Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4128

Pages:98

Published On:December 2025

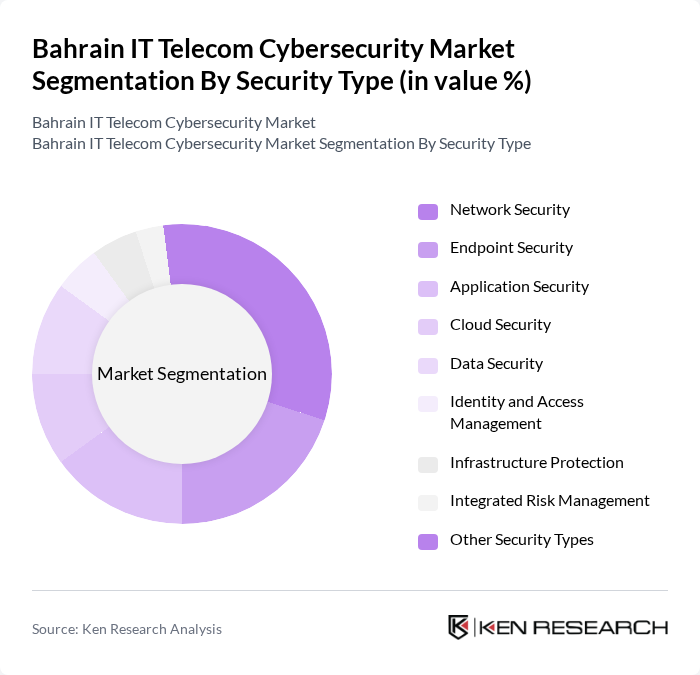

By Security Type:The security type segmentation includes various subsegments such as Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Protection, Integrated Risk Management, and Other Security Types. Among these, Network Security is currently the leading subsegment due to the increasing need for organizations to protect their networks from unauthorized access and cyber threats. The rise in remote work and cloud adoption has further amplified the demand for robust network security solutions.

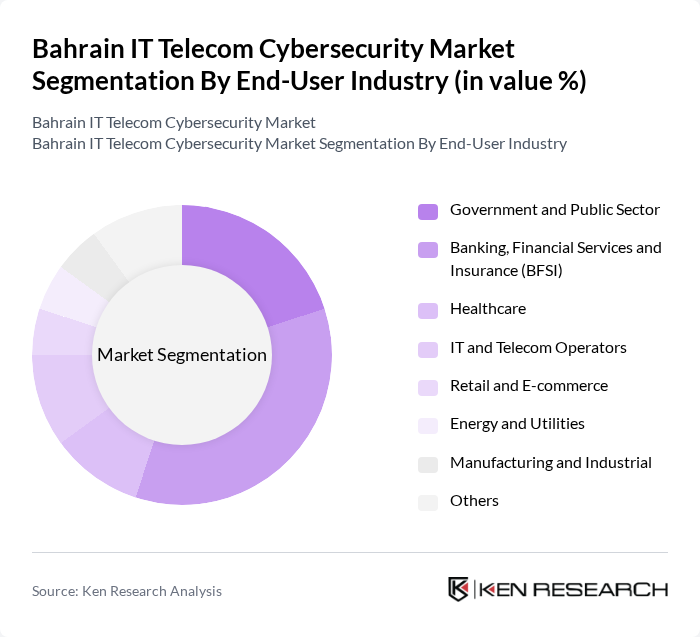

By End-User Industry:The end-user industry segmentation encompasses Government and Public Sector, Banking, Financial Services and Insurance (BFSI), Healthcare, IT and Telecom Operators, Retail and E-commerce, Energy and Utilities, Manufacturing and Industrial, and Others. The BFSI sector is the dominant segment, driven by stringent regulatory requirements and the need for robust security measures to protect sensitive financial data. The increasing digitization of banking services has also led to a surge in demand for cybersecurity solutions in this sector.

