Region:Middle East

Author(s):Shubham

Product Code:KRAD6675

Pages:83

Published On:December 2025

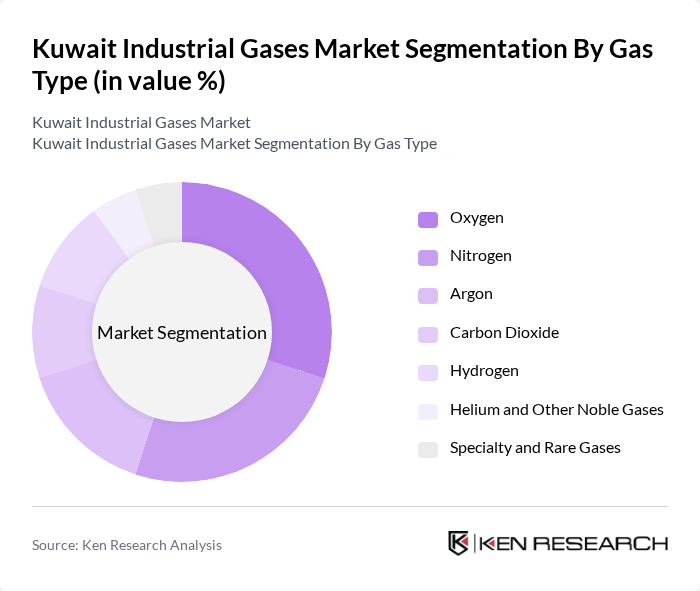

By Gas Type:The market is segmented into various gas types, including Oxygen, Nitrogen, Argon, Carbon Dioxide, Hydrogen, Helium and Other Noble Gases, and Specialty and Rare Gases. This structure is consistent with the broader Middle East industrial gases market and global classifications used by major gas producers. Among these, Oxygen and Nitrogen are the most widely used gases, primarily due to their applications in healthcare (medical oxygen, respiratory therapy), manufacturing and metal fabrication (cutting, welding, inerting), and oil and gas operations (enhanced safety, inerting, blanketing). The demand for Specialty and Rare Gases, including high-purity noble gases, is also growing, driven by advancements in electronics, laboratory and analytical applications, and specific healthcare and imaging uses, in line with trends observed in the Kuwait noble gases segment.

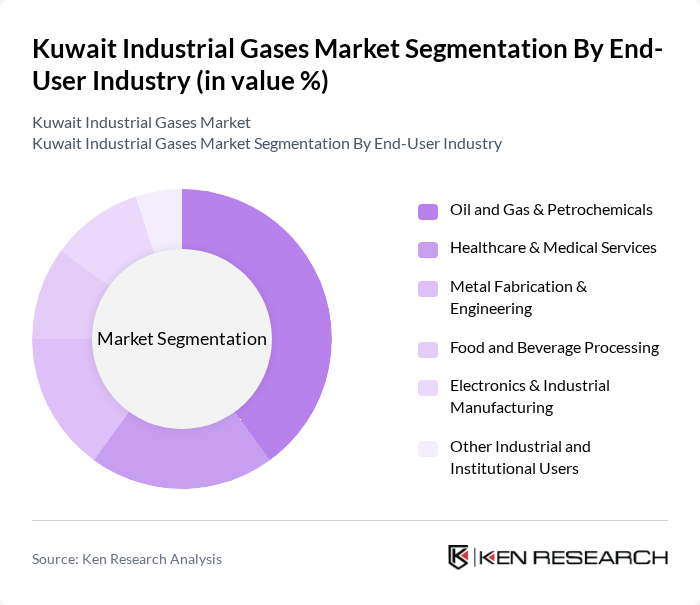

By End-User Industry:The Kuwait Industrial Gases Market is segmented by end-user industries, including Oil and Gas & Petrochemicals, Healthcare & Medical Services, Metal Fabrication & Engineering, Food and Beverage Processing, Electronics & Industrial Manufacturing, and Other Industrial and Institutional Users. This segmentation aligns with the primary demand centers for industrial gases in the Middle East, where energy, oil and gas, and chemicals account for a substantial share, followed by healthcare, metals, and F&B. The Oil and Gas sector is the largest consumer of industrial gases in Kuwait, supported by the country’s significant hydrocarbon reserves, large refining and petrochemical complexes (such as Al-Zour and Mina Al-Ahmadi), and ongoing exploration, production, and downstream value-add initiatives that require hydrogen, nitrogen, oxygen, and other gases for refining, hydro-treating, processing, and maintenance activities.

