Region:Middle East

Author(s):Dev

Product Code:KRAB7405

Pages:85

Published On:October 2025

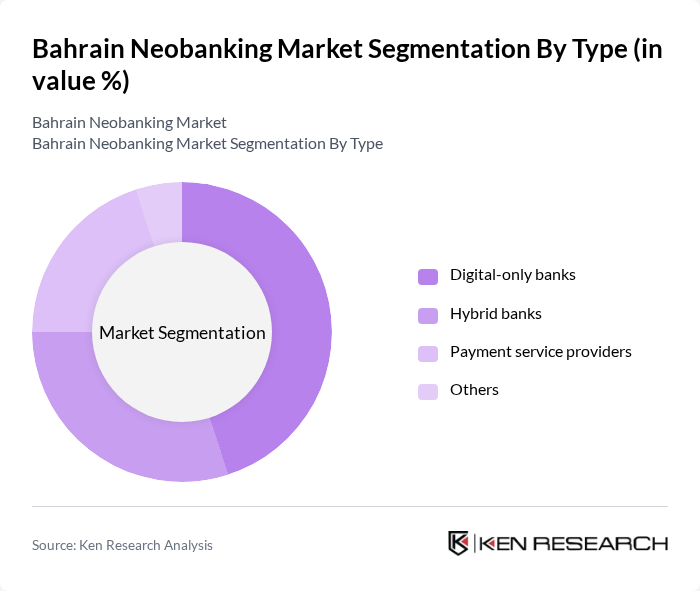

By Type:The neobanking market can be segmented into various types, including digital-only banks, hybrid banks, payment service providers, and others. Digital-only banks are gaining traction due to their low operational costs and customer-centric services. Hybrid banks combine traditional banking with digital services, appealing to a broader customer base. Payment service providers facilitate seamless transactions, while other types include niche players offering specialized services.

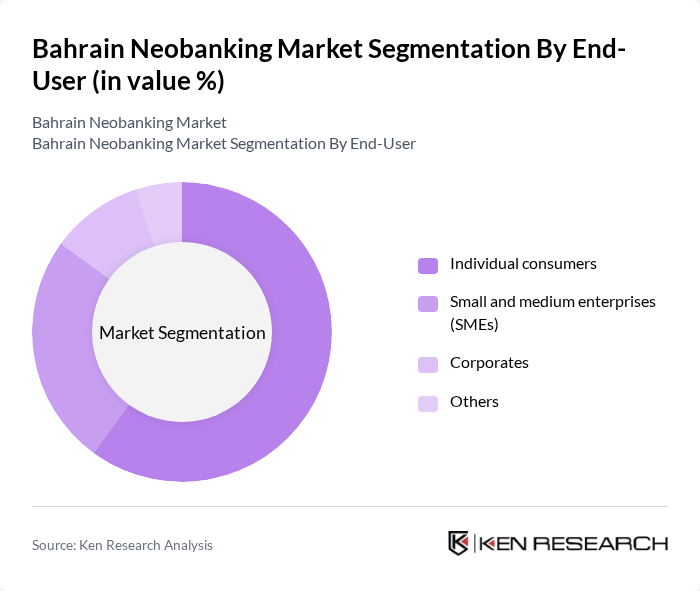

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), corporates, and others. Individual consumers are the largest segment, driven by the increasing demand for convenient banking solutions. SMEs are also adopting neobanking services for their flexibility and cost-effectiveness, while corporates leverage these services for enhanced financial management.

The Bahrain Neobanking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Islamic Bank, Al Baraka Banking Group, Bank of Bahrain and Kuwait, Gulf International Bank, Ahli United Bank, National Bank of Bahrain, Bahrain Development Bank, Khaleeji Commercial Bank, Abu Dhabi Islamic Bank, Qatar National Bank, Emirates NBD, Mashreq Bank, Standard Chartered Bank, HSBC Bank Middle East, Citibank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain neobanking market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy continues to rise, neobanks are expected to enhance their service offerings, focusing on user experience and personalized solutions. Additionally, the integration of AI and machine learning will likely streamline operations and improve customer engagement. With ongoing regulatory support, neobanks are well-positioned to capture a larger share of the financial services market, fostering innovation and competition in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital-only banks Hybrid banks Payment service providers Others |

| By End-User | Individual consumers Small and medium enterprises (SMEs) Corporates Others |

| By Customer Segment | Millennials Gen Z Professionals Others |

| By Service Offered | Savings accounts Loans and credit Investment services Others |

| By Distribution Channel | Mobile applications Websites Third-party platforms Others |

| By Pricing Model | Subscription-based Transaction-based Freemium Others |

| By Geographic Focus | Urban areas Rural areas Expat communities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Individuals aged 18-45, tech-savvy users |

| Small Business Owners | 100 | Entrepreneurs and SMEs utilizing digital banking services |

| Financial Advisors | 80 | Professionals providing financial services and advice |

| Regulatory Bodies | 50 | Officials from Bahrain's Central Bank and financial regulatory authorities |

| Fintech Industry Experts | 70 | Consultants and analysts specializing in financial technology |

The Bahrain Neobanking Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and a surge in smartphone penetration among consumers.