Region:Middle East

Author(s):Shubham

Product Code:KRAC8969

Pages:86

Published On:November 2025

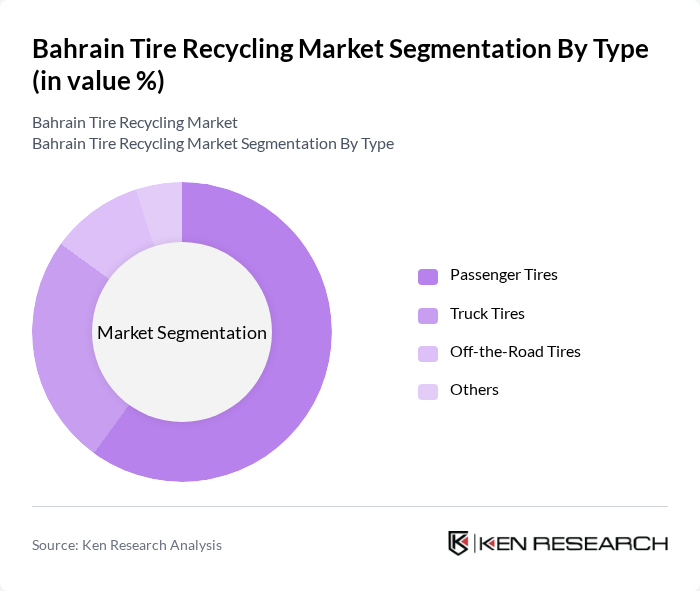

By Type:The tire recycling market is segmented into passenger tires, truck tires, off-the-road tires, and others. Passenger tires account for the largest share due to high volume of vehicle ownership and frequent replacement cycles, reflecting Bahrain's expanding passenger car fleet and rising disposable income. Truck tires and off-the-road tires follow, driven by commercial and industrial applications, including logistics, construction, and mining activities.

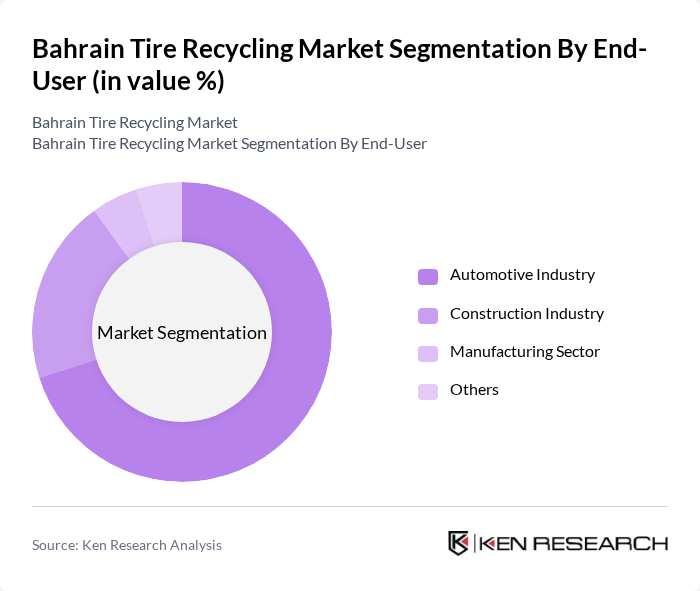

By End-User:The end-user segmentation includes the automotive industry, construction industry, manufacturing sector, and others. The automotive industry is the leading end-user, generating the highest volume of used tires requiring recycling, supported by Bahrain's growing vehicle fleet and replacement demand. The construction industry utilizes recycled tire materials for road construction, civil engineering, and infrastructure projects. The manufacturing sector leverages recycled rubber for product development, including flooring, insulation, and molded goods.

The Bahrain Tire Recycling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Rubber Recycling, Eco-Tire Recycling Bahrain, Al-Mohannad Recycling, Bahrain Environmental Services, Green Rubber Solutions, Eco-Friendly Tire Solutions, Bahrain Waste Management, Recycle Bahrain, Tire Recycling Solutions, Rubber Recovery Bahrain, Sustainable Tire Recycling, Eco-Tire Solutions, Bahrain Green Recycling, Tire Reclaimers Bahrain, Green Distillation Technologies (Bahrain operations) contribute to innovation, geographic expansion, and service delivery in this space.

**Sources:**

The future of the tire recycling market in Bahrain appears promising, driven by increasing environmental awareness and supportive government policies. As the nation moves towards a circular economy, investments in recycling technologies are expected to rise, enhancing operational efficiencies. Additionally, partnerships with local automotive industries will likely foster innovation and expand the market for recycled products. These trends indicate a robust growth trajectory for the tire recycling sector, positioning it as a key player in Bahrain's sustainable development agenda.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Tires Truck Tires Off-the-Road Tires Others |

| By End-User | Automotive Industry Construction Industry Manufacturing Sector Others |

| By Application | Material Recovery Energy Recovery Civil Engineering Applications Others |

| By Collection Method | Curbside Collection Drop-off Centers Mobile Collection Units Others |

| By Processing Technology | Mechanical Recycling Pyrolysis Devulcanization Others |

| By Product Type | Crumb Rubber Reclaimed Rubber Tire-derived Fuel Others |

| By Policy Support | Subsidies for Recycling Facilities Tax Incentives for Recycled Products Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tire Recycling Facilities | 40 | Facility Managers, Operations Directors |

| Automotive Retailers | 50 | Store Managers, Procurement Officers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

| Environmental NGOs | 40 | Program Directors, Advocacy Coordinators |

| Consumers (Tire Users) | 80 | Car Owners, Fleet Managers |

The Bahrain Tire Recycling Market is valued at approximately USD 20 million, reflecting a steady growth driven by increasing environmental awareness, government initiatives, and rising demand for sustainable waste management solutions.