Region:Middle East

Author(s):Shubham

Product Code:KRAD3647

Pages:83

Published On:November 2025

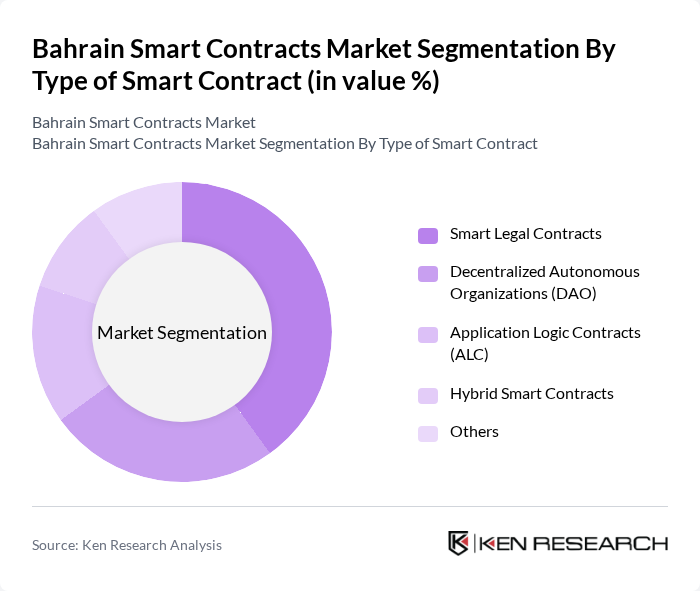

By Type of Smart Contract:The market is segmented into various types of smart contracts, including Smart Legal Contracts, Decentralized Autonomous Organizations (DAO), Application Logic Contracts (ALC), Hybrid Smart Contracts, and Others. Among these, Smart Legal Contracts are gaining significant traction due to their ability to automate legal agreements and enhance compliance. The increasing need for efficiency and transparency in legal processes is driving the adoption of these contracts, making them a dominant force in the market. The rise of decentralized autonomous organizations (DAOs) and hybrid smart contracts is also contributing to market diversification, with growing interest in governance and multi-chain solutions .

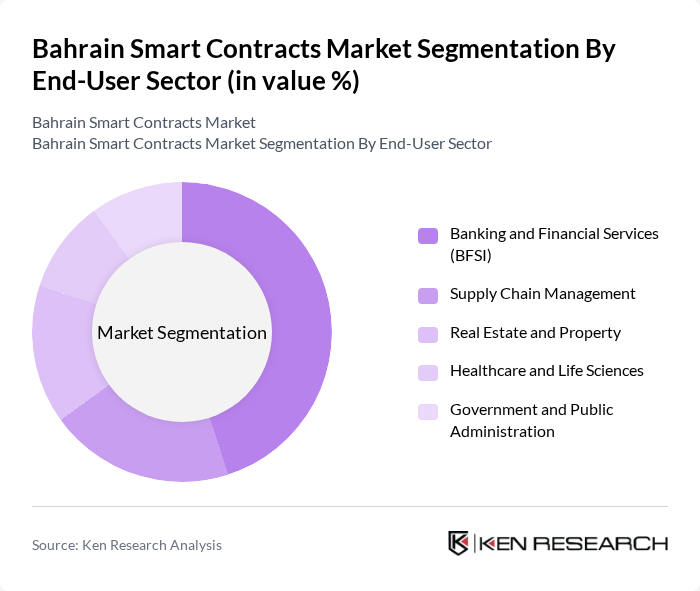

By End-User Sector:The end-user sectors for smart contracts include Banking and Financial Services (BFSI), Supply Chain Management, Real Estate and Property, Healthcare and Life Sciences, and Government and Public Administration. The BFSI sector is leading the market due to the increasing need for secure and efficient transaction processing. Financial institutions are leveraging smart contracts to streamline operations, reduce fraud, and enhance customer trust, making this sector a key driver of market growth. The adoption of smart contracts in supply chain management and real estate is also expanding, driven by the need for traceability, automation, and reduced paperwork .

The Bahrain Smart Contracts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain FinTech Bay, Tamkeen (Labour Fund), Ernst & Young (EY) Bahrain, Zain Bahrain, Gulf International Bank (GIB), Bahrain Economic Development Board (EDB), Bittrex Global, Rain Financial, CoinMENA, Aion Digital, BFC Group Holdings, C5 Accelerate, Bahrain Fintech Consortium, Bahrain Blockchain Association, BitOasis contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart contracts market in Bahrain appears promising, driven by increasing blockchain adoption and government support for digital initiatives. As businesses become more aware of the benefits of smart contracts, particularly in enhancing transparency and efficiency, the market is likely to expand. Additionally, the integration of artificial intelligence in smart contract development is expected to streamline processes, making them more accessible and user-friendly, thus attracting a broader user base.

| Segment | Sub-Segments |

|---|---|

| By Type of Smart Contract | Smart Legal Contracts Decentralized Autonomous Organizations (DAO) Application Logic Contracts (ALC) Hybrid Smart Contracts Others |

| By End-User Sector | Banking and Financial Services (BFSI) Supply Chain Management Real Estate and Property Healthcare and Life Sciences Government and Public Administration |

| By Platform | Ethereum Hyperledger Polkadot Counterparty Other Platforms |

| By Deployment Model | On-Premises Cloud-Based Hybrid Deployment Others |

| By Application Area | Decentralized Finance (DeFi) Identity Management and Verification Automated Compliance Tokenization of Assets Trade and Commerce |

| By Organization Size | Large Enterprises Small and Medium-Sized Enterprises (SMEs) Startups |

| By Geographic Presence | Local Bahrain-Based Companies GCC Regional Players International Companies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Adoption | 100 | Banking Executives, Compliance Officers |

| Real Estate Transactions | 80 | Real Estate Developers, Legal Advisors |

| Supply Chain Management | 70 | Logistics Managers, Procurement Specialists |

| Government Services Implementation | 60 | Public Sector Officials, IT Managers |

| Healthcare Sector Integration | 50 | Healthcare Administrators, IT Directors |

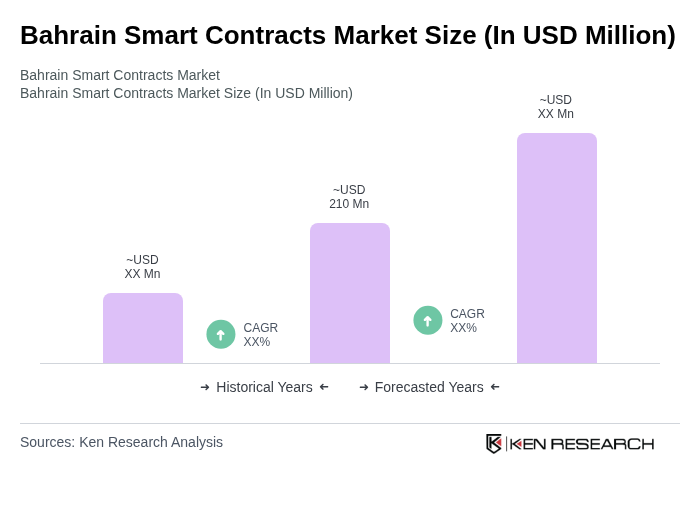

The Bahrain Smart Contracts Market is valued at approximately USD 210 million, reflecting significant growth driven by the increasing adoption of blockchain technology across various sectors, including finance, real estate, and supply chain management.