Region:Middle East

Author(s):Rebecca

Product Code:KRAD4995

Pages:90

Published On:December 2025

By Type:The market is segmented into various types of vegan dips, including Hummus, Tahini- and Sesame-Based Dips, Baba Ghanoush and Eggplant-Based Dips (Vegan Formulations), Guacamole and Avocado-Based Dips, Salsa and Tomato-Based Dips, Bean and Lentil Dips, Nut- and Seed-Based Dips, Vegetable Puree Dips, Plant-Based Cheese Style Dips, and Others. This structure aligns with the way global and regional vegan dips markets are typically categorized, where hummus, salsa, bean-based products, and other plant-based dips are key type segments. Among these, Hummus has emerged as the leading subsegment due to its widespread popularity in Middle Eastern cuisine, strong presence in retail and foodservice, and versatility in culinary applications. The increasing consumer preference for Mediterranean and Levantine flavors, combined with the perceived health benefits associated with chickpeas, olive oil, and sesame, has further solidified its market position in Bahrain and across the wider GCC region.

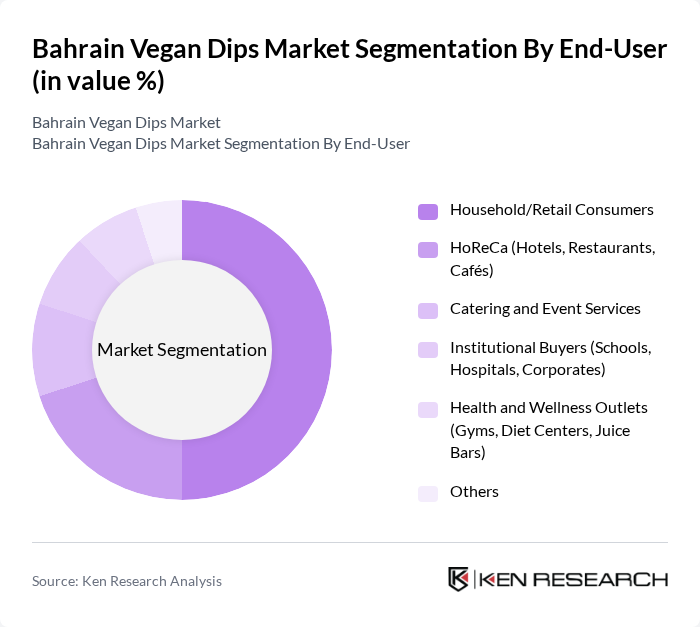

By End-User:The market is segmented by end-user into Household/Retail Consumers, HoReCa (Hotels, Restaurants, Cafés), Catering and Event Services, Institutional Buyers (Schools, Hospitals, Corporates), Health and Wellness Outlets (Gyms, Diet Centers, Juice Bars), and Others. This segmentation is consistent with regional sauces, dressings, condiments, and spreads markets, where retail households and foodservice are the primary demand centers. The Household/Retail Consumers segment is the most significant, driven by the growing trend of healthy eating, the expansion of organized retail and e-commerce, and the increasing availability of vegan and plant-based products in supermarkets and online grocery platforms in Bahrain and the GCC. This segment's growth is further supported by rising health consciousness, flexitarian and plant-forward dietary patterns, and the use of vegan dips as convenient snacks, sandwich spreads, and accompaniments for home cooking and social gatherings.

The Bahrain Vegan Dips Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Wafa Food Industries B.S.C. (c) – Hummus & Dips Division, Trafco Group B.S.C. – Food Distribution & Private Label Dips, Bahrain Flour Mills Company B.S.C. – Food Products & Spreads Unit, Americana Foods (Americana Group) – Regional Hummus & Ready Dips Portfolio, Almarai Company – Plant-Based and Fresh Dips Segment, Nestlé Middle East FZE – Plant-Based Culinary & Dips Offerings, Savola Foods Company – Middle East Sauces, Dressings & Dips Business, Unilever Gulf FZE – Hellmann’s & Plant-Based Sauces and Dips, Al Jameel International Co. W.L.L. – Foodservice Distribution (Hummus & Dips), Lulu Group International – Private Label Vegan Hummus and Dips (Bahrain Operations), Carrefour (Majid Al Futtaim Retail) – Private Label and Imported Vegan Dips, Waitrose & Partners (Bahrain Franchise) – Premium Imported Vegan Dips Range, Alosra Supermarket (BMMI Group) – Premium and Health-Focused Vegan Dips Range, Organic Foods & Café – Organic and Clean-Label Vegan Dips, Local Artisanal and Cloud Kitchen Brands (Small-Batch Vegan Hummus and Dips Producers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the vegan dips market in Bahrain appears promising, driven by increasing health consciousness and a growing preference for plant-based diets. As consumers become more aware of the health benefits associated with vegan products, the demand for innovative flavors and natural ingredients is expected to rise. Additionally, the expansion of retail channels, including online platforms, will facilitate greater accessibility, allowing brands to reach a broader audience and capitalize on the growing trend towards sustainable eating.

| Segment | Sub-Segments |

|---|---|

| By Type | Hummus Tahini- and Sesame-Based Dips Baba Ghanoush and Eggplant-Based Dips (Vegan Formulations) Guacamole and Avocado-Based Dips Salsa and Tomato-Based Dips Bean and Lentil Dips Nut- and Seed-Based Dips (e.g., cashew, almond, sunflower) Vegetable Puree Dips (e.g., beetroot, carrot, pepper) Plant-Based Cheese Style Dips Others |

| By End-User | Household/Retail Consumers HoReCa (Hotels, Restaurants, Cafés) Catering and Event Services Institutional Buyers (Schools, Hospitals, Corporates) Health and Wellness Outlets (Gyms, Diet Centers, Juice Bars) Others |

| By Packaging Type | Rigid Plastic Tubs and Cups Glass Jars PET and HDPE Bottles Flexible Pouches and Sachets Bulk Foodservice Packs Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores and Groceries Specialty and Health Food Stores HoReCa and Foodservice Distributors Online Retail (E-commerce Platforms and Delivery Apps) Others |

| By Flavor Profile | Classic/Mild Spicy/Chili-Infused Herb and Garlic Smoky and Roasted Sweet and Fruit-Infused Fusion and Ethnic Flavors Others |

| By Ingredient Type | Legumes (Chickpeas, Lentils, Beans) Nuts and Seeds Vegetables Fruits Plant Oils and Fats Clean-Label Additives and Seasonings Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 90 | Store Managers, Category Buyers |

| Consumer Preferences for Vegan Dips | 140 | Health-Conscious Consumers, Vegan Diet Adopters |

| Food Service Industry Feedback | 80 | Restaurant Owners, Chefs |

| Market Trends Analysis | 70 | Food Industry Analysts, Market Researchers |

| Distribution Channel Effectiveness | 60 | Logistics Managers, Supply Chain Coordinators |

The Bahrain Vegan Dips Market is valued at approximately USD 1 million, reflecting a growing trend towards plant-based diets and increased consumer awareness of health benefits associated with vegan products.