Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3022

Pages:90

Published On:October 2025

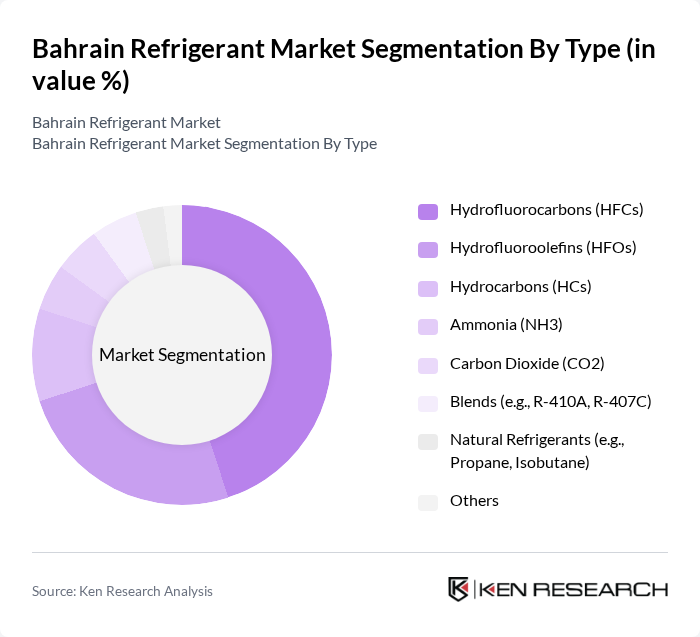

By Type:The refrigerant market can be segmented into various types, including Hydrofluorocarbons (HFCs), Hydrofluoroolefins (HFOs), Hydrocarbons (HCs), Ammonia (NH), Carbon Dioxide (CO), Blends (e.g., R-410A, R-407C), Natural Refrigerants (e.g., Propane, Isobutane), and Others. Among these, HFCs remain the most widely used due to their efficiency and compatibility with existing systems. However, there is a growing trend towards HFOs and natural refrigerants as consumers and businesses become more environmentally conscious, driven by both regulatory pressures and technological innovation in the region.

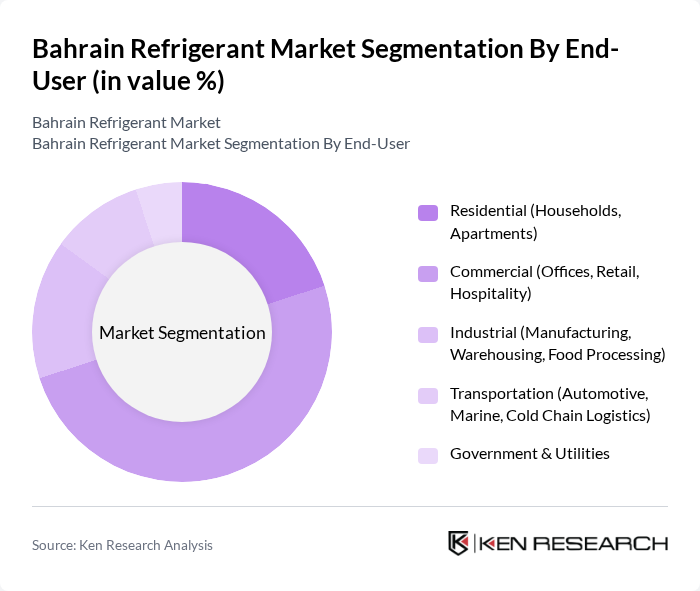

By End-User:The end-user segmentation includes Residential (Households, Apartments), Commercial (Offices, Retail, Hospitality), Industrial (Manufacturing, Warehousing, Food Processing), Transportation (Automotive, Marine, Cold Chain Logistics), and Government & Utilities. The commercial sector is the largest consumer of refrigerants, driven by the rapid growth of the retail and hospitality industries, which require efficient cooling solutions. Residential demand is also significant, particularly for air conditioning in a country with extreme summer temperatures.

The Bahrain Refrigerant Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Cryo, A-Gas, Air Products and Chemicals, Inc., The Chemours Company, Honeywell International Inc., Arkema S.A., Linde plc, Daikin Industries, Ltd., Trane Technologies plc, Solvay S.A., Orbia Advance Corporation, S.A.B. de C.V. (Koura), Chemours, Koura Global, Refron, National Refrigerants, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain refrigerant market is poised for significant transformation, driven by technological advancements and regulatory changes. As the demand for low-GWP refrigerants increases, companies are expected to invest in innovative solutions that enhance energy efficiency and sustainability. Furthermore, the integration of IoT technologies in refrigeration systems will streamline operations and improve monitoring capabilities. These trends indicate a shift towards a more environmentally conscious market, aligning with global sustainability goals and enhancing Bahrain's competitive edge in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrofluorocarbons (HFCs) Hydrofluoroolefins (HFOs) Hydrocarbons (HCs) Ammonia (NH3) Carbon Dioxide (CO2) Blends (e.g., R-410A, R-407C) Natural Refrigerants (e.g., Propane, Isobutane) Others |

| By End-User | Residential (Households, Apartments) Commercial (Offices, Retail, Hospitality) Industrial (Manufacturing, Warehousing, Food Processing) Transportation (Automotive, Marine, Cold Chain Logistics) Government & Utilities |

| By Application | Air Conditioning (Room, Central, VRF/VRV) Refrigeration (Commercial, Industrial, Supermarkets) Automotive Air Conditioning Food Processing & Cold Storage Others (Chillers, Heat Pumps) |

| By Distribution Channel | Direct Sales (Manufacturers to End-Users) Distributors/Dealers Online Sales Retail Outlets |

| By Region | Capital Governorate (Manama) Northern Governorate Southern Governorate Muharraq Governorate |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Refrigeration Users | 60 | Facility Managers, Procurement Officers |

| Residential HVAC Installers | 50 | Installation Technicians, Business Owners |

| Refrigerant Distributors | 40 | Sales Managers, Distribution Coordinators |

| Environmental Regulatory Bodies | 45 | Policy Makers, Compliance Officers |

| End-Users in Industrial Applications | 55 | Operations Managers, Plant Engineers |

The Bahrain Refrigerant Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for air conditioning and refrigeration systems in both commercial and residential sectors.