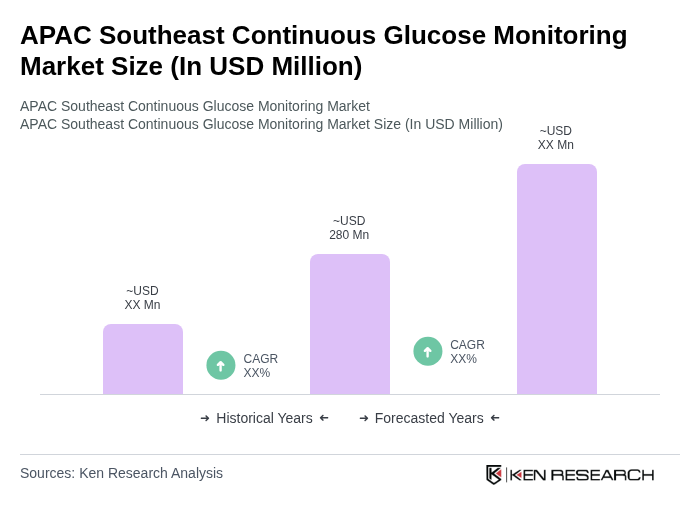

APAC Southeast Continuous Glucose Monitoring Market Overview

- The APAC Southeast Continuous Glucose Monitoring Market is valued at USD 280 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of diabetes across Southeast Asia, coupled with a growing awareness and adoption of advanced diabetes management technologies. The demand for personalized healthcare solutions and continuous innovations in CGM devices—such as enhanced accuracy, smartphone integration, and real-time alerts—are further fuelling adoption and driving growth.

- Key players in this market include Dexcom, Abbott, Medtronic, F. Hoffmann-La Roche, Senseonics, and Ascensia Diabetes Care. These companies are expanding their reach through partnerships and localized distribution strategies, particularly in countries with advanced healthcare infrastructure and high diabetes prevalence, such as Singapore and Indonesia. Singapore leads due to its robust medical system and government backing of innovation, while Indonesia's rising diabetic population spurs adoption of CGM systems.

- In 2024, the government of Singapore announced a strategic initiative to enhance diabetes care through the implementation of a national diabetes management program. This program aims to increase access to continuous glucose monitoring technologies and improve patient education, thereby promoting better health outcomes for individuals living with diabetes.

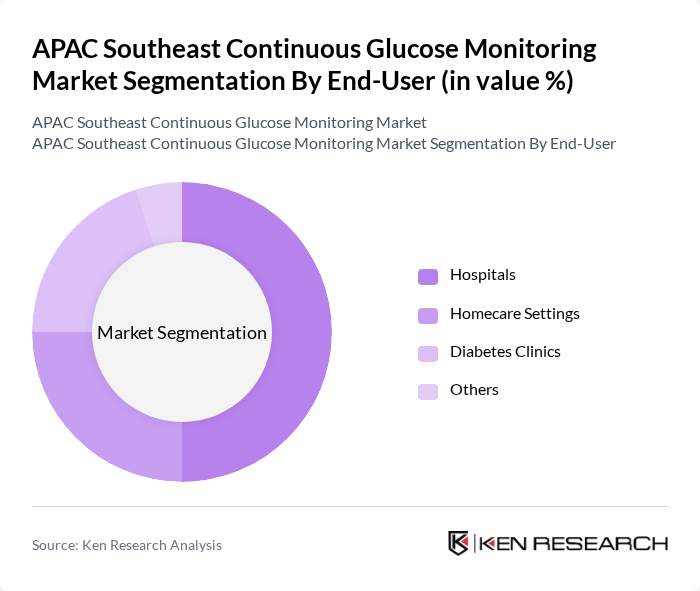

APAC Southeast Continuous Glucose Monitoring Market Segmentation

By Type:The market is segmented into various types of continuous glucose monitoring systems, including Real-time Continuous Glucose Monitoring Systems, Flash Glucose Monitoring Systems, Implantable Continuous Glucose Monitoring Systems, and Others. Among these, Real-time Continuous Glucose Monitoring Systems are leading the market due to their ability to provide immediate feedback to users, which is crucial for effective diabetes management. The increasing demand for real-time data and the convenience offered by these systems are driving their popularity.

