Region:Middle East

Author(s):Dev

Product Code:KRAD7791

Pages:90

Published On:December 2025

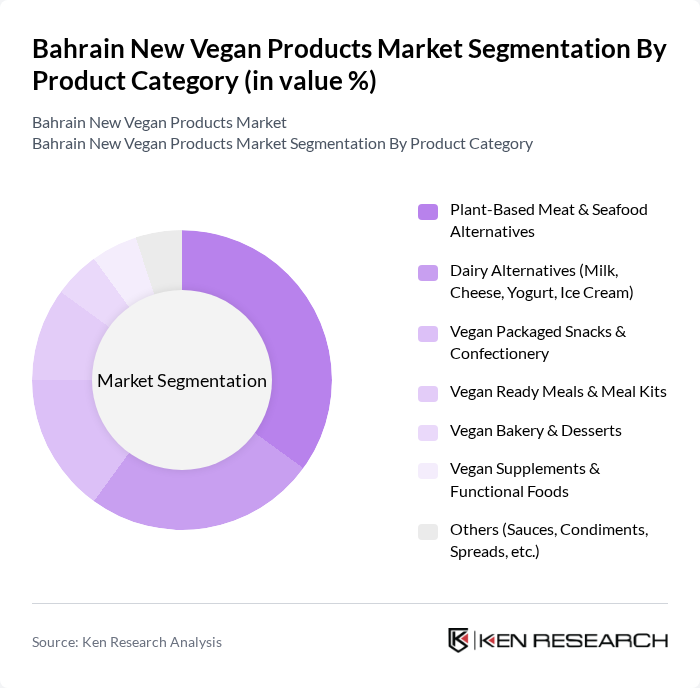

By Product Category:The product category segmentation includes various subsegments such as Plant-Based Meat & Seafood Alternatives, Dairy Alternatives, Vegan Packaged Snacks & Confectionery, Vegan Ready Meals & Meal Kits, Vegan Bakery & Desserts, Vegan Supplements & Functional Foods, and Others (Sauces, Condiments, Spreads, etc.). Among these, Plant-Based Meat & Seafood Alternatives dominate the market due to increasing consumer preference for meat substitutes driven by health and environmental concerns. The Dairy Alternatives segment is also gaining traction as consumers seek lactose-free options.

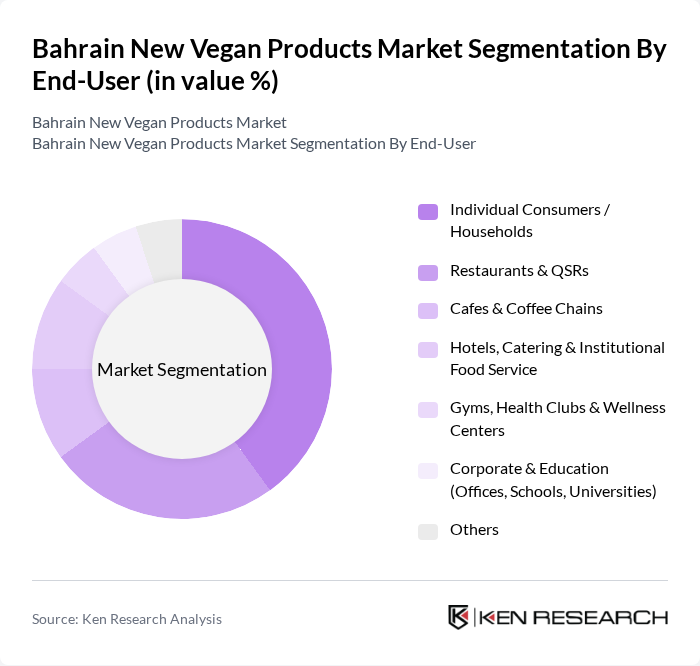

By End-User:The end-user segmentation includes Individual Consumers / Households, Restaurants & QSRs, Cafes & Coffee Chains, Hotels, Catering & Institutional Food Service, Gyms, Health Clubs & Wellness Centers, Corporate & Education (Offices, Schools, Universities), and Others. Individual Consumers / Households are the leading segment, driven by the increasing trend of home cooking and the growing awareness of health benefits associated with vegan diets. Restaurants and QSRs are also significant contributors as they adapt their menus to include vegan options to cater to changing consumer preferences.

The Bahrain New Vegan Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrefour Bahrain (Majid Al Futtaim Retail), Lulu Hypermarket Bahrain, AlJazira Supermarket, Alosra Supermarket, Alosra Online & Waitrose Bahrain (BMMI), Talabat Bahrain, HungerStation Bahrain, Plant Café Bahrain, Green Bar Bahrain, Natuur Plant-Based Ice Cream (Bahrain), Mana Café & Concept Store, Sprouts Health Foods Bahrain, Holland & Barrett Bahrain, Body & Soul Health Club (Vegan Nutrition Offerings), Starbucks Bahrain (Plant-Based & Dairy-Alternative Portfolio) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the vegan products market in Bahrain appears promising, driven by increasing health awareness and a growing youth demographic embracing plant-based diets. As e-commerce continues to expand, more consumers will have access to vegan options, enhancing market visibility. Additionally, collaborations with local restaurants can introduce innovative vegan dishes, further popularizing these products. With government support for sustainable practices, the market is poised for significant growth, aligning with global trends toward healthier and more sustainable food choices.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Plant-Based Meat & Seafood Alternatives Dairy Alternatives (Milk, Cheese, Yogurt, Ice Cream) Vegan Packaged Snacks & Confectionery Vegan Ready Meals & Meal Kits Vegan Bakery & Desserts Vegan Supplements & Functional Foods Others (Sauces, Condiments, Spreads, etc.) |

| By End-User | Individual Consumers / Households Restaurants & QSRs Cafes & Coffee Chains Hotels, Catering & Institutional Food Service Gyms, Health Clubs & Wellness Centers Corporate & Education (Offices, Schools, Universities) Others |

| By Distribution Channel | Supermarkets & Hypermarkets Convenience & Neighborhood Stores Specialty & Health Food Stores Online Retail & Delivery Platforms HoReCa & Foodservice Distributors Others |

| By Packaging Type | Flexible Packaging (Pouches, Sachets, Films) Rigid Packaging (Bottles, Tubs, Trays) Glass & Metal Packaging Sustainable / Eco-Friendly Packaging Bulk & Foodservice Packs Others |

| By Price Range | Premium Mid-Range Value / Budget Private Label |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Income Level (Low, Middle, High) Lifestyle & Diet (Vegans, Flexitarians, Health-Conscious, Eco-Conscious) Expat vs Bahraini Nationals Others |

| By Occasion & Usage | Daily Consumption On-the-Go & Snacking Meal Replacement / Sports Nutrition Special Occasions & Gifting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vegan Product Retailers | 60 | Store Managers, Product Buyers |

| Health and Wellness Consumers | 120 | Health Enthusiasts, Dieticians |

| Food Service Providers | 40 | Restaurant Owners, Menu Planners |

| Vegan Product Manufacturers | 50 | Production Managers, Marketing Directors |

| Nutrition Experts | 40 | Nutritionists, Health Coaches |

The Bahrain New Vegan Products Market is valued at approximately USD 55 million, reflecting a significant growth trend driven by increasing health consciousness, a rise in veganism, and the availability of plant-based alternatives in both retail and foodservice sectors.