The Kuwait Industrial Gases Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Cryo Holding KSCC, Gaschem Kuwait Co. KSCC, Kuwait Oxygen & Acetylene Co. (KOAC), National Gas Co. (NATGAS Kuwait), Buzwair Industrial Gases Factories, Linde plc, Air Products and Chemicals, Inc., Air Liquide Middle East, Messer Group GmbH, Sharq Industrial Gases Co., Al Ahlia Industrial Gases Co., Al Sanea Chemical Products & Gases, Kuwait Chemical & Petroleum Products Co., Dubai Industrial Gases (regional supplier to Kuwait), Abdullah Hashim Industrial Gases & Equipment Co. (regional supplier) contribute to innovation, geographic expansion, and service delivery in this space, consistent with the broader Middle East industrial gases competitive environment where regional firms like Gulf Cryo operate alongside global majors such as Linde, Air Products, and Air Liquide.

The future of the Kuwait industrial gases market appears promising, driven by ongoing investments in the oil and gas sector and infrastructure projects. As the country transitions towards more sustainable energy solutions, the demand for cleaner industrial gases is expected to rise. Additionally, advancements in production technologies will likely enhance efficiency and reduce costs, enabling companies to meet the evolving market needs while adhering to stringent environmental regulations. Strategic partnerships with local industries will further bolster growth opportunities in this sector.

| Segment | Sub-Segments |

|---|---|

| By Gas Type | Oxygen Nitrogen Argon Carbon Dioxide Hydrogen Helium and Other Noble Gases Specialty and Rare Gases |

| By End-User Industry | Oil and Gas & Petrochemicals Healthcare & Medical Services Metal Fabrication & Engineering Food and Beverage Processing Electronics & Industrial Manufacturing Other Industrial and Institutional Users |

| By Application | Welding, Cutting, and Metal Processing Refining, Petrochemical, and Chemical Processing Food Freezing, Chilling, and Packaging Medical and Laboratory Applications Water Treatment, Power, and Other Applications |

| By Supply Mode / Distribution Channel | Packaged Cylinders Bulk & Liquid Delivery On-Site Generation & Pipeline Supply Channel Partners and Distributors Emerging Digital / Online Ordering |

| By Governorate | Capital (Al Asimah) Governorate Hawalli Governorate Al Ahmadi Governorate Al Farwaniya Governorate Al Jahra & Mubarak Al-Kabeer Governorates |

| By Production Method | Cryogenic Air Separation Pressure Swing Adsorption (PSA) Membrane Separation Other On-Site and Non-Cryogenic Methods |

| By Storage & Handling Type | High-Pressure Cylinders Bulk Tanks and Microbulk Systems On-Site Storage with Pipeline Networks Other Specialized Storage Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Gas Usage | 100 | Hospital Administrators, Medical Equipment Managers |

| Manufacturing Industry Gas Consumption | 80 | Production Managers, Quality Control Supervisors |

| Food Processing Gas Applications | 70 | Food Safety Officers, Operations Managers |

| Energy Sector Gas Supply | 60 | Energy Analysts, Procurement Managers |

| Research and Development in Industrial Gases | 50 | R&D Managers, Chemical Engineers |

The Kuwait Industrial Gases Market is valued at approximately USD 1.1 billion, driven by demand from sectors such as oil and gas, healthcare, and manufacturing, alongside technological advancements in gas production and distribution.