Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4164

Pages:96

Published On:December 2025

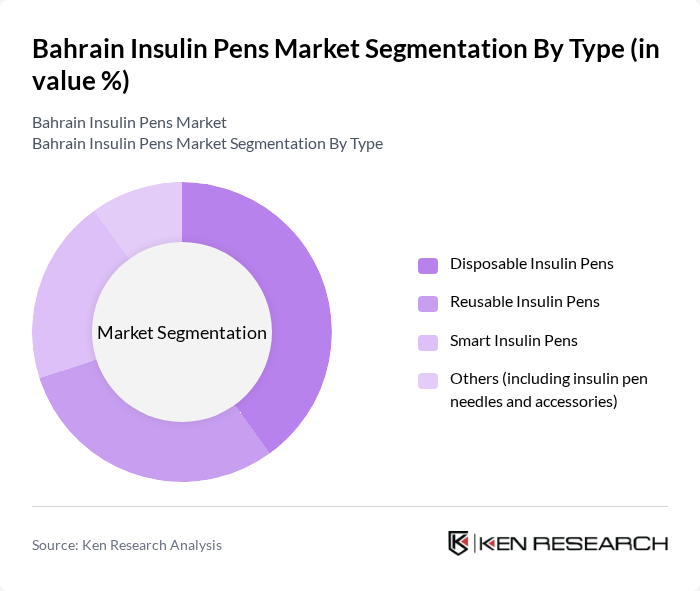

By Type:The market can be segmented into four main types: Disposable Insulin Pens, Reusable Insulin Pens, Smart Insulin Pens, and Others (including insulin pen needles and accessories). This structure reflects the typical classification used by leading insulin manufacturers and device companies in the GCC region. Disposable insulin pens are gaining popularity due to their convenience, prefilled format, and lower training burden, which makes them particularly suitable for newly diagnosed patients and busy outpatient settings. Reusable insulin pens remain important among experienced users seeking flexibility with cartridges and cost efficiency over time, while smart insulin pens are emerging as a significant trend due to their advanced features such as dose logging, reminders, and integration with glucose monitoring apps that aid in personalized diabetes management.

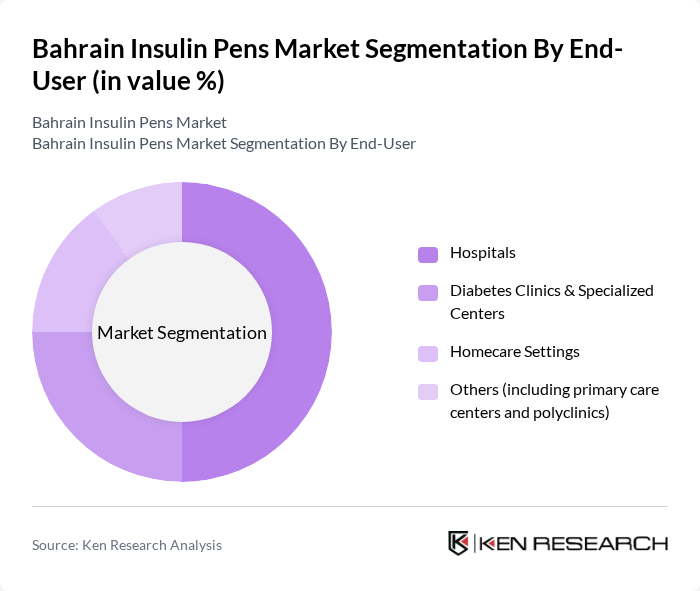

By End-User:The end-user segmentation includes Hospitals, Diabetes Clinics & Specialized Centers, Homecare Settings, and Others (including primary care centers and polyclinics). This breakdown aligns with how diabetes care pathways are organized in Bahrain, where hospital outpatient departments and specialized centers act as primary initiation points for insulin therapy and device selection. Hospitals are the leading end-users due to their comprehensive diabetes management programs, multidisciplinary clinics, and access to a larger patient base, while diabetes centers and homecare settings increasingly support follow?up, self?administration, and chronic disease management.

The Bahrain Insulin Pens Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Becton, Dickinson and Company (BD), Ypsomed AG, Biocon Ltd, Julphar Gulf Pharmaceutical Industries PSC, Gulf Pharmaceutical Industries – Banaja, Gulf Diabetes Specialist Center (as a key institutional buyer), Bahrain Pharmacy & General Store B.S.C. (leading distributor), Hassani Group of Companies – Medical Division, Medtronic plc (for connected insulin delivery ecosystem), Abbott Laboratories (for integrated glucose monitoring with pens), F. Hoffmann-La Roche Ltd, Other Local Distributors and Importers Active in Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain insulin pens market is poised for transformative growth, driven by increasing diabetes prevalence and technological innovations. As healthcare infrastructure expands, particularly in rural areas, access to insulin pens will improve. Additionally, the integration of digital health solutions will enhance patient engagement and adherence. The focus on personalized diabetes care will further shape the market, ensuring that patients receive tailored treatment options that meet their unique needs, ultimately leading to better health outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Insulin Pens Reusable Insulin Pens Smart Insulin Pens Others (including insulin pen needles and accessories) |

| By End-User | Hospitals Diabetes Clinics & Specialized Centers Homecare Settings Others (including primary care centers and polyclinics) |

| By Distribution Channel | Retail Pharmacies Online Pharmacies & E-commerce Platforms Hospital Pharmacies Others (including government tenders and institutional sales) |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Age Group | Pediatric Patients Adult Patients Geriatric Patients Others (including gestational and adolescent patients) |

| By Insulin Type | Rapid-Acting Insulin Long-Acting Insulin Premixed Insulin Others (including intermediate-acting and ultra-long-acting insulin) |

| By User Experience | First-time / Beginner Users Experienced / Long-term Users Healthcare Professionals Initiating Therapy Others (including caregivers and family-administered use) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 60 | Endocrinologists, General Practitioners |

| Pharmacy Sector | 50 | Pharmacists, Pharmacy Managers |

| Patient Insights | 120 | Diabetes Patients, Caregivers |

| Insurance Companies | 40 | Health Insurance Analysts, Policy Makers |

| Diabetes Advocacy Groups | 40 | Advocacy Leaders, Community Health Workers |

The Bahrain Insulin Pens Market is valued at approximately USD 40 million, reflecting strong demand driven by the high prevalence of diabetes among the adult population in Bahrain and the GCC region.