Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4830

Pages:84

Published On:December 2025

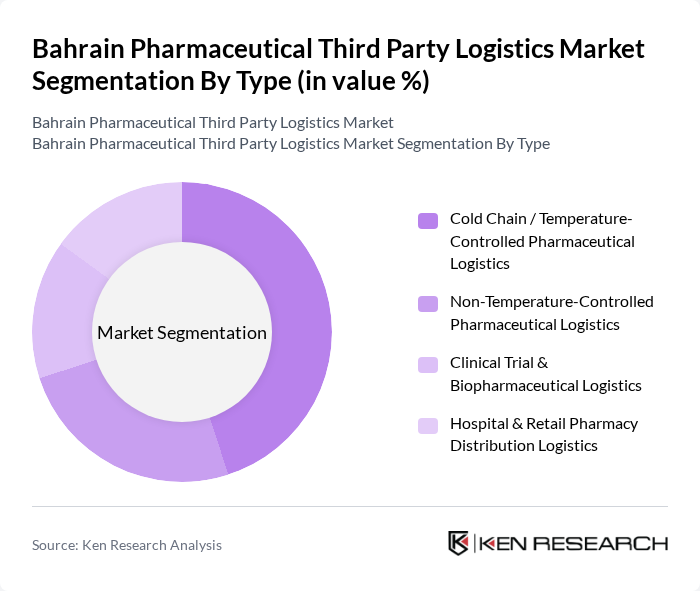

By Type:The market is segmented into four main types: Cold Chain / Temperature-Controlled Pharmaceutical Logistics, Non-Temperature-Controlled Pharmaceutical Logistics, Clinical Trial & Biopharmaceutical Logistics, and Hospital & Retail Pharmacy Distribution Logistics. Cold Chain logistics is particularly crucial due to the need for maintaining specific temperature ranges for sensitive medications and vaccines, especially for biologics, insulin, oncology products, and advanced therapies that are increasingly used in Bahrain and across the GCC.

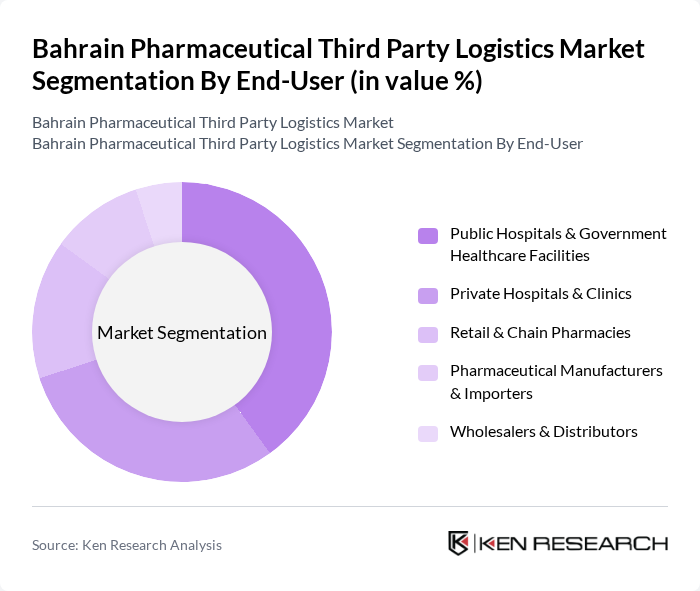

By End-User:The end-user segmentation includes Public Hospitals & Government Healthcare Facilities, Private Hospitals & Clinics, Retail & Chain Pharmacies, Pharmaceutical Manufacturers & Importers, and Wholesalers & Distributors. Public hospitals and government healthcare facilities account for a major share of pharmaceutical logistics demand due to their extensive patient base, national health insurance coverage, and centralized procurement of medicines, which require reliable, compliant logistics for timely and continuous drug supply.

