Region:Asia

Author(s):Rebecca

Product Code:KRAC3923

Pages:94

Published On:October 2025

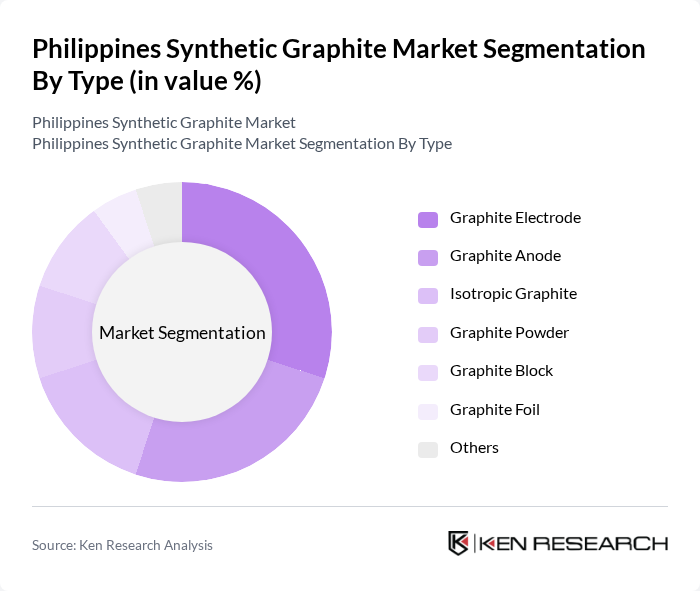

By Type:The synthetic graphite market is segmented into Graphite Electrode, Graphite Anode, Isotropic Graphite, Graphite Powder, Graphite Block, Graphite Foil, and Others. Each type serves distinct industrial applications, with Graphite Electrode widely used in steelmaking, Graphite Anode critical for battery manufacturing, and Isotropic Graphite favored for high-temperature and precision applications.

The leading subsegment is Graphite Electrode, reflecting its extensive use in electric arc furnaces for steel production. Demand for high-quality electrodes is driven by the growing steel industry and the shift toward electric steelmaking processes. Additionally, the surge in electric vehicle adoption has increased the need for graphite electrodes in battery manufacturing, reinforcing its critical role in the market.

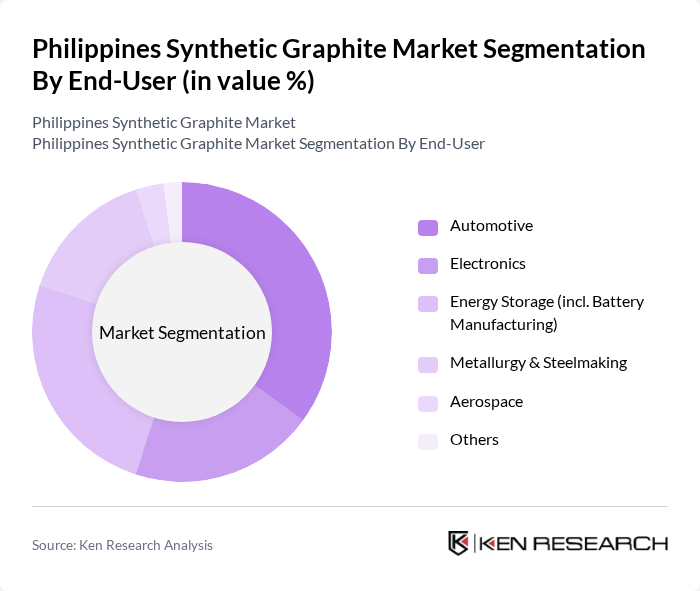

By End-User:The market is segmented by end-users: Automotive, Electronics, Energy Storage (including Battery Manufacturing), Metallurgy & Steelmaking, Aerospace, and Others. Each segment has unique requirements for synthetic graphite, influencing demand patterns and product specifications.

The Energy Storage segment is the fastest-growing end-user category, driven by the rapid expansion of lithium-ion battery production for electric vehicles and renewable energy systems. Automotive manufacturers are increasingly seeking high-performance synthetic graphite to improve battery efficiency and lifespan, supporting continued growth as the global transition to sustainable energy accelerates.

The Philippines Synthetic Graphite Market features a dynamic mix of regional and international players. Leading participants such as GrafTech International Ltd., SGL Carbon SE, Showa Denko K.K., Tokai Carbon Co., Ltd., Northern Graphite Corporation, Mitsubishi Chemical Corporation, HEG Limited, Asbury Carbons, Imerys Graphite & Carbon, Graphite India Limited, BTR New Material Group Co., Ltd., Chengdu Rongda Carbon Co., Ltd., Jilin Carbon Co., Ltd., Qingdao Tianhe Graphite Co., Ltd., and Yichang Xincheng Graphite Co., Ltd. drive innovation, geographic expansion, and service delivery in the sector.

The future of the synthetic graphite market in the Philippines appears promising, driven by technological advancements and increasing demand across various sectors. As industries prioritize sustainability, manufacturers are likely to adopt eco-friendly production methods, enhancing their market position. Additionally, the growth of the renewable energy sector will create new applications for synthetic graphite, further expanding its market potential. Strategic partnerships and government incentives will also play a crucial role in fostering innovation and supporting market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Graphite Electrode Graphite Anode Isotropic Graphite Graphite Powder Graphite Block Graphite Foil Others |

| By End-User | Automotive Electronics Energy Storage (incl. Battery Manufacturing) Metallurgy & Steelmaking Aerospace Others |

| By Application | Battery Anodes (Li-ion, etc.) Refractories Lubricants Thermal Management Conductive Materials Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Distribution Mode | Bulk Distribution Packaged Distribution Direct Shipping Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Policy Support | Subsidies Tax Exemptions Grants for R&D Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturing Sector | 60 | Production Managers, R&D Managers |

| Electronics Industry Applications | 50 | Product Development Engineers, Supply Chain Managers |

| Steel Production and Foundries | 40 | Operations Directors, Quality Control Managers |

| Automotive Components Sector | 40 | Procurement Managers, Technical Specialists |

| Research Institutions and Academia | 40 | Research Scientists, Professors in Material Science |

The Philippines Synthetic Graphite Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by demand from electric vehicles, energy storage, and industrial applications, particularly in battery manufacturing and metallurgy.