Region:Middle East

Author(s):Shubham

Product Code:KRAD6685

Pages:93

Published On:December 2025

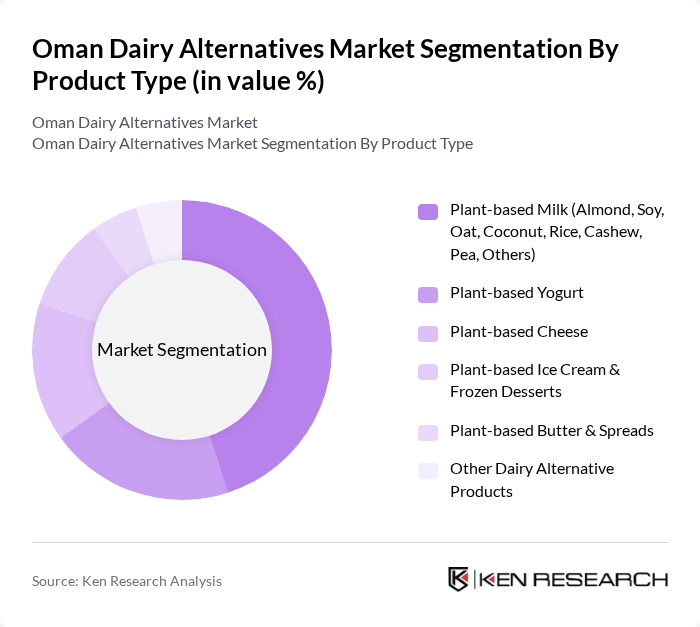

By Product Type:The product type segmentation includes various dairy alternative products such as plant-based milk, yogurt, cheese, ice cream, butter, and other dairy alternatives. Among these, plant-based milk is the most popular segment, in line with regional trends where non-dairy milk accounts for more than half of dairy alternatives consumption, driven by consumer preferences for lactose-free, vegan, and lower-cholesterol options. The increasing availability of diverse flavors, fortified formulations (with calcium, vitamins B12 and D), and barista-style products has further boosted its market presence, while plant-based yogurt and cheese are recording faster growth from a smaller base as consumers look for convenient, on-the-go, and culinary-use alternatives.

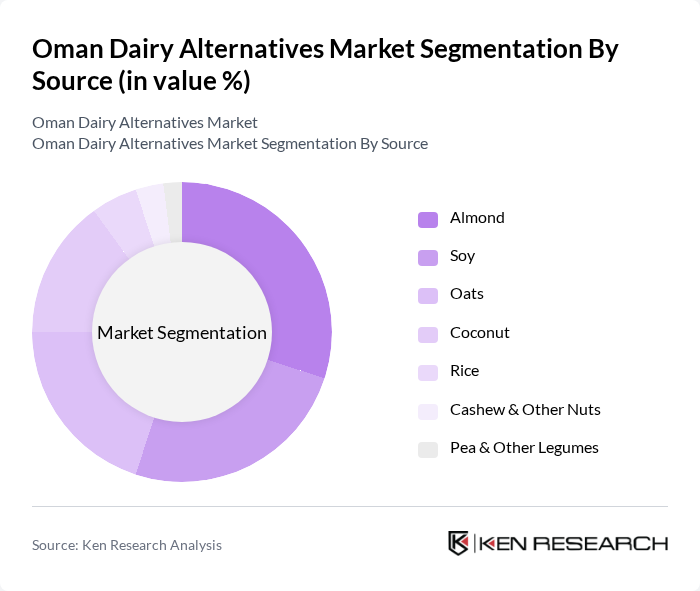

By Source:The source segmentation includes various plant-based sources such as almond, soy, oats, coconut, rice, cashew, and pea. Almond and soy are the leading sources globally due to their widespread acceptance, established presence in retail, and nutritional benefits, and they hold strong positions in Oman’s plant-based milk shelf as part of imported and regional brands. The growing trend of using oats and coconut in dairy alternatives is also notable, as consumers seek creamier textures, allergen-friendly options, and products perceived as more sustainable, mirroring shifts seen in other Middle Eastern markets.

