Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4149

Pages:94

Published On:December 2025

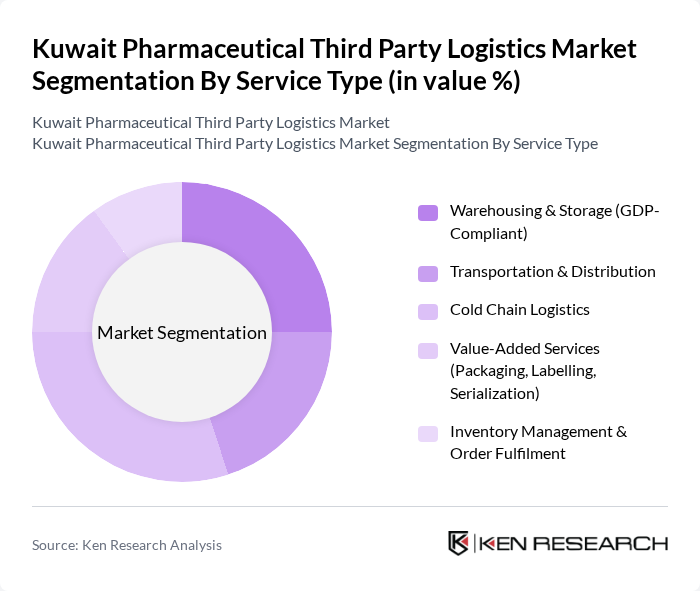

By Service Type:The service type segmentation includes various essential logistics services that cater to the pharmaceutical industry. The key subsegments are Warehousing & Storage (GDP-Compliant), Transportation & Distribution, Cold Chain Logistics, Value-Added Services (Packaging, Labelling, Serialization), and Inventory Management & Order Fulfilment. Among these, Cold Chain Logistics is particularly significant due to the increasing demand for temperature-sensitive products such as vaccines, biologics, and specialty injectables, which require validated temperature monitoring, data loggers, and refrigerated or frozen transport solutions.

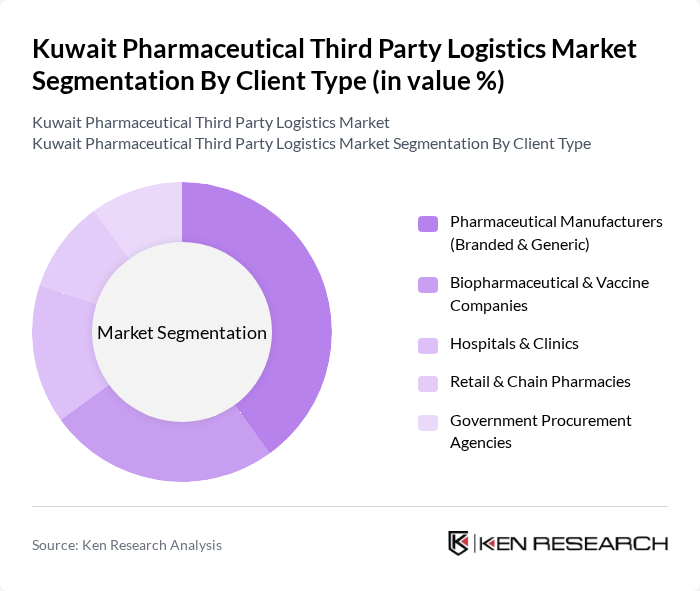

By Client Type:This segmentation focuses on the various clients that utilize third-party logistics services in the pharmaceutical sector. The subsegments include Pharmaceutical Manufacturers (Branded & Generic), Biopharmaceutical & Vaccine Companies, Hospitals & Clinics, Retail & Chain Pharmacies, and Government Procurement Agencies. Pharmaceutical Manufacturers represent the largest client type due to their extensive logistics needs for import, bonded storage, regional distribution, and value?added services such as secondary packaging and serialization, while biopharmaceutical and vaccine companies increasingly rely on specialized cold chain providers to handle complex biologics and cell? and gene?therapy shipments.

The Kuwait Pharmaceutical Third Party Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agility Logistics (Agility Public Warehousing Company K.S.C.P.), DHL Supply Chain (DHL Global Forwarding Kuwait), Kuehne + Nagel International AG (Kuehne + Nagel Kuwait), DB Schenker, CEVA Logistics, UPS Supply Chain Solutions (United Parcel Service), FedEx Logistics (FedEx Express Kuwait), DSV A/S (DSV Solutions Kuwait), Maersk Logistics & Services (A.P. Moller – Maersk), Gulf Agency Company (GAC Kuwait), KGL Logistics Company K.S.C.C., Aramex International LLC (Aramex Kuwait), Al-Rashed International Shipping Co., Kuwait Transcontinental Shipping Co., KAN Logistics & Warehousing (Kuwait Airport Services Subsidiary) contribute to innovation, geographic expansion, and service delivery in this space, with many of these providers investing in GDP?compliant facilities, cold chain fleets, real?time tracking, and IT integration with hospital and pharmacy systems.

The future of the Kuwait pharmaceutical third-party logistics market appears promising, driven by advancements in technology and increasing demand for efficient supply chain solutions. As the healthcare sector continues to expand, logistics providers will likely adopt innovative technologies such as AI and automation to enhance operational efficiency. Additionally, the growing trend of outsourcing logistics functions will further solidify the role of third-party providers in ensuring timely and reliable delivery of pharmaceutical products across the region.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Warehousing & Storage (GDP-Compliant) Transportation & Distribution Cold Chain Logistics Value-Added Services (Packaging, Labelling, Serialization) Inventory Management & Order Fulfilment |

| By Client Type | Pharmaceutical Manufacturers (Branded & Generic) Biopharmaceutical & Vaccine Companies Hospitals & Clinics Retail & Chain Pharmacies Government Procurement Agencies |

| By Product Type | Branded Pharmaceuticals Generic Pharmaceuticals Biologics & Biosimilars Vaccines Cell & Gene Therapies |

| By Temperature Control | Non?Cold Chain (Ambient) Cold Chain (2–8°C) Frozen (20°C)</p |

| By Transportation Mode | Road Freight (Domestic) Air Freight Sea Freight Multimodal |

| By Contract Type | Dedicated / Long?Term Contracts Shared / Multi?Client Contracts On?Demand / Spot Contracts |

| By Ownership Model | Asset?Based 3PL Providers Non?Asset?Based 3PL Providers Hybrid 3PL Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Cold Chain Management for Pharmaceuticals | 80 | Operations Managers, Quality Assurance Heads |

| Regulatory Compliance in Pharmaceutical Logistics | 60 | Compliance Officers, Regulatory Affairs Managers |

| Third-Party Logistics Provider Insights | 90 | Business Development Managers, Account Executives |

| Market Trends and Innovations in Pharma Logistics | 70 | Industry Analysts, Research and Development Managers |

The Kuwait Pharmaceutical Third Party Logistics Market is valued at approximately USD 650 million, driven by the increasing demand for efficient supply chain solutions and the rise in pharmaceutical consumption, particularly in the context of a growing healthcare sector.