Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3780

Pages:89

Published On:October 2025

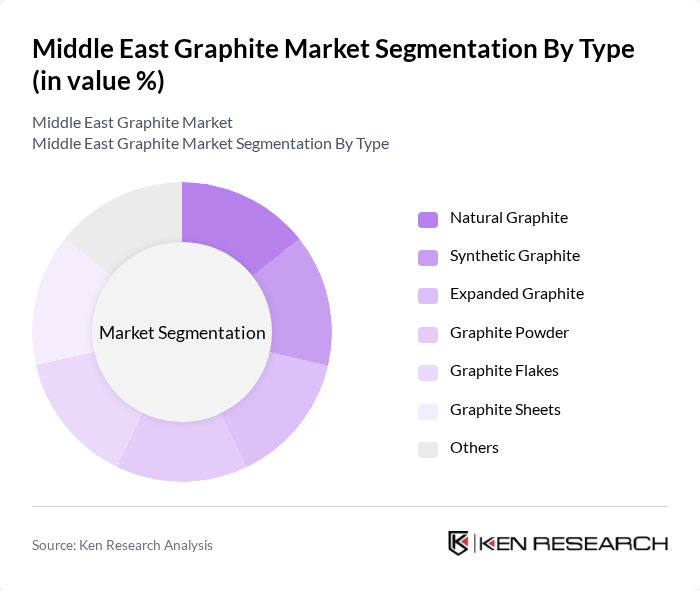

By Type:The graphite market can be segmented into various types, including Natural Graphite, Synthetic Graphite, Expanded Graphite, Graphite Powder, Graphite Flakes, Graphite Sheets, and Others. Among these, Synthetic Graphite is currently the leading subsegment by revenue, driven by its extensive use in electrodes and high-performance industrial applications. Natural Graphite remains critical for battery manufacturing and lubricants, with demand supported by the region’s growing electric vehicle and energy storage sectors. Expanded and specialty graphite types are gaining traction in advanced manufacturing and thermal management solutions .

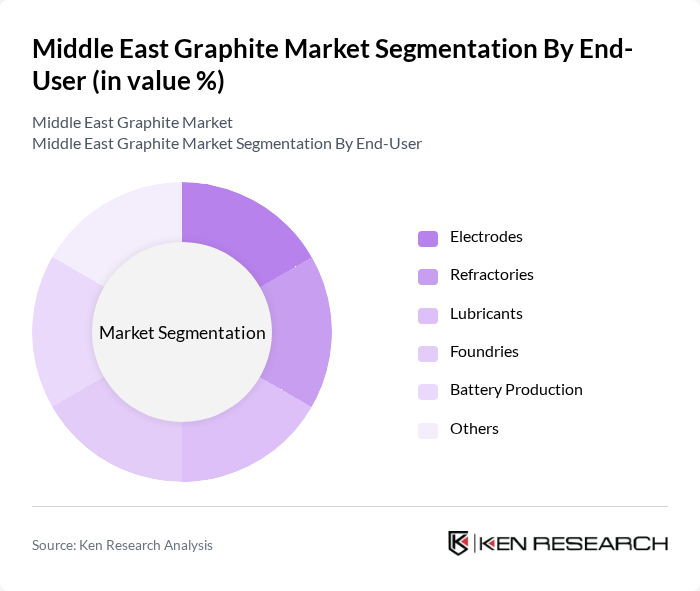

By End-User:The end-user segmentation includes Electrodes, Refractories, Lubricants, Foundries, Battery Production, and Others. The Electrodes segment is currently the most dominant, reflecting the strong demand from steelmaking and foundry industries. Battery Production is rapidly expanding, driven by the surge in electric vehicle adoption and energy storage needs. Refractories and lubricants continue to represent significant applications, while advanced uses in electronics and thermal management are emerging .

The Middle East Graphite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Balagh Trading & Contracting Co., Al Refaey Group, Middle East Carbon LLC, Emirates Carbon LLC, Fujairah Carbon Industries, Saudi Refractories Company, National Industrial Gases Company, KSA Carbon & Chemicals, Advanced Carbon Solutions, Gulf Graphite Trading LLC, GrafTech International Ltd., Imerys Graphite & Carbon, SGL Carbon SE, Tokai Carbon Co., Ltd., Graphite India Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East graphite market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As electric vehicle production ramps up and renewable energy projects expand, the demand for high-quality graphite is expected to rise. Additionally, innovations in recycling technologies and the development of advanced graphite materials will create new avenues for growth. Strategic partnerships with technology firms will further enhance the market's potential, positioning the region as a key player in the global graphite landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Graphite Synthetic Graphite Expanded Graphite Graphite Powder Graphite Flakes Graphite Sheets Others |

| By End-User | Electrodes Refractories Lubricants Foundries Battery Production Others |

| By Application | Battery Manufacturing Lubricants Thermal Management Composites Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Oman Others |

| By Product Form | Granular Powdered Sheet Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Graphite Mining Operations | 120 | Mine Managers, Operations Directors |

| Graphite Product Manufacturers | 90 | Production Managers, Quality Control Supervisors |

| Battery Manufacturers | 60 | R&D Managers, Procurement Specialists |

| Graphite Traders and Distributors | 50 | Sales Managers, Supply Chain Coordinators |

| End-User Industries (e.g., Automotive, Electronics) | 80 | Product Development Managers, Engineering Leads |

The Middle East Graphite Market is valued at approximately USD 255 million, driven by increasing demand for graphite in applications such as batteries, lubricants, and refractories, alongside the growth of electric vehicles and renewable energy technologies.