Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4865

Pages:96

Published On:December 2025

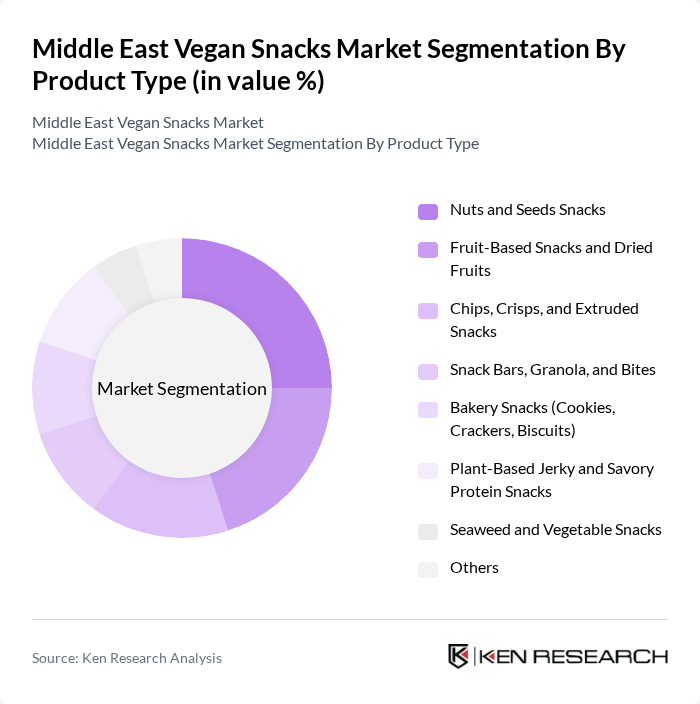

By Product Type:The product type segmentation includes various categories such as Nuts and Seeds Snacks, Fruit-Based Snacks and Dried Fruits, Chips, Crisps, and Extruded Snacks, Snack Bars, Granola, and Bites, Bakery Snacks (Cookies, Crackers, Biscuits), Plant-Based Jerky and Savory Protein Snacks, Seaweed and Vegetable Snacks, and Others. Each of these subsegments caters to different consumer preferences and dietary needs, contributing to the overall growth of the market, with particular momentum in plant-based protein snacks, high-fiber nut and seed mixes, and clean-label baked snacks positioned for on-the-go consumption.

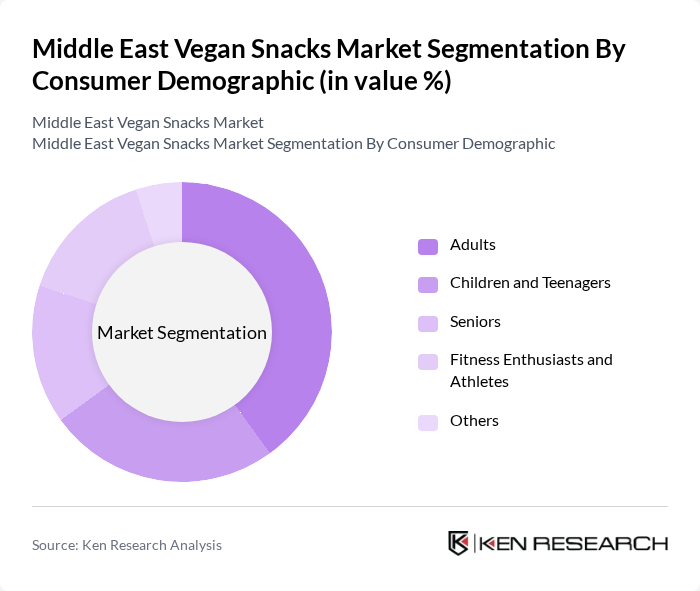

By Consumer Demographic:The consumer demographic segmentation includes Adults, Children and Teenagers, Seniors, Fitness Enthusiasts and Athletes, and Others. This segmentation highlights the diverse target audiences for vegan snacks, with each group exhibiting unique preferences and consumption patterns that influence product development and marketing strategies, such as high-protein and low-sugar formats for fitness-focused consumers, portion-controlled packs for children and teenagers, and functional snacks with added fiber or micronutrients targeting adults and seniors.

The Middle East Vegan Snacks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hunter Foods LLC (UAE), Bateel International (UAE / KSA), Bakemart Gourmet (UAE), Al Islami Foods (Plant-Based and Vegan Range, UAE), Americana Group (Plant-Based and Better-for-You Snacks, GCC), Al Rifai Roastery (Lebanon / GCC), Al Seedawi Sweets (Kuwait), Natures Market (Private Label Healthy & Vegan Snacks, UAE), Go Organic ME (UAE), Koita International (Plant-Based & Organic, UAE), Al Ain Dairy – Plant-Based and Snack Extensions (UAE), IFFCO Group – THRYVE Plant-Based and Snacks (UAE), Nestlé Middle East FZE (Garden Gourmet & Vegan Snack Lines), Mondelez International Middle East (Vegan/Plant-Based Snack Portfolio), PepsiCo Middle East (Vegan-Suitable Snack SKUs) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East vegan snacks market appears promising, driven by increasing health consciousness and a growing vegan demographic. As more consumers adopt plant-based diets, the demand for innovative and diverse vegan snack options is expected to rise in future. Additionally, the expansion of e-commerce and retail channels will facilitate greater accessibility, allowing brands to reach a broader audience. Companies that invest in marketing and education will likely capture significant market share as awareness of vegan products continues to grow in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Nuts and Seeds Snacks Fruit-Based Snacks and Dried Fruits Chips, Crisps, and Extruded Snacks Snack Bars, Granola, and Bites Bakery Snacks (Cookies, Crackers, Biscuits) Plant-Based Jerky and Savory Protein Snacks Seaweed and Vegetable Snacks Others |

| By Consumer Demographic | Adults Children and Teenagers Seniors Fitness Enthusiasts and Athletes Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Specialty Health and Organic Stores Online Retail and E-commerce Platforms HoReCa and Foodservice Others |

| By Packaging Type | Single-Serve Packs Multi-Serve Resealable Bags and Pouches Boxes and Cartons Bulk and Foodservice Packaging Sustainable and Eco-Friendly Packaging Others |

| By Flavor Profile | Sweet Savory Spicy and Ethnic Flavors Mixed and Fusion Flavors Others |

| By Nutritional Positioning | High Protein and High Fiber Low Calorie and Weight Management Gluten-Free Organic and Clean Label Free-From (Allergen-Free, Sugar-Free, etc.) Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Israel Egypt Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vegan Snack Retailers | 100 | Store Managers, Category Buyers |

| Health Food Distributors | 80 | Distribution Managers, Sales Representatives |

| Consumer Focus Groups | 60 | Health-Conscious Consumers, Vegan Diet Adopters |

| Nutritionists and Dietitians | 40 | Health Professionals, Food Scientists |

| Market Analysts | 40 | Industry Analysts, Market Researchers |

The Middle East Vegan Snacks Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing health consciousness and the rising popularity of plant-based diets among consumers in the region.