Region:Middle East

Author(s):Dev

Product Code:KRAA8352

Pages:86

Published On:November 2025

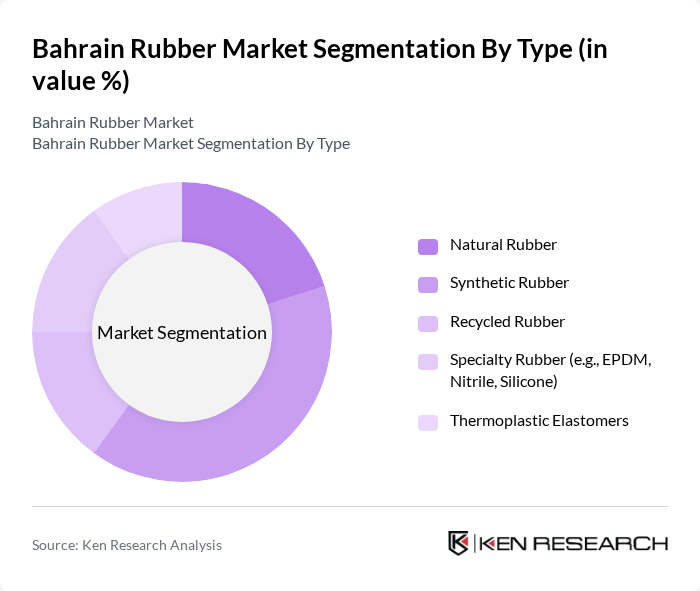

By Type:The rubber market can be segmented into various types, including Natural Rubber, Synthetic Rubber, Recycled Rubber, Specialty Rubber (e.g., EPDM, Nitrile, Silicone), and Thermoplastic Elastomers. Each type serves different applications and industries, with synthetic rubber often dominating due to its versatility and performance characteristics. The demand for specialty rubber is also increasing, driven by specific industry needs.

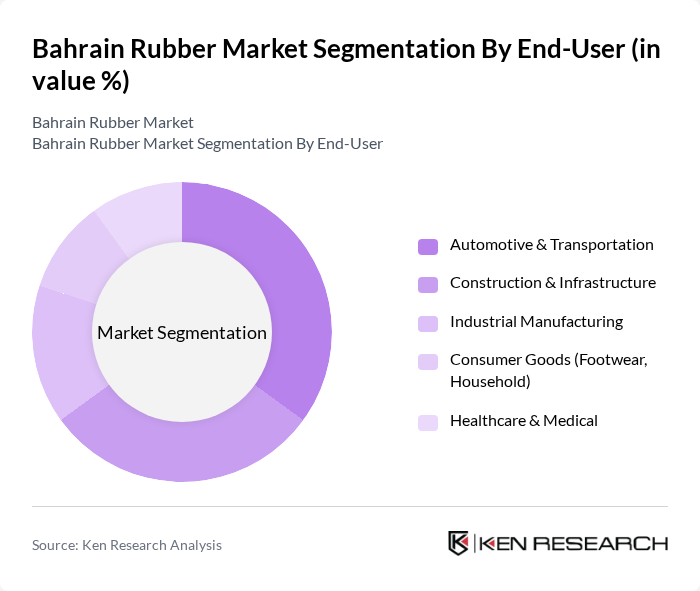

By End-User:The end-user segmentation includes Automotive & Transportation, Construction & Infrastructure, Industrial Manufacturing, Consumer Goods (Footwear, Household), Healthcare & Medical, and Others. The automotive sector is a significant consumer of rubber products, particularly tires and seals, while the construction industry utilizes rubber for flooring and insulation. The healthcare sector is also emerging as a key user, driven by the demand for medical-grade rubber products.

The Bahrain Rubber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Rubber Factory, Bahrain Rubber Company (BRC), Al Ahlia Rubber Industries, Al Moayyed Rubber Products, Bahrain Industrial Rubber Company, Al Hidd Rubber Factory, Bahrain Polymer Products Company, Al Muharraq Rubber Industries, Al Fateh Rubber Factory, Al Salam Rubber Products, Bahrain Rubber & Plastics, Bahrain Rubber Solutions, Gulf International Chemicals, Al Noor Rubber Factory, Al Jazeera Rubber Products contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain rubber market is poised for growth, driven by increasing demand in the automotive and construction sectors, alongside a shift towards sustainable practices. As the government invests in infrastructure and green technologies, local manufacturers are likely to innovate and adapt to changing consumer preferences. The integration of automation in production processes will enhance efficiency, while the expansion of e-commerce platforms will facilitate broader market access, positioning the industry for a robust future.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Rubber Synthetic Rubber Recycled Rubber Specialty Rubber (e.g., EPDM, Nitrile, Silicone) Thermoplastic Elastomers |

| By End-User | Automotive & Transportation Construction & Infrastructure Industrial Manufacturing Consumer Goods (Footwear, Household) Healthcare & Medical Others |

| By Application | Tires & Tubes Seals, Gaskets & O-Rings Hoses & Belts Flooring & Matting Industrial Components Others |

| By Distribution Channel | Direct Sales (B2B) Retail (B2C) Online Sales Distributors & Agents Others |

| By Region | Capital Governorate (Manama) Northern Governorate Southern Governorate Muharraq Governorate Others |

| By Product Form | Sheets & Rolls Blocks & Slabs Granules & Powders Compounds & Mixtures Molded Products Others |

| By Manufacturing Process | Extrusion Molding (Injection, Compression, Transfer) Calendering Vulcanization Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rubber Manufacturing Sector | 45 | Production Managers, Quality Control Supervisors |

| Rubber Distribution Channels | 38 | Sales Managers, Logistics Coordinators |

| End-User Industries (Automotive) | 42 | Procurement Officers, Product Development Managers |

| Retail Sector Insights | 35 | Store Managers, Category Buyers |

| Regulatory and Compliance Insights | 28 | Compliance Officers, Industry Regulators |

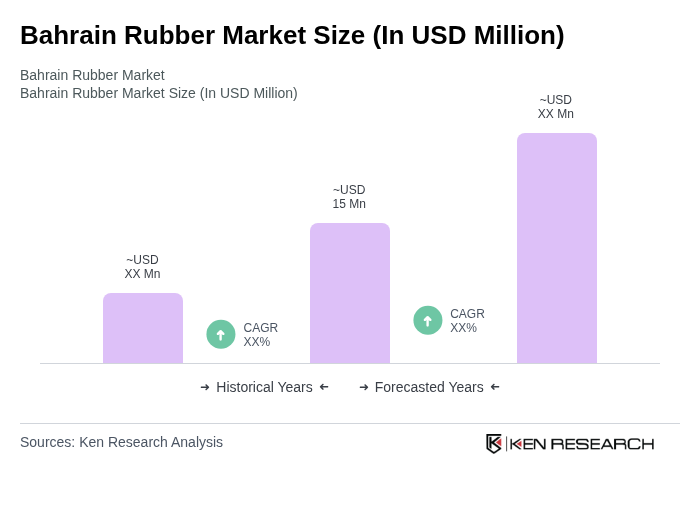

The Bahrain Rubber Market is valued at approximately USD 15 million, reflecting total revenues from various rubber products, including unvulcanized and processed rubber. This valuation is based on a five-year historical analysis of the market.