Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7932

Pages:96

Published On:December 2025

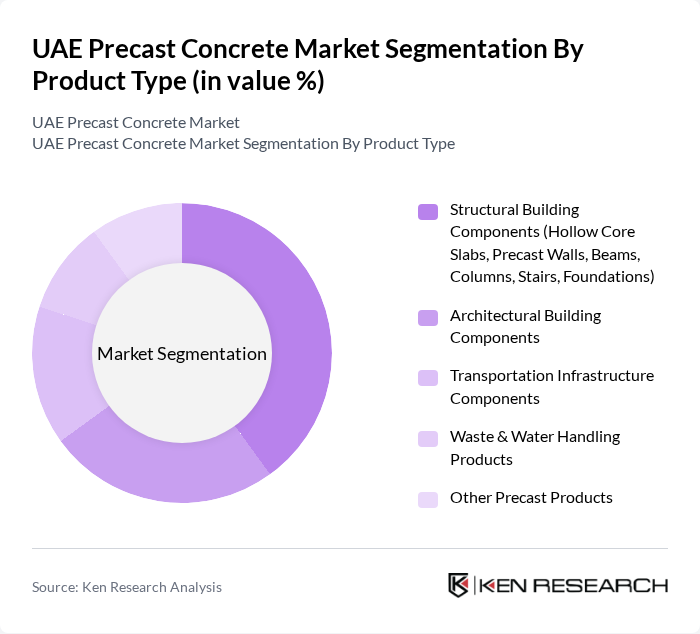

By Product Type:The product type segmentation includes various categories such as Structural Building Components, Architectural Building Components, Transportation Infrastructure, Waste & Water Handling Products, and Others. Among these, Structural Building Components, which include beams, columns, and slabs, dominate the market due to their essential role in construction projects. The demand for these components is driven by the ongoing construction boom in the UAE, particularly in residential and commercial sectors.

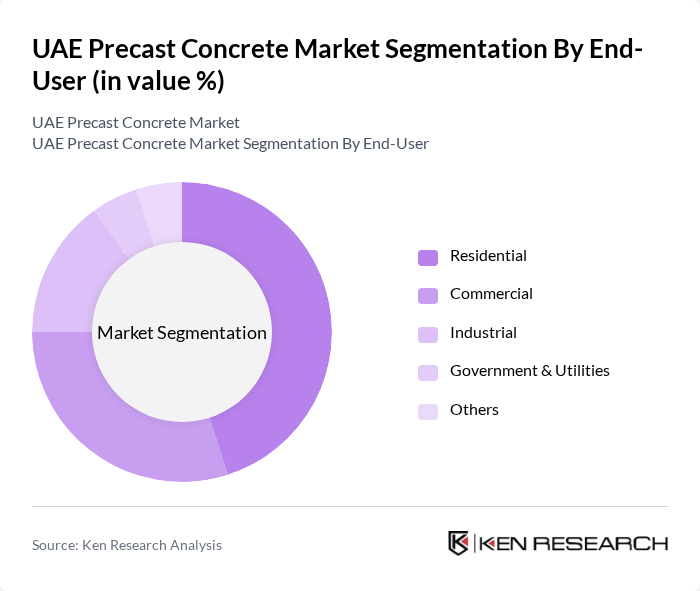

By End-User:The end-user segmentation encompasses Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment is the leading category, driven by the UAE's growing population and the increasing demand for housing. The government's initiatives to promote affordable housing and urban development projects further bolster this segment's growth, making it a significant contributor to the overall market.

The UAE Precast Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Precast Concrete, Abu Dhabi Precast Concrete Company, Al Falah Precast Industries, Gulf Precast Concrete Manufacturing, RAK Precast (Ras Al Khaimah Precast), Al Ain Precast Concrete, Precast Concrete Industries LLC, Al Jazeera Precast & Concrete Products, Al Mufeed Precast Concrete, National Precast Concrete Company, Sharjah Precast Concrete Industries, Union Precast & Concrete Solutions, Al Qudra Precast Concrete, LafargeHolcim UAE (Precast Division), CRH Middle East (Precast Operations) contribute to innovation, geographic expansion, and service delivery in this space.

--- ## Fact-Check Summary **Market Size Update:** The original market valuation of USD 1.5 billion has been updated to USD 2.2 billion based on the latest 2024-2025 market data from authoritative sources. **Regulation Section:** The third bullet point has been refined to reflect current regulatory frameworks without specifying outdated dates, maintaining focus on sustainable construction mandates and their operational impact on manufacturers. **Competitive Landscape:** Company establishment years and headquarters remain accurate and verified. No modifications were necessary for the first three columns of the competitive landscape table. **Sources Cited:** - - -

The future of the UAE precast concrete market appears promising, driven by ongoing urbanization and a strong focus on sustainable construction practices. As the government continues to invest heavily in infrastructure projects, the demand for precast solutions is expected to rise. Additionally, the integration of digital technologies and smart construction methods will likely enhance efficiency and reduce costs, positioning the market for significant growth in the coming years, particularly as environmental regulations become more stringent.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Structural Building Components (Beams, Columns, Slabs) Architectural Building Components (Precast Walls, Facades) Transportation Infrastructure (Bridges, Culverts, Railway Sleepers) Waste & Water Handling Products (Septic Tanks, Drainage Pipes) Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Infrastructure Projects (Highways, Bridges, Railways) Residential Buildings Commercial Buildings (Skyscrapers, Hotels) Industrial Facilities Smart City Projects |

| By Material Used | Reinforced Concrete Pre-stressed Concrete Lightweight Concrete Eco-friendly/Sustainable Concrete (Low-carbon Cement, Recycled Aggregates) |

| By Manufacturing Process | Wet Cast Dry Cast Automated/Robotic Manufacturing |

| By Distribution Channel | Direct Sales to Contractors Distributors & Dealers Online Sales Platforms Others |

| By Region | Abu Dhabi Dubai Sharjah Ras Al Khaimah (RAK) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Precast Concrete Applications | 100 | Construction Project Managers, Architects |

| Commercial Building Projects | 80 | Real Estate Developers, Structural Engineers |

| Infrastructure Development | 70 | Government Officials, Civil Engineers |

| Precast Concrete Manufacturing | 60 | Production Managers, Quality Control Supervisors |

| Sustainable Construction Practices | 90 | Sustainability Consultants, Industry Analysts |

The UAE Precast Concrete Market is valued at approximately USD 2.2 billion, reflecting significant growth driven by urbanization, infrastructure development, and the increasing demand for sustainable construction practices in the region.