Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8341

Pages:81

Published On:October 2025

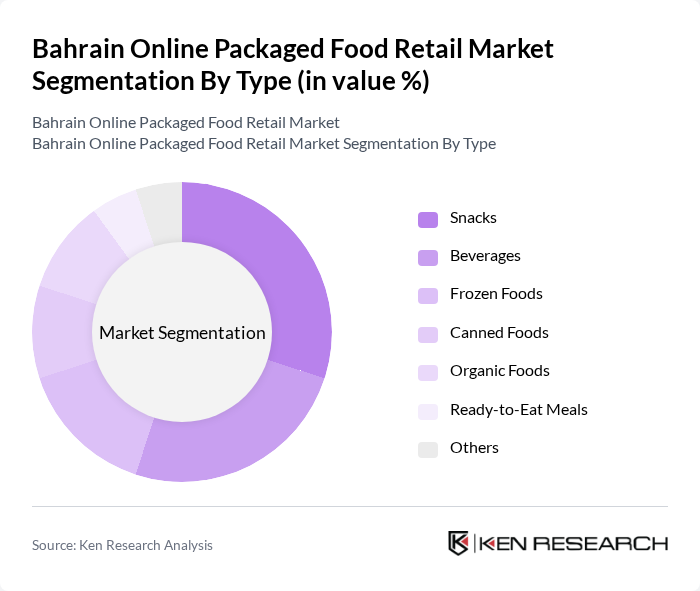

By Type:

The market is segmented into various types, including Snacks, Beverages, Frozen Foods, Canned Foods, Organic Foods, Ready-to-Eat Meals, and Others. Among these, Snacks have emerged as the leading sub-segment, driven by changing consumer lifestyles and the increasing trend of on-the-go snacking. The demand for healthy and convenient snack options has surged, particularly among younger consumers who prioritize convenience and taste. This trend is further supported by innovative product offerings and aggressive marketing strategies by leading brands.

By End-User:

The end-user segmentation includes Households, Restaurants, Cafes, and Retail Stores. Households represent the largest segment, driven by the increasing trend of online grocery shopping and the convenience it offers. The busy lifestyles of consumers have led to a significant rise in demand for packaged food products that can be easily ordered online and delivered to their doorsteps. This shift in consumer behavior has made households the dominant end-user in the online packaged food retail market.

The Bahrain Online Packaged Food Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Food & Beverages, Lulu Hypermarket, Carrefour Bahrain, Talabat, Monoprix Bahrain, Bahrain Food & Drug Control, Al Jazeera Group, Gulf Food Industries, Al Watania Poultry, Al Marai, Americana Group, Nestle Bahrain, Unilever Bahrain, Mondelez International, PepsiCo Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain online packaged food retail market appears promising, driven by technological advancements and changing consumer preferences. As more consumers embrace digital shopping, retailers are likely to enhance their online platforms, integrating features like personalized recommendations and seamless payment options. Additionally, the focus on sustainability will likely shape product offerings, with an increasing number of consumers seeking eco-friendly packaging and organic options, further influencing market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Snacks Beverages Frozen Foods Canned Foods Organic Foods Ready-to-Eat Meals Others |

| By End-User | Households Restaurants Cafes Retail Stores |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms Mobile Apps |

| By Distribution Mode | Direct Delivery Third-Party Logistics Click and Collect |

| By Price Range | Budget Mid-Range Premium |

| By Packaging Type | Plastic Glass Metal |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Packaged Foods | 150 | Online Shoppers, Health-Conscious Consumers |

| Retailer Insights on Online Sales | 100 | Retail Managers, E-commerce Directors |

| Supplier Perspectives on Market Trends | 80 | Manufacturers, Distributors |

| Expert Opinions on Food Regulations | 50 | Food Safety Inspectors, Regulatory Affairs Specialists |

| Market Analysts' Views on Future Growth | 60 | Market Researchers, Industry Analysts |

The Bahrain Online Packaged Food Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased e-commerce adoption, changing consumer preferences, and a growing population seeking diverse food options.