The Bahrain Pharmaceutical Third Party Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Global Forwarding & DHL Supply Chain Bahrain, Agility Logistics Bahrain, GAC Bahrain, Almoayed Wilhelmsen Ltd., Kuehne + Nagel Bahrain, DB Schenker Bahrain, CEVA Logistics (Bahrain Operations), FedEx Express Bahrain, UPS Supply Chain Solutions (Bahrain), Bahrain Logistics Zone–Based 3PLs Serving Pharma (Selected Players), Bahri Logistics (Regional Services Covering Bahrain), Emirates SkyCargo & Emirates Logistics (Regional Pharma Corridors to Bahrain), Bahrain Airport Services (BAS) Air Cargo & Cool Chain, APM Terminals Bahrain (Khalifa Bin Salman Port – Cold Chain & Reefer Handling), Selected Local SME Logistics Providers Specializing in Healthcare & Pharma Distribution contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain pharmaceutical third-party logistics market appears promising, driven by advancements in technology and increasing demand for specialized logistics services. As the healthcare sector continues to expand, logistics providers will need to adapt to new challenges, including regulatory compliance and operational efficiency. The integration of AI and automation in logistics processes is expected to enhance service delivery, while the focus on sustainability will shape operational strategies, ensuring that providers remain competitive in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Chain / Temperature-Controlled Pharmaceutical Logistics Non-Temperature-Controlled Pharmaceutical Logistics Clinical Trial & Biopharmaceutical Logistics Hospital & Retail Pharmacy Distribution Logistics |

| By End-User | Public Hospitals & Government Healthcare Facilities Private Hospitals & Clinics Retail & Chain Pharmacies Pharmaceutical Manufacturers & Importers Wholesalers & Distributors |

| By Service Type | Warehousing & Distribution Transportation & Freight Management Cold Chain / Temperature-Controlled Services Value-Added Services (Packaging, Labelling, Kitting, Returns) |

| By Delivery Model | Domestic Distribution (Within Bahrain) Cross-Border / GCC Distribution Direct-to-Patient / Home Delivery Emergency & Specialty Deliveries |

| By Packaging Type | Passive Temperature-Controlled Packaging Active Temperature-Controlled Containers Standard Secondary & Tertiary Packaging Specialized Hazardous & Controlled-Drug Packaging |

| By Geographic Coverage | Manama & Northern Governorate Southern & Muharraq Governorates Remote & Island Locations |

| By Technology Utilization | GDP-Compliant WMS & TMS Solutions Real-Time Temperature & Shipment Monitoring (IoT/Telematics) Serialization, Track & Trace, and Digital Documentation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Managers, Supply Chain Coordinators |

| Cold Chain Management for Pharmaceuticals | 80 | Operations Managers, Quality Assurance Specialists |

| Regulatory Compliance in Pharmaceutical Logistics | 60 | Compliance Officers, Regulatory Affairs Managers |

| Healthcare Facility Supply Chain | 75 | Pharmacy Managers, Procurement Officers |

| Emerging Trends in Pharmaceutical Logistics | 90 | Industry Analysts, Market Researchers |

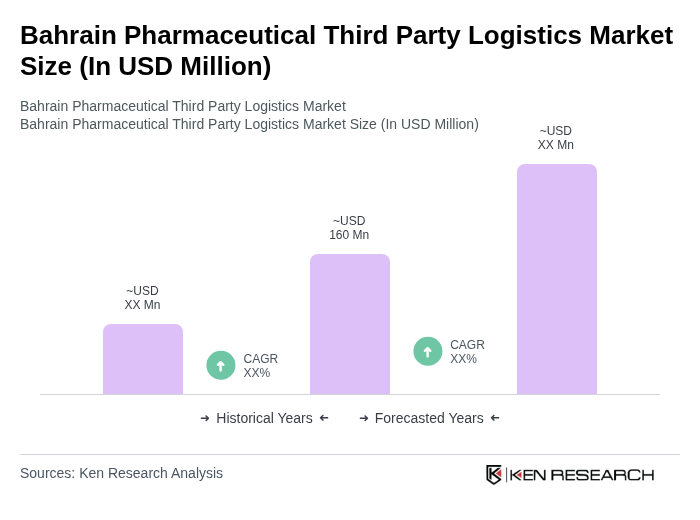

The Bahrain Pharmaceutical Third Party Logistics Market is valued at approximately USD 160 million, reflecting the growth driven by increasing demand for efficient supply chain solutions, rising volumes of imported medicines, and the need for temperature-sensitive logistics for biopharmaceutical products.