The Bahrain IT Telecom Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Telecommunications Company (Batelco), Zain Bahrain B.S.C., stc Bahrain, Kalaam Telecom, Beyon Cyber (Batelco / Beyon Group), Bahrain Information & eGovernment Authority (iGA) – National SOC / Government Cyber Initiatives, Injazat (including regional cybersecurity services for Bahrain), Gulf Business Machines (GBM Bahrain), Infinigate Gulf, Trend Micro Incorporated, Cisco Systems, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Kaspersky Lab, IBM Security (International Business Machines Corporation), Microsoft Corporation (Security and Azure Sentinel / Defender Solutions), Dell Technologies (including Secureworks) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain IT Telecom Cybersecurity Market appears promising, driven by increasing investments in technology and a heightened focus on cybersecurity. As organizations continue to embrace digital transformation, the demand for innovative security solutions will grow. Furthermore, the government's commitment to enhancing cybersecurity infrastructure and fostering public-private partnerships will likely create a more secure environment. This proactive approach will encourage businesses to adopt advanced cybersecurity measures, ensuring resilience against evolving cyber threats and fostering economic growth.

| Segment | Sub-Segments |

|---|---|

| By Security Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Infrastructure Protection Integrated Risk Management Other Security Types |

| By End-User Industry | Government and Public Sector Banking, Financial Services and Insurance (BFSI) Healthcare IT and Telecom Operators Retail and E-commerce Energy and Utilities Manufacturing and Industrial Others |

| By Deployment Model | On-Premise Cloud Hybrid |

| By Service Type | Professional Services (Consulting, Integration) Managed Security Services Security Operations Center (SOC) as a Service Training and Awareness Services Incident Response and Forensics Other Services |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Type of Threat | Malware Ransomware Phishing and Social Engineering Denial of Service and DDoS Insider Threats Other Threat Types |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate Others |

| By Compliance and Regulatory Framework | ISO 27001 and Related ISO Standards PCI DSS Central Bank of Bahrain (CBB) Cybersecurity Requirements National Cybersecurity Frameworks and Guidelines Other International and Sectoral Standards |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Cybersecurity Solutions | 110 | IT Security Managers, Network Administrators |

| Financial Sector Cybersecurity Practices | 90 | Chief Information Security Officers, Risk Management Heads |

| Healthcare Data Protection Strategies | 80 | Compliance Officers, IT Directors |

| Government Cybersecurity Initiatives | 60 | Policy Makers, Cybersecurity Analysts |

| SME Cybersecurity Awareness | 70 | Business Owners, IT Consultants |

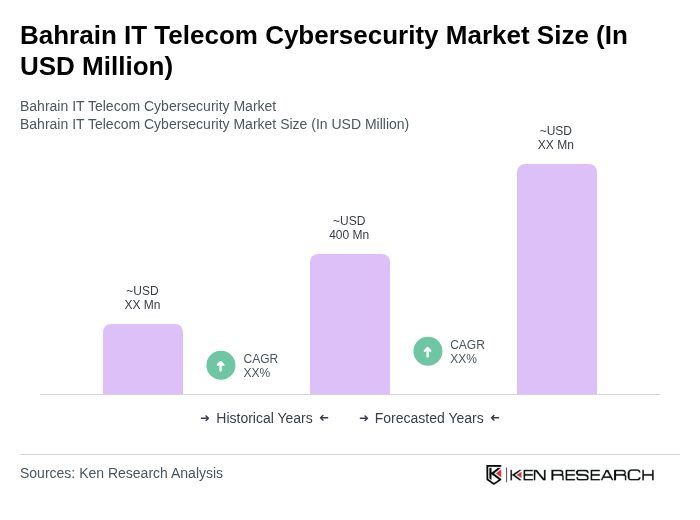

The Bahrain IT Telecom Cybersecurity Market is valued at approximately USD 400 million, reflecting significant growth driven by increasing cyber threats, digital transformation, and heightened security awareness among enterprises adopting advanced technologies.