Region:Middle East

Author(s):Rebecca

Product Code:KRAB0855

Pages:80

Published On:December 2025

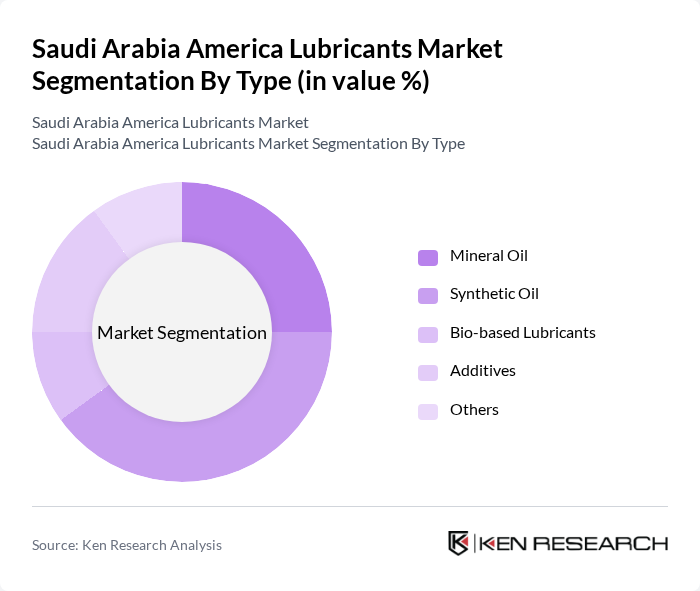

By Type:The lubricants market in Saudi Arabia is segmented into various types, including Mineral Oil, Synthetic Oil, Bio-based Lubricants, Additives, and Others. Among these, Synthetic Oil is gaining traction due to its superior performance and longevity compared to traditional mineral oils. The increasing demand for high-performance lubricants in automotive and industrial applications is driving the growth of synthetic oils, which are perceived as more efficient and environmentally friendly.

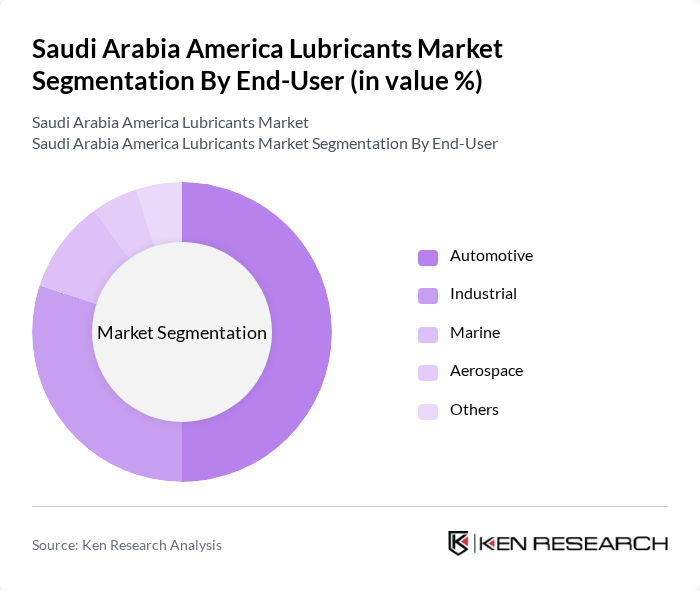

By End-User:The end-user segmentation of the lubricants market includes Automotive, Industrial, Marine, Aerospace, and Others. The Automotive sector is the largest consumer of lubricants, driven by the growing vehicle population and the need for regular maintenance. Industrial applications are also significant, with lubricants being essential for machinery and equipment operation, thus contributing to the overall market growth.

The Saudi Arabia America Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, ExxonMobil, Shell, TotalEnergies, Chevron, Fuchs Petrolub SE, Castrol, Gulf Oil International, Lukoil, Petronas, Valvoline, Mobil 1, Amsoil, Klüber Lubrication, Chevron Oronite contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia lubricants market is poised for transformation, driven by sustainability regulations and technological innovations. With over 50 bio-lubricant products certified by SASO by future, the market is shifting towards eco-friendly solutions. Additionally, investments in R&D for high-performance lubricants are expected to enhance product offerings, improving machinery efficiency and reducing maintenance costs. These trends indicate a robust market evolution, aligning with global sustainability goals and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral Oil Synthetic Oil Bio-based Lubricants Additives Others |

| By End-User | Automotive Industrial Marine Aerospace Others |

| By Application | Engine Oils Gear Oils Hydraulic Fluids Greases Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Brand Positioning | Premium Brands Mid-range Brands Economy Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lubricants | 150 | Fleet Managers, Automotive Service Center Owners |

| Industrial Lubricants | 100 | Plant Managers, Maintenance Supervisors |

| Marine Lubricants | 80 | Marine Operations Managers, Ship Maintenance Engineers |

| Specialty Lubricants | 70 | Product Development Managers, R&D Engineers |

| Retail Lubricant Sales | 90 | Retail Store Managers, Supply Chain Coordinators |

The Saudi Arabia America Lubricants Market is valued at approximately USD 1.350 billion. This valuation reflects the market's growth driven by industrialization, automotive fleet expansion, and significant infrastructure projects under the country's economic diversification initiatives.