Region:Middle East

Author(s):Dev

Product Code:KRAD5109

Pages:80

Published On:December 2025

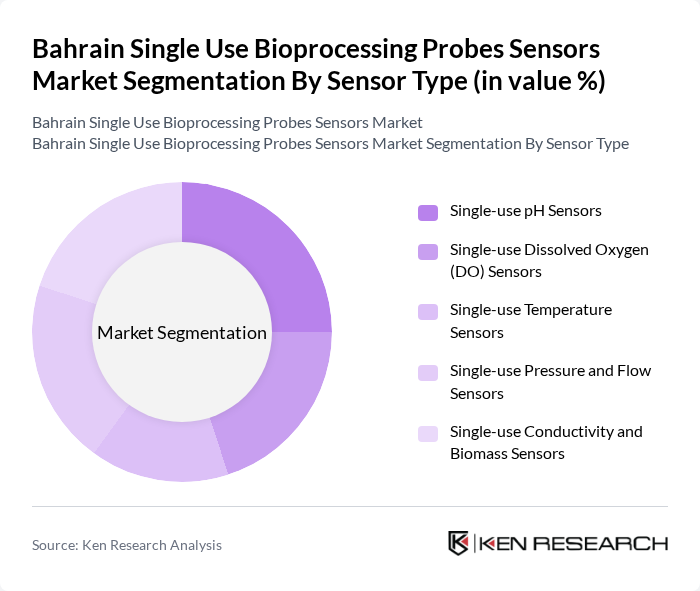

By Sensor Type:The sensor type segmentation includes various categories that cater to different monitoring needs in bioprocessing. The subsegments are Single-use pH Sensors, Single-use Dissolved Oxygen (DO) Sensors, Single-use Temperature Sensors, Single-use Pressure and Flow Sensors, and Single-use Conductivity and Biomass Sensors. Each of these sensors plays a crucial role in ensuring optimal conditions for bioprocessing, with specific applications in monitoring critical parameters. Global studies highlight strong uptake of single-use pH, DO, pressure/flow and conductivity sensors as part of integrated single-use assemblies and bioreactors for cell culture and fermentation, reflecting similar demand patterns in GCC markets.

The Single-use pH Sensors segment is currently dominating the market due to their critical role in maintaining the optimal pH levels during bioprocessing. These sensors are essential for various applications, including cell culture and fermentation processes, where pH control is vital for cell growth and product yield. The increasing adoption of automated and closed bioprocessing systems, including single-use bioreactors and single-use assemblies with integrated pH and DO probes, has further propelled the demand for these sensors, as they provide real-time monitoring, in-line data acquisition, and improved accuracy, which are crucial for regulatory compliance, process analytical technology (PAT) initiatives, and overall process optimization.

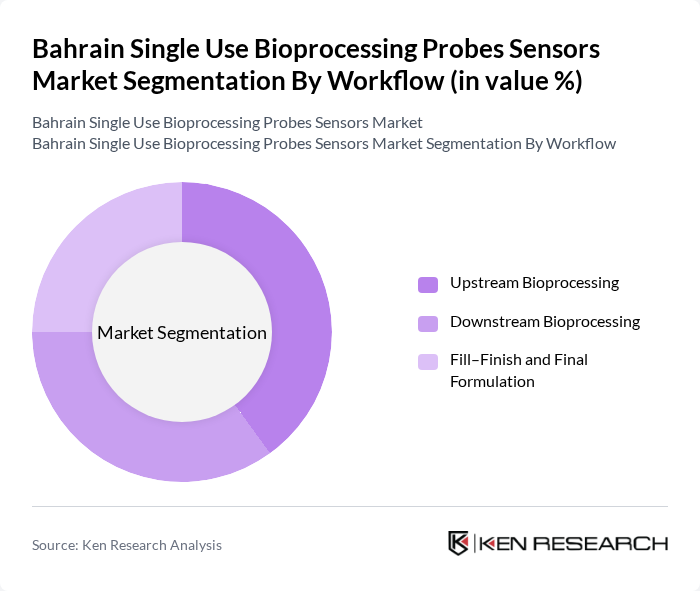

By Workflow:The workflow segmentation encompasses Upstream Bioprocessing, Downstream Bioprocessing, and Fill–Finish and Final Formulation. Each workflow stage has distinct requirements for monitoring and control, necessitating specific types of sensors to ensure efficiency and product quality. Global single-use bioprocessing adoption has been strongest in upstream (cell culture and fermentation) and filtration steps, with increasing penetration in downstream purification and fill–finish as suppliers introduce more robust single-use sensors and assemblies for critical control points.

