

By End-User:The end-user segmentation includes Automotive, Electronics, Aerospace, Energy (including battery and renewable energy), Industrial (metallurgy, refractories, foundry), Construction, and Others. Automotive and Energy sectors are the largest consumers, driven by the adoption of electric vehicles and energy storage systems. Electronics and Aerospace utilize graphite for thermal management, lightweight composites, and specialty components. Industrial applications focus on metallurgy, refractories, and foundry processes, while Construction uses graphite in insulation and specialty materials .

The Bahrain Graphite Market is characterized by a dynamic mix of regional and international players. Leading participants such as GrafTech International Ltd., Northern Graphite Corporation, Syrah Resources Limited, Mason Graphite Inc., Focus Graphite Inc., Talga Group Ltd., AMG Advanced Metallurgical Group N.V., SGL Carbon SE, Imerys Graphite & Carbon, Asbury Carbons, Nippon Carbon Co., Ltd., Hitachi Chemical Co., Ltd., Tokai Carbon Co., Ltd., Graphite India Limited, Tirupati Graphite PLC, Gratomic Inc., Triton Minerals Ltd., NextSource Materials Inc., Guangdong Kaijin New Energy Technology Co., Ltd., Mersen Corporate Services SAS, Ameri-Source Speciality Products, Fangda Carbon New Material Co., Ltd., BTR New Material Group Co., Ltd., Carbone Savoie contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain graphite market is poised for significant transformation, driven by the increasing integration of sustainable practices and technological advancements. As the demand for electric vehicles and renewable energy solutions rises, local manufacturers are likely to invest in innovative processing techniques to enhance product quality. Furthermore, strategic partnerships with automotive and energy sectors will facilitate the development of new applications, ensuring that Bahrain remains competitive in the global graphite landscape while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Graphite Synthetic Graphite Expanded Graphite Amorphous Graphite Flake Graphite Vein Graphite Graphite Powder Graphite Blocks Graphite Sheets Others |

| By End-User | Automotive Electronics Aerospace Energy (including battery and renewable energy) Industrial (including metallurgy, refractories, foundry) Construction Others |

| By Application | Batteries (Li-ion, lead-acid, etc.) Lubricants Composites Thermal Management Refractories Conductive Materials Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Distribution Mode | Bulk Distribution Packaged Distribution Direct Shipping Others |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Graphite Mining Operations | 50 | Mining Engineers, Operations Managers |

| Graphite Processing Facilities | 40 | Production Supervisors, Quality Control Managers |

| End-User Industries (Automotive) | 45 | Procurement Managers, Product Development Engineers |

| Research Institutions and Universities | 40 | Research Scientists, Academic Professors |

| Graphite Product Distributors | 40 | Sales Managers, Supply Chain Coordinators |

The Bahrain Graphite Market is valued at approximately USD 160 million, driven by increasing demand for graphite in various sectors, including batteries, lubricants, and industrial applications, particularly in the context of electric vehicle production and renewable energy technologies.