The Oman Dairy Alternatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Al Ain Farms, National Dairy Company (NADEC), Al Safi Danone, Al Rawabi Dairy Company, A’Saffa Foods SAOG, Koita Foods, Danone S.A., Oatly Group AB, Blue Diamond Growers, Nestlé S.A., Earth’s Own Food Company Inc., SunOpta Inc., Valsoia S.p.A., Sanitarium Health and Wellbeing Company contribute to innovation, geographic expansion, and service delivery in this space, primarily through plant-based milks and, increasingly, yogurt and specialty beverages imported into Oman’s modern retail and foodservice channels.

The future of the Oman dairy alternatives market appears promising, driven by increasing health awareness and a shift towards sustainable consumption. As more consumers adopt plant-based diets, the demand for innovative dairy alternatives is expected to rise. Additionally, the growth of e-commerce platforms will facilitate easier access to these products, enhancing market visibility. Companies are likely to invest in research and development to create diverse offerings that cater to evolving consumer preferences, ensuring sustained growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Plant-based Milk (Almond, Soy, Oat, Coconut, Rice, Cashew, Pea, Others) Plant-based Yogurt Plant-based Cheese Plant-based Ice Cream & Frozen Desserts Plant-based Butter & Spreads Other Dairy Alternative Products |

| By Source | Almond Soy Oats Coconut Rice Cashew & Other Nuts Pea & Other Legumes |

| By End-User | Households Restaurants and Cafes Food Processing Industry Hotels & Hospitality Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Health & Organic Stores Convenience Stores HoReCa & Foodservice Distributors |

| By Packaging Type | Cartons Bottles Pouches Aseptic Tetra Packs Others |

| By Flavor | Original/Unsweetened Sweetened Vanilla Chocolate Other Flavors |

| By Nutritional / Label Claim | High Protein Low / No Sugar Fortified (Vitamins & Minerals) Organic Clean Label / Free-from (Lactose-free, Gluten-free, Non-GMO) |

| By Price Range | Economy Mid-Range Premium Private Label |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Dairy Alternatives | 150 | Health-conscious Consumers, Millennials, Parents |

| Retailer Insights on Dairy Alternative Products | 100 | Store Managers, Category Buyers, Product Merchandisers |

| Manufacturers of Dairy Alternatives | 80 | Production Managers, R&D Heads, Marketing Directors |

| Nutritionists and Health Experts | 60 | Registered Dietitians, Wellness Coaches, Health Bloggers |

| Distribution Channels for Dairy Alternatives | 70 | Logistics Managers, Supply Chain Analysts, Import/Export Specialists |

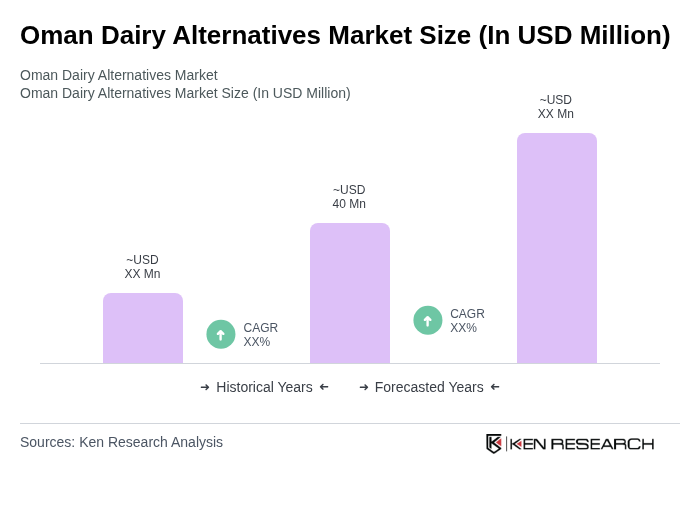

The Oman Dairy Alternatives Market is valued at approximately USD 40 million, reflecting a growing trend towards health-conscious and plant-based diets among consumers, as well as an increase in lactose intolerance awareness.