Region:Middle East

Author(s):Shubham

Product Code:KRAD5441

Pages:83

Published On:December 2025

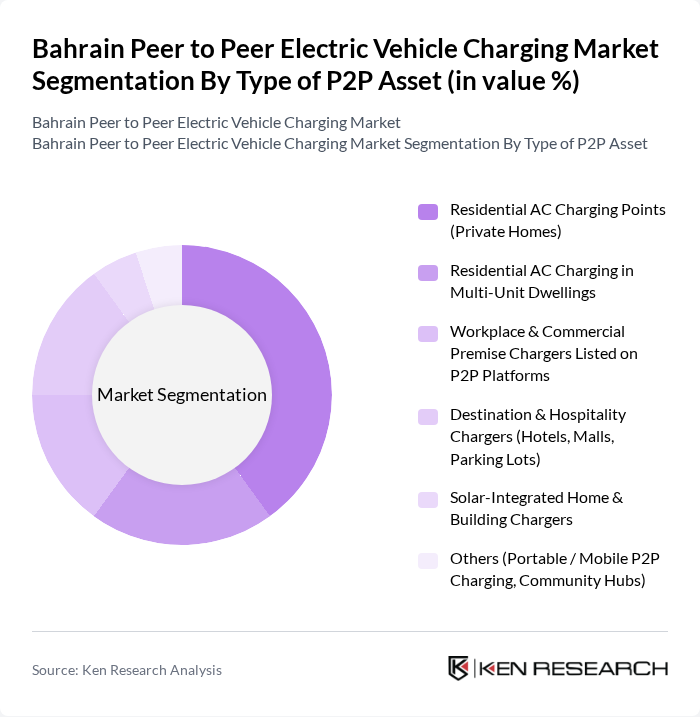

By Type of P2P Asset:The market is segmented into various types of peer-to-peer assets, including residential AC charging points, workplace chargers, and destination chargers. Among these, residential AC charging points in private homes are gaining traction due to the increasing number of electric vehicle owners who prefer the convenience of charging at home, a trend also observed in Bahrain’s broader EV market where home charging is cited as the primary solution addressing public?infrastructure gaps. This segment is expected to dominate the market as more homeowners in premium and new residential communities install smart AC charging stations that can be shared with neighbours or listed on digital platforms, supporting peer?to?peer use and monetisation models.

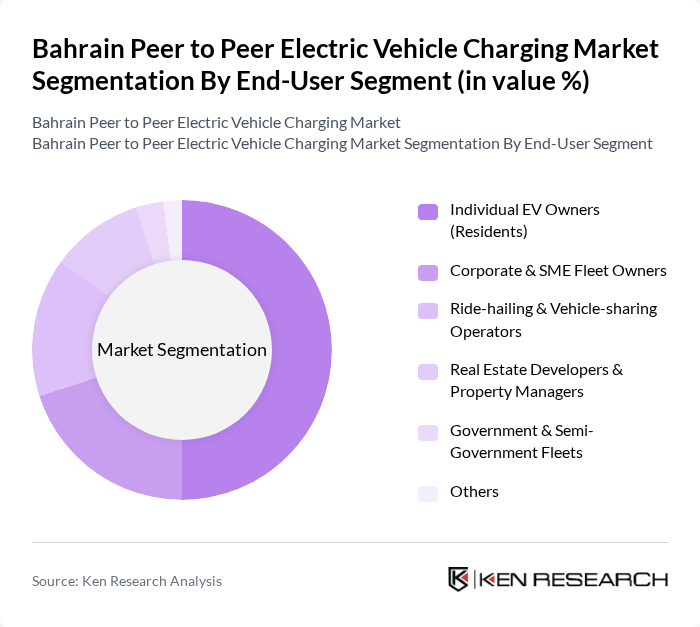

By End-User Segment:The end-user segment includes individual EV owners, corporate fleet owners, and ride-hailing operators. Individual EV owners are the leading segment, driven by the increasing number of electric vehicles on the road and the growing awareness of sustainable transportation, with recent studies indicating that passenger EVs in Bahrain are concentrated among higher?income residential users who rely primarily on home and private chargers. This segment is characterized by a strong preference for home charging solutions, which are convenient and cost-effective for daily use and can increasingly be integrated with smartphone apps and access?control features that enable peer?to?peer sharing with trusted users or local communities.

