Region:Middle East

Author(s):Rebecca

Product Code:KRAB7027

Pages:97

Published On:October 2025

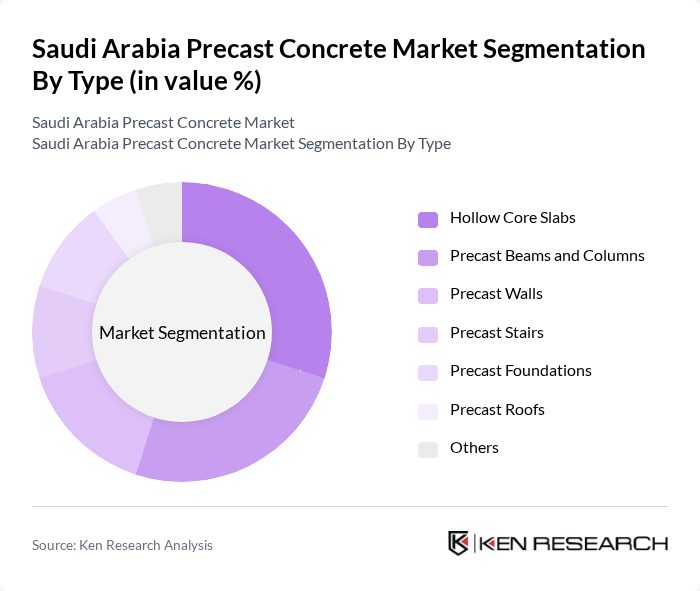

By Type:The precast concrete market can be segmented into various types, including Hollow Core Slabs, Precast Beams and Columns, Precast Walls, Precast Stairs, Precast Foundations, Precast Roofs, and Others. Each of these subsegments serves specific construction needs, with Hollow Core Slabs and Precast Beams and Columns being particularly popular due to their structural efficiency and versatility in various building applications.

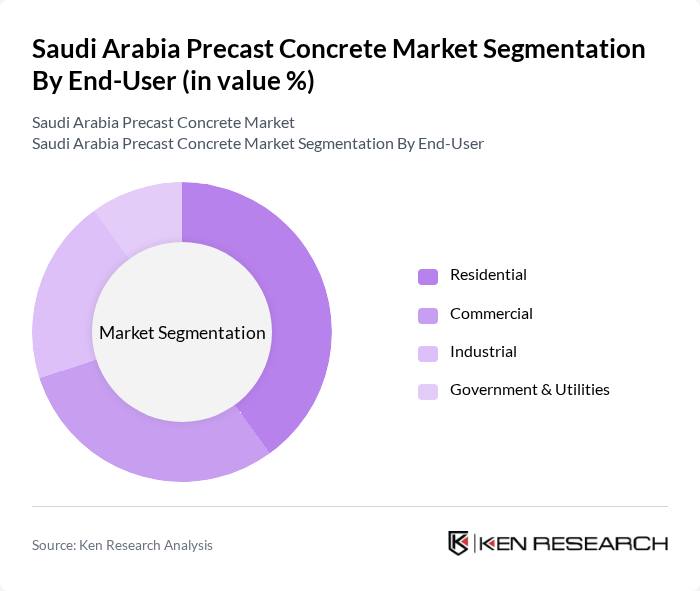

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities sectors. The Residential segment is currently the largest, driven by the increasing demand for housing and urban development projects. The Commercial sector follows closely, fueled by the growth of retail and office spaces, while Government & Utilities projects are also significant contributors to the market.

The Saudi Arabia Precast Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Precast Concrete Company, Al-Fouzan Trading & General Construction Co., Eastern Province Cement Company, Al Bawani Company, Al Kifah Holding Company, Al Rajhi Construction, Al-Mabani General Contractors, Al-Habtoor Group, Al-Jazira Concrete Products, Al-Muhaidib Group, Al-Qemam Precast, Al-Suwaidi Industrial Services, Al-Tamimi Group, Al-Watania Concrete, Saudi Readymix Concrete Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the precast concrete market in Saudi Arabia appears promising, driven by ongoing urbanization and government support for infrastructure projects. As the nation continues to invest in sustainable construction practices, the adoption of precast solutions is expected to rise. Additionally, advancements in manufacturing technologies will likely enhance production efficiency, further solidifying precast concrete's role in meeting the growing demand for rapid and eco-friendly construction methods in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Hollow Core Slabs Precast Beams and Columns Precast Walls Precast Stairs Precast Foundations Precast Roofs Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Infrastructure Projects Residential Buildings Commercial Buildings Industrial Facilities |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Material Type | Reinforced Concrete Pre-stressed Concrete Lightweight Concrete |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Architects |

| Commercial Building Developments | 80 | Construction Supervisors, Engineers |

| Infrastructure and Public Works | 70 | Government Officials, Urban Planners |

| Precast Concrete Manufacturing | 60 | Production Managers, Quality Control Inspectors |

| Supply Chain and Distribution | 90 | Logistics Coordinators, Procurement Managers |

The Saudi Arabia Precast Concrete Market is valued at approximately USD 1.2 billion, driven by rapid urbanization, government infrastructure projects, and a growing demand for sustainable construction solutions.