Region:Middle East

Author(s):Dev

Product Code:KRAC2689

Pages:96

Published On:October 2025

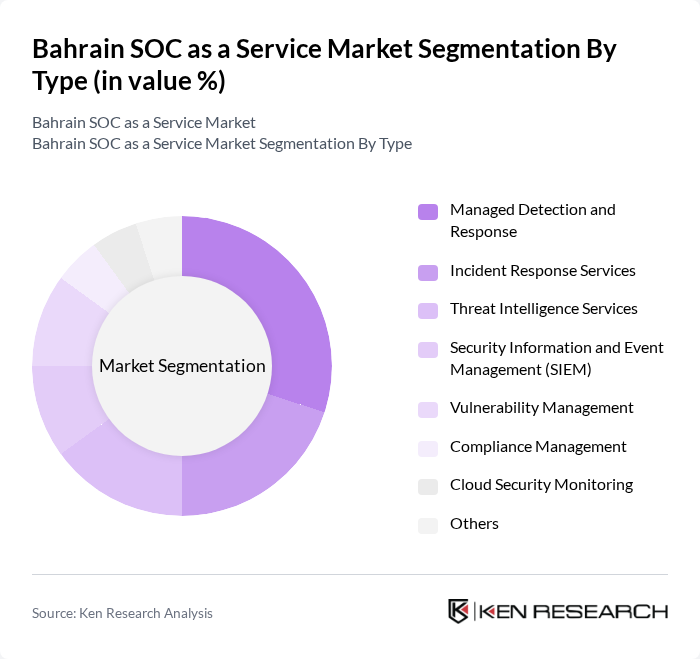

By Type:The SOC as a Service market can be segmented into various types, including Managed Detection and Response, Incident Response Services, Threat Intelligence Services, Security Information and Event Management (SIEM), Vulnerability Management, Compliance Management, Cloud Security Monitoring, and Others. Each of these sub-segments plays a crucial role in addressing specific security needs of organizations. Managed Detection and Response (MDR) is increasingly favored due to its ability to provide continuous threat monitoring and rapid incident response, while Threat Intelligence Services and SIEM are critical for proactive risk management and regulatory compliance .

The Managed Detection and Response (MDR) segment is currently dominating the market due to the increasing complexity of cyber threats and the need for continuous monitoring and rapid response capabilities. Organizations are increasingly opting for MDR services to enhance their security posture without the need for extensive in-house resources. The demand for proactive threat detection and incident response is driving growth in this segment, as businesses seek to mitigate risks associated with cyberattacks and comply with evolving regulatory standards .

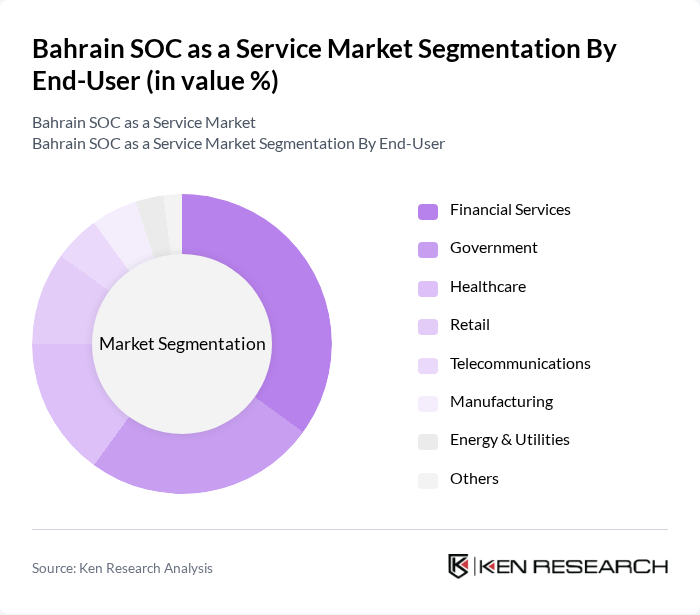

By End-User:The SOC as a Service market is segmented by end-users, including Financial Services, Government, Healthcare, Retail, Telecommunications, Manufacturing, Energy & Utilities, and Others. Each sector has unique security requirements, influencing the adoption of SOC services. Financial Services and Government sectors lead adoption due to stringent compliance obligations and the criticality of sensitive data, while Healthcare is rapidly increasing investment in SOC services to protect patient records and comply with data protection laws .