By End-User:The end-user segmentation includes Hospitals, Homecare Settings, Diabetes Clinics, and Others. Hospitals are the dominant segment, as they provide comprehensive diabetes management services and have the necessary infrastructure to support advanced monitoring technologies. The increasing number of diabetes patients seeking treatment in hospitals is further propelling this segment's growth.

APAC Southeast Continuous Glucose Monitoring Market Competitive Landscape

The APAC Southeast Continuous Glucose Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Dexcom, Inc., Medtronic plc, Roche Diabetes Care, Ascensia Diabetes Care, Senseonics Holdings, Inc., Insulet Corporation, Tandem Diabetes Care, Inc., Ypsomed AG, Nova Biomedical, Glooko, Inc., LifeScan, Inc., B. Braun Melsungen AG, F. Hoffmann-La Roche AG, DarioHealth Corp. contribute to innovation, geographic expansion, and service delivery in this space.

APAC Southeast Continuous Glucose Monitoring Market Industry Analysis

Growth Drivers

- Rising Regional GDP in Southeast Asia:Southeast Asia’s combined GDP in future is projected to reach USD 4.05 trillion, reflecting a robust economic environment. This growth supports increased disposable income, allowing consumers to invest in healthcare technologies, including continuous glucose monitoring (CGM) devices. As healthcare spending rises, the demand for advanced diabetes management solutions is expected to grow significantly, enhancing market opportunities for CGM manufacturers. Source: Andaman Partners, future.

- Large Diabetic Population Base:In future, Southeast Asia reported approximately 95 million adults living with diabetes, with Thailand alone accounting for 2.5 million cases. This substantial diabetic population creates a pressing need for effective glucose monitoring solutions. The increasing prevalence of diabetes drives demand for CGM systems, as patients seek real-time monitoring to manage their condition effectively. Source: Grand View Research report.

- Digital Infrastructure Expansion in the Philippines:The Philippines has invested over USD 300 million in fiber-optic infrastructure, significantly enhancing digital connectivity. By future, mobile internet subscribers are expected to reach 56.5%, facilitating the adoption of Bluetooth-enabled CGM devices. Improved digital infrastructure supports remote monitoring and telehealth services, making CGM technology more accessible to patients in homecare settings. Source: World Bank Philippines Digital Infrastructure projects.

Market Challenges

- Stringent Regulatory Approval in Major Markets:Regulatory hurdles in Southeast Asia, particularly in Singapore and Malaysia, require extensive clinical data for CGM device approval. These stringent regulations can delay product launches, increasing costs for manufacturers. The lengthy approval processes hinder timely access to innovative diabetes management solutions, impacting market growth. Source: Grand View Research report.

- Limited Insurance Reimbursement in APAC:In the APAC region, fewer than 35% of diabetes patients have insurance coverage for CGM systems, forcing many to pay out-of-pocket. This financial burden limits access to essential monitoring technologies, particularly for lower-income patients. The lack of reimbursement policies poses a significant barrier to widespread adoption of CGM devices across the region. Source: IndustryResearch.biz regional data.

APAC Southeast Continuous Glucose Monitoring Market Future Outlook

The future of the APAC Southeast Continuous Glucose Monitoring market appears promising, driven by advancements in integrated CGM-insulin pump systems and the growth of digital diabetes management platforms. As urbanization accelerates, particularly in megacities like Jakarta and Metro Manila, the demand for CGM devices is expected to rise. Additionally, innovations in sensor technology and strategic partnerships among manufacturers will likely enhance product offerings, improving patient convenience and outcomes in diabetes management.

Market Opportunities

- Rapid Urban Growth in Megacities:With Jakarta's population nearing 45 million and Metro Manila's urban population at approximately 60 million, these megacities present significant market potential for CGM devices. The concentration of healthcare facilities and pharmacies in urban areas facilitates the distribution and adoption of advanced diabetes management solutions. Source: UN urbanization data.

- Digital Diabetes Management Platforms:The digital diabetes management market in Asia Pacific is projected to generate USD 3,200 million in future. This growth opens opportunities for integrating CGM devices into telehealth services, enhancing remote monitoring capabilities and patient engagement in diabetes care. Source: Grand View Research digital diabetes data.