Upstream Bioprocessing is the leading segment in this category, primarily due to the increasing focus on cell culture and fermentation processes, which are critical for the production of biopharmaceuticals, vaccines, and advanced therapies. The demand for real-time monitoring of parameters such as pH, temperature, pressure, and dissolved oxygen during these processes has driven the adoption of single-use sensors integrated into bioreactors, media bags, and transfer lines. Additionally, advancements in bioprocessing technologies such as high-density perfusion, intensified and continuous upstream processing, and modular single-use facilities are further enhancing the need for robust, disposable monitoring solutions to support flexible, multi-product manufacturing across GCC and broader Middle East facilities.

The Bahrain Single Use Bioprocessing Probes Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Merck KGaA (MilliporeSigma), Sartorius AG, Thermo Fisher Scientific Inc., Cytiva (formerly GE Healthcare Life Sciences), Pall Corporation (a Danaher Company), Parker Hannifin Corporation, Emerson Electric Co. (including Rosemount Analytical), Hamilton Company, Broadley-James Corporation, PreSens Precision Sensing GmbH, Endress+Hauser Group Services AG, Eppendorf SE, Applikon Biotechnology B.V. (a Getinge company), BlueSens gas sensor GmbH, Single Use Support GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain single-use bioprocessing probes sensors market appears promising, driven by ongoing technological advancements and increasing investments in biopharmaceutical manufacturing. As companies prioritize automation and sustainability, the integration of IoT technologies is expected to enhance operational efficiency. Furthermore, the growing emphasis on personalized medicine will likely create new avenues for innovation, positioning Bahrain as a competitive player in the global bioprocessing landscape while addressing local healthcare needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Sensor Type | Single-use pH Sensors Single-use Dissolved Oxygen (DO) Sensors Single-use Temperature Sensors Single-use Pressure and Flow Sensors Single-use Conductivity and Biomass Sensors |

| By Workflow | Upstream Bioprocessing Downstream Bioprocessing Fill–Finish and Final Formulation |

| By Application | Cell Culture and Fermentation Monitoring Process Analytical Technology (PAT) and Real-time Release In-process and Final Product Quality Control Vaccine and mAb Manufacturing |

| By End-User | Biopharmaceutical Manufacturers Contract Development and Manufacturing Organizations (CDMOs) Academic and Government Research Institutes Clinical and Translational Research Centers |

| By Material of Construction | Polymer-based (e.g., Polyethylene, Polypropylene, PET) Elastomers and Silicone-based Components Hybrid Single-use Assemblies with Integrated Electronics Others |

| By Technology | Optical Sensors Electrochemical Sensors Capacitive, Resistive, and Mass-based Sensors Multiparameter Single-use Probes |

| By Regulatory and Quality Compliance | cGMP-compliant Installations ISO 13485 and ISO 9001-certified Facilities Compliance with FDA, EMA, and SFDA/NRAs in GCC Local NMRA and Bahrain NHRA Guidelines |

| By Customer Location in Bahrain | Manama and Capital Governorate Southern Governorate (incl. Bahrain International Investment Park) Northern Governorate Muharraq and Hidd Industrial Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical Manufacturing | 100 | Production Managers, Quality Assurance Leads |

| Research & Development in Bioprocessing | 80 | R&D Directors, Lab Managers |

| Regulatory Compliance in Bioprocessing | 60 | Regulatory Affairs Managers, Compliance Officers |

| Supply Chain Management for Bioprocessing | 70 | Supply Chain Directors, Procurement Managers |

| End-User Applications of Bioprocessing Sensors | 90 | Application Engineers, Product Managers |

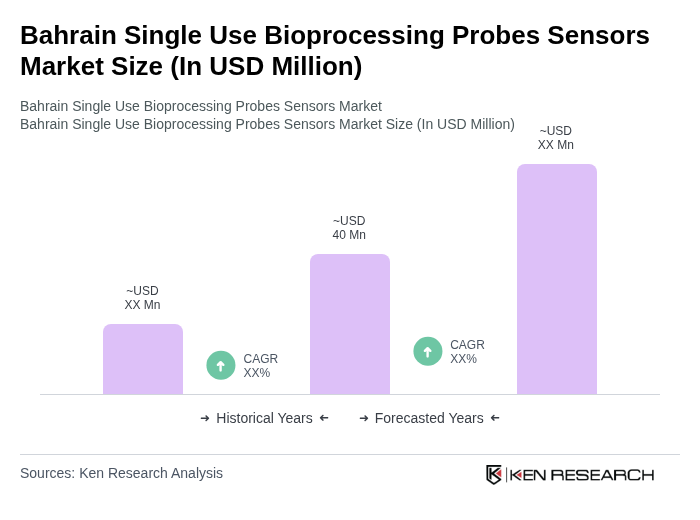

The Bahrain Single Use Bioprocessing Probes Sensors Market is valued at approximately USD 40 million, reflecting growth driven by the increasing demand for biopharmaceuticals and the adoption of single-use technologies in biomanufacturing.