The Financial Services sector is the leading end-user of SOC as a Service solutions, driven by stringent regulatory requirements and the high value of sensitive financial data. Financial institutions are increasingly investing in advanced security measures to protect against data breaches and cyber threats, making them the largest consumers of SOC services. The need for compliance with regulations such as PCI DSS and GDPR further propels the demand in this sector, while government and healthcare sectors are rapidly expanding SOC investments to meet national security and data protection mandates .

The Bahrain SOC as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Bahrain, Batelco, Zain Bahrain, Gulf Cybersecurity, Infinigate, Secureworks, IBM Security, Cisco Systems, Fortinet, Check Point Software Technologies, Palo Alto Networks, Trend Micro, FireEye (now Trellix), McAfee, CrowdStrike, Atos, Proficio, Arctic Wolf Networks, Thales Group, Cloudflare contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain SOC as a Service market is poised for significant growth, driven by increasing cybersecurity threats and government support for digital initiatives. As organizations prioritize cybersecurity, the demand for managed services will likely rise. Additionally, the integration of advanced technologies such as AI and machine learning will enhance threat detection capabilities. The focus on compliance and regulatory standards will further propel the adoption of SOC services, ensuring a robust market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Detection and Response Incident Response Services Threat Intelligence Services Security Information and Event Management (SIEM) Vulnerability Management Compliance Management Cloud Security Monitoring Others |

| By End-User | Financial Services Government Healthcare Retail Telecommunications Manufacturing Energy & Utilities Others |

| By Industry Vertical | BFSI Energy and Utilities Education Transportation and Logistics IT and Telecom Government & Public Sector Others |

| By Service Model | On-Premises Cloud-Based Hybrid |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Security Type | Network Security Endpoint Security Application Security Cloud Security |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector SOC Utilization | 100 | IT Security Managers, Risk Officers |

| Healthcare Cybersecurity Practices | 60 | Compliance Officers, IT Directors |

| Government Agency SOC Implementation | 50 | Cybersecurity Analysts, IT Administrators |

| Telecommunications SOC Services | 40 | Network Security Engineers, Operations Managers |

| Retail Sector Cybersecurity Strategies | 70 | Chief Information Officers, Security Consultants |

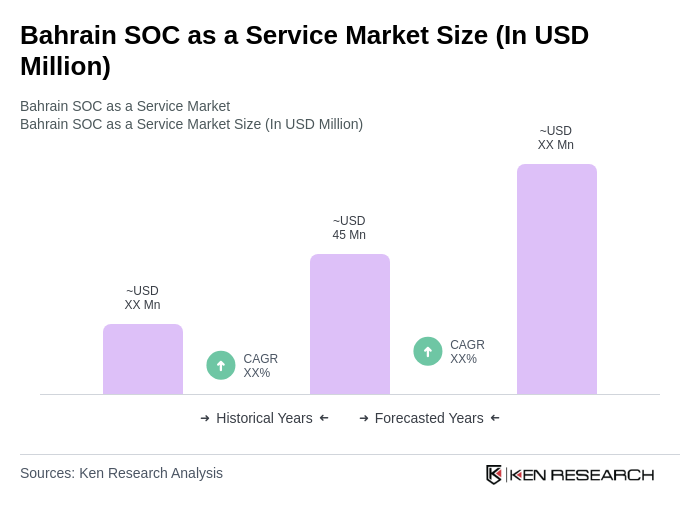

The Bahrain SOC as a Service market is valued at approximately USD 45 million, reflecting a significant growth driven by increasing cyber threats, compliance needs, and the adoption of cloud-based solutions among businesses.