The Bahrain Peer to Peer Electric Vehicle Charging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Electricity and Water Authority (EWA) – EV Charging Initiatives, Bahrain Network (BNET) – Solar EV Charging Stations, ABB Group – Fast Charging Infrastructure Partner, Zain Bahrain – EV Charging & Connectivity Initiatives, Bahrain Petroleum Company (Bapco Energies) – Public Charging Pilots, National Bank of Bahrain (NBB) – EV Financing & Ecosystem Support, Majid Al Futtaim – Mall & Destination Charging in Bahrain, Seef Properties – Destination & Mall?Based EV Charging, Hilton & International Hotel Groups in Bahrain – Guest EV Charging, Porsche Centre Bahrain (Behbehani Bros) – Branded Charging Solutions, Tesla (Regional) – Vehicle?Integrated & Destination Charging, Audi & Volkswagen Bahrain – Dealership & Customer Charging, Manara Developments & Other Real Estate Developers – Residential EV?Ready Projects, Private EV Charging Operators & EPC Contractors in Bahrain, Emerging P2P EV Charging Platforms & Start?ups in GCC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain Peer to Peer Electric Vehicle Charging Market appears promising, driven by technological advancements and increasing consumer demand for sustainable solutions. As the government continues to invest in EV infrastructure and incentives, the market is likely to see enhanced participation from local businesses and consumers. Furthermore, the integration of smart technologies and mobile applications will facilitate user engagement, making P2P charging more accessible and efficient, ultimately supporting the transition to a greener economy.

| Segment | Sub-Segments |

|---|---|

| By Type of P2P Asset | Residential AC Charging Points (Private Homes) Residential AC Charging in Multi-Unit Dwellings Workplace & Commercial Premise Chargers Listed on P2P Platforms Destination & Hospitality Chargers (Hotels, Malls, Parking Lots) Solar-Integrated Home & Building Chargers Others (Portable / Mobile P2P Charging, Community Hubs) |

| By End-User Segment | Individual EV Owners (Residents) Corporate & SME Fleet Owners Ride?hailing & Vehicle?sharing Operators Real Estate Developers & Property Managers Government & Semi?Government Fleets Others |

| By Charging Power / Speed | AC Slow Charging (? 7 kW) AC Fast Charging (7.1 – 22 kW) DC Fast & Ultra?Fast Charging (> 22 kW) Others (Battery Swapping / Emerging Models) |

| By Monetization & Tariff Model | Host?Set Dynamic Pricing (Time?of?Day / Demand?Based) Flat Pay?Per?Use Tariff Subscription / Membership Plans Revenue?Share Agreements with Hosts Free?to?Use / Sponsored Charging |

| By Location & Use Case | High?Density Urban Areas (Manama, Seef, Juffair) Suburban Residential Communities Industrial & Logistics Corridors Tourism & Retail Destinations Highway & Inter?City Nodes Others |

| By Ownership & Hosting Model | Individually Owned Chargers Listed on P2P Platforms Corporate / Fleet?Owned Chargers Opened to Third Parties Real Estate & Parking Operator?Owned Chargers Utility / Telecom?Backed Community Chargers Others |

| By Regulatory & Policy Environment | Chargers in Developments Mandated by Building Codes Incentivized Installations (Subsidies, Grants, Tax Relief) Unregulated / Pilot & Sandbox Projects Public?Private Partnership (PPP) Backed P2P Networks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Owners | 120 | Individual EV Owners, Fleet Managers |

| Charging Infrastructure Providers | 90 | Business Development Managers, Operations Directors |

| Local Government Officials | 40 | Policy Makers, Urban Planners |

| Energy Sector Stakeholders | 70 | Energy Analysts, Utility Company Representatives |

| Potential Users of Peer-to-Peer Charging | 110 | General Public, Community Leaders |

The Bahrain Peer to Peer Electric Vehicle Charging Market is valued at approximately USD 150 million, reflecting a significant growth driven by the increasing adoption of electric vehicles and government initiatives promoting sustainable transportation.