Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3153

Pages:88

Published On:October 2025

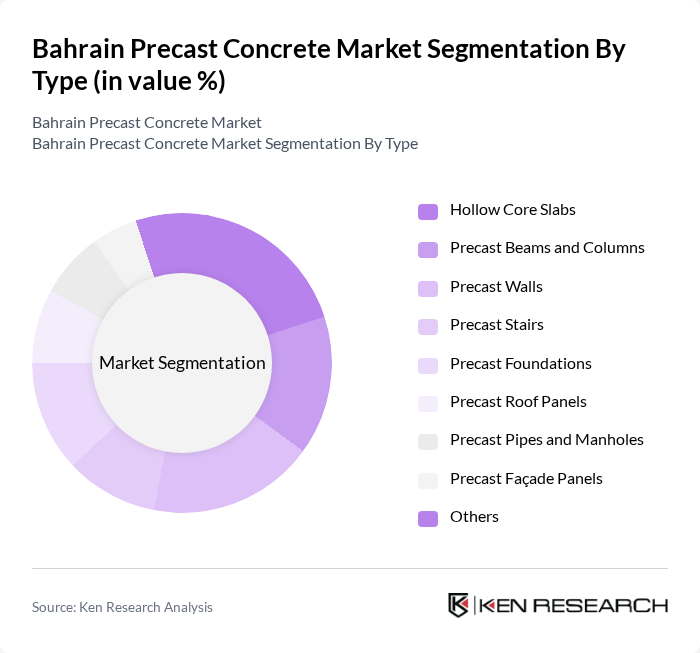

By Type:The precast concrete market can be segmented into various types, including Hollow Core Slabs, Precast Beams and Columns, Precast Walls, Precast Stairs, Precast Foundations, Precast Roof Panels, Precast Pipes and Manholes, Precast Façade Panels, and Others. Each of these subsegments serves specific construction needs, with varying levels of demand based on project requirements. Hollow core slabs and precast walls are particularly favored for their structural efficiency and speed of installation, while precast beams, columns, and façade panels are widely used in commercial and infrastructure projects to meet design flexibility and durability standards .

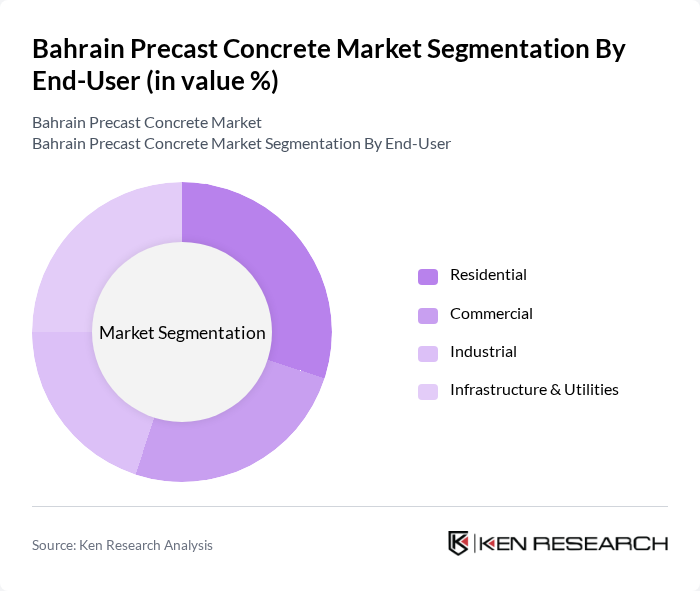

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Infrastructure & Utilities. Each segment has distinct requirements and preferences, influencing the types of precast concrete products utilized in various projects. Residential and infrastructure projects are leading demand, driven by population growth and government-led urban development, while the commercial and industrial sectors increasingly adopt precast solutions for their speed and cost efficiency .

The Bahrain Precast Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Precast Concrete Company, Gulf Precast Concrete Co. LLC, Al Manama Precast, Al Jazeera Precast Concrete, Al Kifah Precast Company, Almoayyed Contracting Group (Precast Division), BPC Group Precast, Al Hidd Precast, Bahrain Ready Mix Concrete Company, Al Ahlia Precast Concrete, Al Mufeed Precast, Al Maktab Precast, Al Mufeed Concrete, Al Ameen Precast, and Al Noor Precast contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain precast concrete market is poised for significant growth, driven by increasing infrastructure investments and a strong push for sustainable construction practices. As the government continues to prioritize housing and infrastructure projects, the demand for precast solutions is expected to rise. Additionally, advancements in technology and design methodologies, such as Building Information Modeling (BIM), will enhance efficiency and reduce costs, making precast concrete an increasingly attractive option for developers and contractors in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Hollow Core Slabs Precast Beams and Columns Precast Walls Precast Stairs Precast Foundations Precast Roof Panels Precast Pipes and Manholes Precast Façade Panels Others |

| By End-User | Residential Commercial Industrial Infrastructure & Utilities |

| By Application | Infrastructure Projects (Roads, Bridges, Tunnels) Residential Buildings Commercial Buildings Industrial Facilities Water & Waste Management |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low Price Mid Price High Price |

| By Material Type | Reinforced Concrete Pre-stressed Concrete Lightweight Concrete Fiber-Reinforced Concrete |

| By Project Size | Small Scale Medium Scale Large Scale |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 65 | Project Managers, Site Engineers |

| Commercial Building Developments | 55 | Architects, Construction Supervisors |

| Infrastructure Projects (Bridges, Roads) | 50 | Civil Engineers, Urban Planners |

| Precast Concrete Manufacturing | 45 | Production Managers, Quality Control Officers |

| Supply Chain and Distribution | 60 | Logistics Managers, Procurement Specialists |

The Bahrain Precast Concrete Market is valued at approximately USD 420 million, reflecting a robust growth trajectory driven by increasing demand for efficient construction methods and significant investments in infrastructure projects.