Region:Middle East

Author(s):Rebecca

Product Code:KRAD8413

Pages:93

Published On:December 2025

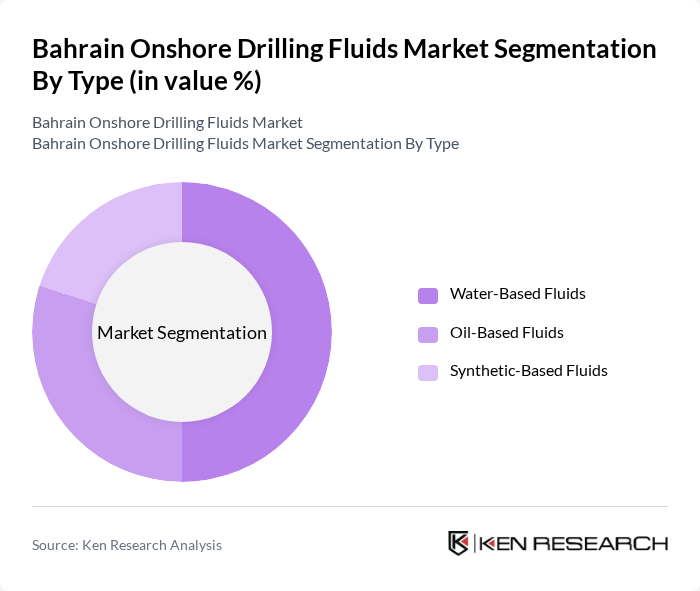

By Type:

The market is segmented into three main types: Water-Based Fluids, Oil-Based Fluids, and Synthetic-Based Fluids. Among these, Water-Based Fluids dominate the market due to their cost-effectiveness and environmental friendliness. They are widely used in various drilling applications, particularly in regions with stringent environmental regulations. Oil-Based Fluids are also significant, especially in high-temperature and high-pressure conditions, while Synthetic-Based Fluids are gaining traction due to their superior performance and reduced environmental impact.

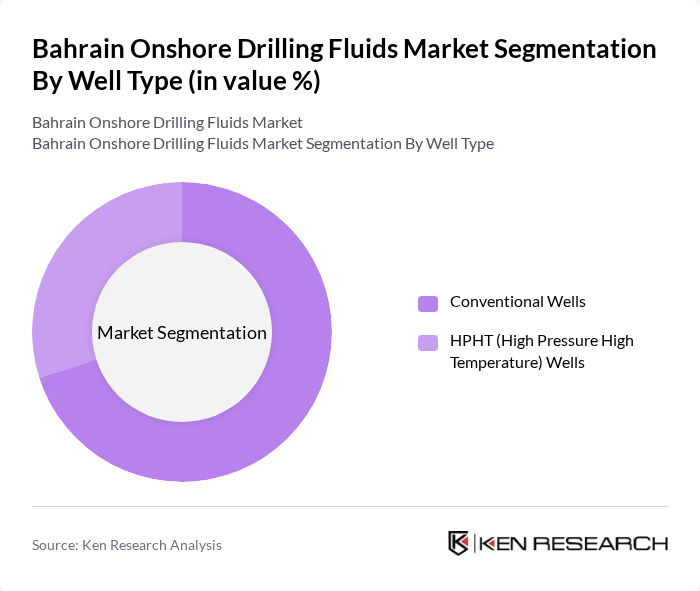

By Well Type:

This segmentation includes Conventional Wells and HPHT (High Pressure High Temperature) Wells. Conventional Wells are the leading segment, primarily due to their widespread use in Bahrain's oil fields. The demand for HPHT Wells is increasing as operators seek to exploit deeper and more challenging reservoirs, but they currently represent a smaller portion of the market. The trend towards more complex drilling operations is expected to drive growth in the HPHT segment.

The Bahrain Onshore Drilling Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton Energy Services, Inc., Baker Hughes Company, Schlumberger Limited, National Oilwell Varco (NOV), Weatherford International plc, Newpark Resources, Inc., TETRA Technologies, Inc., Scomi Group Bhd, CES Energy Solutions Corp., GEO Drilling Fluids, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain onshore drilling fluids market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As companies increasingly adopt digital technologies, operational efficiencies are expected to improve, reducing costs and enhancing productivity. Furthermore, the focus on environmentally friendly solutions will likely lead to the development of innovative products. Strategic partnerships and investments in R&D will be crucial for navigating challenges and capitalizing on emerging opportunities in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-Based Fluids Oil-Based Fluids Synthetic-Based Fluids |

| By Well Type | Conventional Wells HPHT (High Pressure High Temperature) Wells |

| By Application | Onshore Drilling Workover Operations Exploration Drilling |

| By End-User | Oil and Gas Exploration Companies Service Providers Government Agencies |

| By Distribution Channel | Direct Sales Distributors Service Providers |

| By Region | Northern Governorate Southern Governorate Central Governorate Muharraq Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Drilling Operations | 100 | Drilling Engineers, Operations Managers |

| Fluid Supply Chain Management | 80 | Procurement Officers, Supply Chain Analysts |

| Environmental Compliance in Drilling | 60 | Environmental Managers, Compliance Officers |

| Research & Development in Drilling Fluids | 50 | R&D Managers, Product Development Specialists |

| Market Trends and Innovations | 70 | Industry Analysts, Market Researchers |

The Bahrain Onshore Drilling Fluids Market is valued at approximately USD 145 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for oil and gas exploration and advancements in drilling technologies.